This notebook replicates the models in chapter 12 of Godley and Lavoie (2007).

library(sfcr)

library(tidyverse)

#> ── Attaching packages ─────────────────────────────────────── tidyverse 1.3.1 ──

#> ✔ ggplot2 3.3.5 ✔ purrr 0.3.4

#> ✔ tibble 3.1.5 ✔ dplyr 1.0.7

#> ✔ tidyr 1.1.4 ✔ stringr 1.4.0

#> ✔ readr 2.0.2 ✔ forcats 0.5.1

#> ── Conflicts ────────────────────────────────────────── tidyverse_conflicts() ──

#> ✖ dplyr::filter() masks stats::filter()

#> ✖ dplyr::lag() masks stats::lag()Model skeleton

open12_ext <- sfcr_set(

alpha1_uk ~ 0.75,

alpha1_us ~ 0.75,

alpha2_uk ~ 0.13333,

alpha2_us ~ 0.13333,

eps0 ~ - 2.1,

eps1 ~ 0.7,

eps2 ~ 1,

lambda10 ~ 0.7,

lambda11 ~ 5,

lambda12 ~ 5,

lambda20 ~ 0.25,

lambda21 ~ 5,

lambda22 ~ 5,

lambda40 ~ 0.7,

lambda41 ~ 5,

lambda42 ~ 5,

lambda50 ~ 0.25,

lambda51 ~ 5,

lambda52 ~ 5,

mu0 ~ - 2.1,

mu1 ~ 0.7,

mu2 ~ 1,

nu0m ~ - 0.00001,

nu0x ~ - 0.00001,

nu1m ~ 0.7,

nu1x ~ 0.5,

phi_uk ~ 0.2381,

phi_us ~ 0.2381,

theta_uk ~ 0.2,

theta_us ~ 0.2,

# Exogenous variables

#b_cb_ukus_s ~ 0.02031,

dxre_us ~ 0,

g_k_uk ~ 16,

g_k_us ~ 16,

or_uk ~ 7,

pg_us ~ 1,

pr_uk ~ 1.3333,

pr_us ~ 1.3333,

#r_uk ~ 0.03,

r_us ~ 0.03,

w_uk ~ 1,

w_us ~ 1,

#xr_uk ~ 1.0003,

#xr_us ~ 0.99971,

xre_uk ~ 1.0003,

xre_us ~ 0.99971,

or_us ~ 7,

dxre_uk ~ 0,

)

open12_init <- sfcr_set(

# Exogenous

b_cb_ukus_s ~ 0.02031,

dxre_us ~ 0,

g_k_uk ~ 16,

g_k_us ~ 16,

or_uk ~ 7,

pg_us ~ 1,

pr_uk ~ 1.3333,

pr_us ~ 1.3333,

r_uk ~ 0.03,

r_us ~ 0.03,

w_uk ~ 1,

w_us ~ 1,

# Endogenous

b_cb_ukuk_d ~ 0.27984,

b_cb_ukuk_s ~ 0.27984,

b_cb_ukuk_sa ~ 0.27984,

b_cb_ukus_d ~ 0.0203,

b_cb_usus_d ~ 0.29843,

b_cb_usus_s ~ 0.29843,

b_uk_s ~ 138.94,

b_ukuk_d ~ 102.18,

b_ukuk_s ~ 102.18,

b_ukus_d ~ 36.493,

b_ukus_s ~ 36.504,

b_us_s ~ 139.02,

b_usuk_d ~ 36.497,

b_usuk_s ~ 36.487,

b_usus_d ~ 102.19,

b_usus_s ~ 102.19,

h_uk_d ~ 7.2987,

h_uk_s ~ 7.2987,

h_us_d ~ 7.2995,

h_us_s ~ 7.2995,

or_us ~ 7,

v_k_uk ~ 152.62,

v_k_us ~ 152.63,

v_uk ~ 145.97,

v_us ~ 145.99001,

# Other endogenous

c_k_uk ~ 81.393,

c_k_us ~ 81.401,

cab_uk ~ 0,

cab_us ~ 0,

cons_uk ~ 77.851,

cons_us ~ 77.86,

ds_k_uk ~ 97.393,

ds_k_us ~ 97.401,

ds_uk ~ 93.154,

ds_us ~ 93.164,

dxre_uk ~ 0,

f_cb_uk ~ 0.00869,

f_cb_us ~ 0.00895,

g_uk ~ 15.304,

g_us ~ 15.304,

im_k_uk ~ 11.928,

im_k_us ~ 11.926,

im_uk ~ 11.407,

im_us ~ 11.409,

kabp_uk ~ 0.00002,

kabp_us ~ - 0.00002,

n_uk ~ 73.046,

n_us ~ 73.054,

pds_uk ~ 0.95648,

pds_us ~ 0.95649,

pg_uk ~ 0.99971,

pm_uk ~ 0.95628,

pm_us ~ 0.95661,

ps_uk ~ 0.95646,

ps_us ~ 0.9565,

px_uk ~ 0.95634,

px_us ~ 0.95656,

py_uk ~ 0.95648,

py_us ~ 0.95649,

s_k_uk ~ 109.32,

s_k_us ~ 109.33,

s_uk ~ 104.56,

s_us ~ 104.57,

t_uk ~ 19.463,

t_us ~ 19.465,

x_k_uk ~ 11.926,

x_k_us ~ 11.928,

x_uk ~ 11.406,

x_us ~ 11.41,

xr_uk ~ 1.0003,

xr_us ~ 0.99971,

xre_uk ~ 1.0003,

xre_us ~ 0.99971,

y_k_uk ~ 97.392,

y_k_us ~ 97.403,

y_uk ~ 93.154,

y_us ~ 93.164,

yd_uk ~ 77.851,

yd_us ~ 77.86,

ydhs_k_uk ~ 81.394,

ydhs_k_us ~ 81.402,

ydhse_k_uk ~ 81.394,

ydhse_k_us ~ 81.402

)

open12_eqs <- sfcr_set(

# Disposable income in UK - eq. 12.1

yd_uk ~ (y_uk + r_uk[-1]*b_ukuk_d[-1] + xr_us*r_us[-1]*b_ukus_s[-1])*(1 - theta_uk) + (xr_us - xr_us[-1])*b_ukus_s[-1],

# Haig-Simons disposable income in UK - eq. 12.2

yd_hs_uk ~ yd_uk + (xr_us - xr_us[-1])*b_ukus_s[-1],

# Wealth accumulation in UK - eq. 12.3

v_uk ~ v_uk[-1] + yd_uk - cons_uk,

# Disposable income in US - eq. 12.4

yd_us ~ (y_us + r_us[-1]*b_usus_d[-1] + xr_uk*r_uk[-1]*b_usuk_s[-1])*(1 - theta_us) + (xr_uk - xr_uk[-1])*b_usuk_s[-1],

# Haig-Simons disposable income in US - eq. 12.5

yd_hs_us ~ yd_us + d(xr_uk)*b_usuk_s[-1],

# Wealth accumulation in US - eq. 12.6

v_us ~ v_us[-1] + yd_us - cons_us,

# Taxes in UK - eq. 12.7

t_uk ~ theta_uk*(y_uk + r_uk[-1]*b_ukuk_d[-1] + xr_us*r_us[-1]*b_ukus_s[-1]),

# Taxes in US - eq. 12.8

t_us ~ theta_us*(y_us + r_us[-1]*b_usus_d[-1] + xr_uk*r_uk[-1]*b_usuk_s[-1]),

# Equations 12.9 & 12.10 are dropped in favour of equations 12.53 & 12.54

# Profits of Central Bank in UK - eq. 12.11 - typo in the book for r_us

f_cb_uk ~ r_uk[-1]*b_cb_ukuk_d[-1] + r_us[-1]*b_cb_ukus_s[-1]*xr_us,

# Profits of Central Bank in US - eq. 12.12

f_cb_us ~ r_us[-1]*b_cb_usus_d[-1],

# Government budget constraint - UK - eq. 12.13

b_uk_s ~ b_uk_s[-1] + g_uk + r_uk[-1]*b_uk_s[-1] - t_uk - f_cb_uk,

# Government budget constraint - US - eq. 12.14

b_us_s ~ b_us_s[-1] + g_us + r_us[-1]*b_us_s[-1] - t_us - f_cb_us,

# Current account balance - UK - eq. 12.15

cab_uk ~ x_uk - im_uk + xr_us*r_us[-1]*b_ukus_s[-1] - r_uk[-1]*b_usuk_s[-1] + r_us[-1]*b_cb_ukus_s[-1]*xr_us,

# Capital account balance in UK - eq. 12.16

kab_uk ~ kabp_uk - (xr_us*(b_cb_ukus_s - b_cb_ukus_s[-1]) + pg_uk*(or_uk - or_uk[-1])),

# Current account balance in US - eq. 12.17

cab_us ~ x_us - im_us + xr_uk*r_uk[-1]*b_usuk_s[-1] - r_us[-1]*b_ukus_s[-1] - r_us[-1]*b_cb_ukus_s[-1],

# Capital account balance in US - eq. 12.18

kab_us ~ kabp_us + (b_cb_ukus_s - b_cb_ukus_s[-1]) - pg_us*(or_us - or_us[-1]),

# Capital account balance in UK, net of official transactions - eq. 12.19

kabp_uk ~ - (b_ukus_s - b_ukus_s[-1])*xr_us + (b_usuk_s - b_usuk_s[-1]),

# Capital account balance in US, net of official transactions - eq. 12.20

kabp_us ~ - (b_usuk_s - b_usuk_s[-1])*xr_uk + (b_ukus_s - b_ukus_s[-1]),

# TRADE

# Import prices in UK - eq. 12.21

pm_uk ~ exp(nu0m + nu1m*log(py_us) + (1 - nu1m)*log(py_uk) - nu1m*log(xr_uk)),

# Export prices in UK - eq. 12.22

px_uk ~ exp(nu0x + nu1x*log(py_us) + (1 - nu1x)*log(py_uk) - nu1x*log(xr_uk)),

# Export prices in US - eq. 12.23

px_us ~ pm_uk*xr_uk,

# Import prices in US - eq. 12.24

pm_us ~ px_uk*xr_uk,

# Real exports from UK - eq. 12.25 - depends on current relative price

x_k_uk ~ exp(eps0 - eps1*log(pm_us/py_us) + eps2*log(y_k_us)),

# Real imports of UK - eq. 12.26

im_k_uk ~ exp(mu0 - mu1*log(pm_uk[-1]/py_uk[-1]) + mu2*log(y_k_uk)),

# Real exports from US - eq. 12.27

x_k_us ~ im_k_uk,

# Real imports of US - eq. 12.28

im_k_us ~ x_k_uk,

# Exports of UK - eq. 12.29

x_uk ~ x_k_uk*px_uk,

# Exports of US - eq. 12.30

x_us ~ x_k_us*px_us,

# Imports of UK - eq. 12.31

im_uk ~ im_k_uk*pm_uk,

# Imports of US - eq. 12.32

im_us ~ im_k_us*pm_us,

# INCOME AND EXPENDITURE

# Real wealth in UK - eq. 12.33

v_k_uk ~ v_uk/pds_uk,

# Real wealth in US - eq. 12.34

v_k_us ~ v_us/pds_us,

# Real Haig-Simons disposable income in UK - eq. 12.35

ydhs_k_uk ~ yd_uk/pds_uk - v_k_uk[-1]*(pds_uk - pds_uk[-1])/pds_uk,

# Real Haig-Simons disposable income in US - eq. 12.36

ydhs_k_us ~ yd_us/pds_us - v_k_us[-1]*(pds_us - pds_us[-1])/pds_us ,

# Real consumption in UK - eq. 12.37

c_k_uk ~ alpha1_uk*ydhse_k_uk + alpha2_uk*v_k_uk[-1],

# Real consumption in US - eq. 12.38

c_k_us ~ alpha1_us*ydhse_k_us + alpha2_us*v_k_us[-1],

# Expected real Haig-Simons disposable income in UK - eq. 12.39

ydhse_k_uk ~ (ydhs_k_uk + ydhs_k_uk[-1])/2,

# Expected real Haig-Simons disposable income in US - eq. 12.40

ydhse_k_us ~ (ydhs_k_us + ydhs_k_us[-1])/2,

# Real sales in UK - eq. 12.41

s_k_uk ~ c_k_uk + g_k_uk + x_k_uk,

# Real sales in US - eq. 12.42

s_k_us ~ c_k_us + g_k_us + x_k_us,

# Value of sales in UK - eq. 12.43

s_uk ~ s_k_uk*ps_uk,

# Value of sales in US - eq. 12.44

s_us ~ s_k_us*ps_us,

# Price of sales in UK - eq. 12.45

ps_uk ~ (1 + phi_uk)*(w_uk*n_uk + im_uk)/s_k_uk,

# Price of sales in US - eq. 12.46

ps_us ~ (1 + phi_us)*(w_us*n_us + im_us)/s_k_us,

# Price of domestic sales in UK - eq. 12.47

pds_uk ~ (s_uk - x_uk)/(s_k_uk - x_k_uk),

# Price of domestic sales in US - eq. 12.48

pds_us ~ (s_us - x_us)/(s_k_us - x_k_us),

# Domestic sales in UK - eq. 12.49

ds_uk ~ s_uk - x_uk,

# Domestic sales in US - eq. 12.50

ds_us ~ s_us - x_us,

# Real domestic sales in UK - eq. 12.51

ds_k_uk ~ c_k_uk + g_k_uk,

# Real domestic sales in US - eq. 12.52

ds_k_us ~ c_k_us + g_k_us,

# Value of output in UK - eq. 12.53

y_uk ~ s_uk - im_uk,

# Value of output in US - eq. 12.54

y_us ~ s_us - im_us,

# Value of real output in UK - eq. 12.55

y_k_uk ~ s_k_uk - im_k_uk,

# Value of real output in US - eq. 12.56

y_k_us ~ s_k_us - im_k_us,

# Price of output in UK - eq. 12.57

py_uk ~ y_uk/y_k_uk,

# Price of output in US - eq. 12.58

py_us ~ y_us/y_k_us,

# Consumption in UK - eq. 12.59

cons_uk ~ c_k_uk*pds_uk,

# Consumption in US - eq. 12.60

cons_us ~ c_k_us*pds_us,

# Government expenditure in UK - eq. 12.61

g_uk ~ g_k_uk*pds_uk,

# Government expenditure in US - eq. 12.62

g_us ~ g_k_us*pds_us,

# Note: tax definitions in the book as eqns 12.63 & 12.64 are already as eqns 12.7 & 12.8

# Employment in UK - eq. 12.65

n_uk ~ y_k_uk/pr_uk,

# Employment in US - eq. 12.66

n_us ~ y_k_us/pr_us,

# ASSET DEMANDS

# Demand for UK bills in UK - eq. 12.67

b_ukuk_d ~ v_uk*(lambda10 + lambda11*r_uk - lambda12*(r_us + dxre_us)),

# Demand for US bills in UK - 12.68F

b_ukus_d ~ v_uk*(lambda20 - lambda21*r_uk + lambda22*(r_us + dxre_us)),

# Base interest rates r_uk - eq. 12.68R

# r_uk ~ (lambda20 + lambda22*(r_us + dxre_us) - b_ukus_d/v_uk)/lambda21,

# Demand for money in UK - eq. 12.69

h_uk_d ~ v_uk - b_ukuk_d - b_ukus_d,

# Demand for US bills in US - eq. 12.70

b_usus_d ~ v_us*(lambda40 + lambda41*r_us - lambda42*(r_uk + dxre_uk)),

# Demand for UK bills in US - eq. 12.71

b_usuk_d ~ v_us*(lambda50 - lambda51*r_us + lambda52*(r_uk + dxre_uk)),

# Demand for money in US - eq. 12.72

h_us_d ~ v_us - b_usus_d - b_usuk_d,

# Note - we follow eqns numbering in the text...

# Expected change in UK exchange rate - eq. 12.75

# dxre_uk ~ (xre_uk - xr_uk[-1])/xr_uk

# Expected change in US exchange rate - eq. 12.76

# dxre_us ~ (xre_us - xr_us[-1])/xr_us

# ASSET SUPPLIES

# Suply of cash in US - eq. 12.77

h_us_s ~ h_us_d,

# Supply of US bills to CountryN - eq. 12.78

b_usus_s ~ b_usus_d,

# Supply of US bills to US Central bank - eq. 12.79

b_cb_usus_s ~ b_cb_usus_d,

# Suply of cash in UK - eq. 12.80

h_uk_s ~ h_uk_d,

# Bills issued by US acquired by US - eq. 12.81

b_ukuk_s ~ b_ukuk_d,

# Supply of UK bills to UK Central bank - eq. 12.82

# MODLER MACRO VERSION

b_cb_ukuk_s ~ b_cb_ukuk_d,

# BOOK VERSION - eq. 12.82A

# b_cb_ukuk_s ~ b_uk_s - b_ukuk_s - b_usuk_s

# Balance sheet of US Central bank - eq. 12.83 - expressed as changes

b_cb_usus_d ~ b_cb_usus_d[-1] + (h_us_s - h_us_s[-1]) - (or_us - or_us[-1])*pg_us,

# Balance sheet of UK Central bank - eq. 12.84

b_cb_ukuk_d ~ b_cb_ukuk_d[-1] + (h_uk_s - h_uk_s[-1]) - (b_cb_ukus_s - b_cb_ukus_s[-1])*xr_us - (or_uk - or_uk[-1])*pg_uk,

# Price of gold is equal in the two countries - eq. 12.85

pg_uk ~ pg_us/xr_uk,

# US exchange rate - eq. 12.86

xr_us ~ 1/xr_uk,

# Equilibrium condition for bills issued by UK acquired by US - eq. 12.87

b_usuk_s ~ b_usuk_d*xr_us,

# Equilibrium condition for bills issued by US acquired by UK Central bank - eq. 12.88

b_cb_ukus_d ~ b_cb_ukus_s*xr_us,

# UK Exchange rate - eq. 12.89FL - xr_uk is now exogenous

# xr_uk ~ b_ukus_s/b_ukus_d

# Government deficit in the UK

psbr_uk ~ g_uk + r_uk[-1]*b_uk_s[-1] - t_uk - f_cb_uk,

# Government deficit in the US

psbr_us ~ g_us + r_us[-1]*b_us_s[-1] - t_us - f_cb_us,

# Net accumulation of financial assets in the UK

nafa_uk ~ psbr_uk + cab_uk,

# Net accumulation of financial assets in the US

nafa_us ~ psbr_us + cab_us,

# Hidden equation

b_cb_ukuk_sa ~ b_uk_s - b_ukuk_s - b_usuk_s,

# Net wealth of CBUK

nwcb_uk ~ -h_uk_d + b_cb_ukuk_d + b_cb_ukus_d * xr_us + or_uk * pg_uk,

)Model OPEN FIX

Closures

openfix_eqs <- sfcr_set(

open12_eqs,

# 12.89R : Demand of UK Bills in US

b_ukus_s ~ xr_uk*b_ukus_d,

# 12.90R : Supply of UK bills to us

b_cb_ukus_s ~ b_us_s - b_usus_s - b_cb_usus_d - b_ukus_s

)

openfix_ext <- sfcr_set(

open12_ext,

# Eq. 12.91R

xr_uk ~ 1.0003,

r_uk ~ 0.03

)Interestingly, this is the first model that it is not possible to estimate with the Gauss-Seidel method. Further, minor computational divergences appear in the model if it runs for long enough.

Baseline

openfix <- sfcr_baseline(

equations = openfix_eqs,

external = openfix_ext,

initial = open12_init,

periods = 100,

tol = 1e-15,

method = "Broyden",

hidden = c("b_cb_ukuk_s" = "b_cb_ukuk_sa"),

max_iter = 350

)Matrices of Model OPEN FIX

Balance-sheet matrix

This matrix is too cluttered to display with sfcr_matrix_display() function and required a more specialized work. However, the validation step is crucial and I will pursuit it here.

The entries in the matrices must be written exactly as they would be calculated. Therefore, exchange rate transformations must be applied to each required cell. As a natural consequence, the exchange rate column as presented in Godley and Lavoie (2007) must be ignored.

bs_openfix <- sfcr_matrix(

columns = c("Households_UK", "Firms_UK", "Govt_UK", "Central Bank_UK",

"Households_US", "Firms_US", "Govt_US", "Central Bank_US", "Sum"),

codes = c("huk", "fuk", "guk", "cbuk", "hus", "fus", "gus", "cbus", "sum"),

c("Money", huk = "+h_uk_d", cbuk = "-h_uk_s", hus = "+h_us_d", cbus = "-h_us_s"),

c("UK_Bills", huk = "xr_uk * +b_ukuk_d", guk = "xr_uk * -b_uk_s", cbuk = "xr_uk * +b_cb_ukuk_d",

hus = "+b_usuk_d * xr_uk"),

c("US_Bills", huk = "xr_uk * +b_ukus_d * xr_us", cbuk = "xr_uk * +b_cb_ukus_d * xr_us",

hus = "+b_usus_d", gus = "-b_us_s", cbus = "+b_cb_usus_s"),

c("Gold", cbuk = "xr_uk * (+or_uk * pg_uk)", cbus = "+or_us * pg_us", sum = "xr_uk * (or_uk * pg_uk) + or_us * pg_us"),

c("Balance", huk = "xr_uk * -v_uk", guk = "xr_uk * +b_uk_s", cbuk = "xr_uk * -nwcb_uk",

hus = "-v_us", gus = "+b_us_s", sum = "- (xr_uk*(+or_uk * pg_uk) + or_us * pg_us)")

)

sfcr_validate(bs_openfix, openfix, which = "bs", tol = 1)

#> Water tight! The balance-sheet matrix is consistent with the simulated model.Transactions-flow matrix

tfm_openfix <- sfcr_matrix(

columns = c("Households_uk", "Firms_uk", "Govt_uk", "Central bank_uk",

"Households_us", "Firms_us", "Govt_us", "Central bank_us"),

codes = c("huk", "fuk", "guk", "cbuk", "hus", "fus", "gus", "cbus"),

c("Consumption", huk = "-cons_uk", fuk = "+cons_uk", hus = "-cons_us", fus = "+cons_us"),

c("Govt. Exp", fuk = "+g_uk", guk = "-g_uk", fus = "+g_us", gus = "-g_us"),

c("Trade1", fuk = "xr_uk * -im_uk", fus = "+ x_us"),

c("Trade2", fuk = "xr_uk * +x_uk", fus = "- im_us"),

c("GDP", huk = "+y_uk", fuk = "-y_uk", hus = "+y_us", fus = "-y_us"),

c("Taxes", huk = "-t_uk", guk = "+t_uk", hus = "-t_us", gus = "+t_us"),

c("Interest payments1", huk = "xr_uk * (r_uk[-1] * b_ukuk_d[-1])", guk = "-xr_uk * (r_uk[-1] * b_uk_s[-1])", cbuk = "xr_uk * (r_uk[-1] * b_cb_ukus_d[-1])",

hus = "+r_uk[-1] * b_usuk_d[-1] * xr_uk"),

c("Interest payments2", huk = "xr_uk * r_us[-1] * b_ukus_d[-1] * xr_us", cbuk = "xr_uk * r_us[-1] * b_cb_ukus_d[-1] * xr_us",

hus = "r_us[-1] * b_usus_d[-1]", gus = "-r_us[-1] * b_us_s[-1]", cbus = "r_us[-1] * b_cb_usus_d[-1]"),

c("Cb profits", guk = "f_cb_uk", cbuk = "-f_cb_uk", gus = "f_cb_us", cbus = "-f_cb_us"),

c("Ch. Money", huk = "-d(h_uk_d)", cbuk = "d(h_uk_s)",

hus = "-d(h_us_d)", cbus = "d(h_us_s)"),

c("Ch. uk bills", huk = "-xr_uk * d(b_ukuk_d)", guk = "xr_uk * d(b_ukuk_s)",

hus = "d(b_usuk_d) * xr_uk"),

c("Ch. us bills", huk = "-xr_uk * d(b_ukus_d) * xr_us", cbuk = "-xr_uk * d(b_cb_ukus_d) * xr_us",

hus = "-d(b_usus_d)", gus = "d(b_us_s)", cbus = "-d(b_cb_usus_d)"),

c("Gold", cbuk = "-xr_uk * d(or_uk) * pg_uk", cbus = "-d(or_us) * pg_us"),

)

sfcr_validate(tfm_openfix, openfix, which = "tfm", tol = 1)

#> Water tight! The transactions-flow matrix is consistent with the simulated model.Good, the model is SFC!

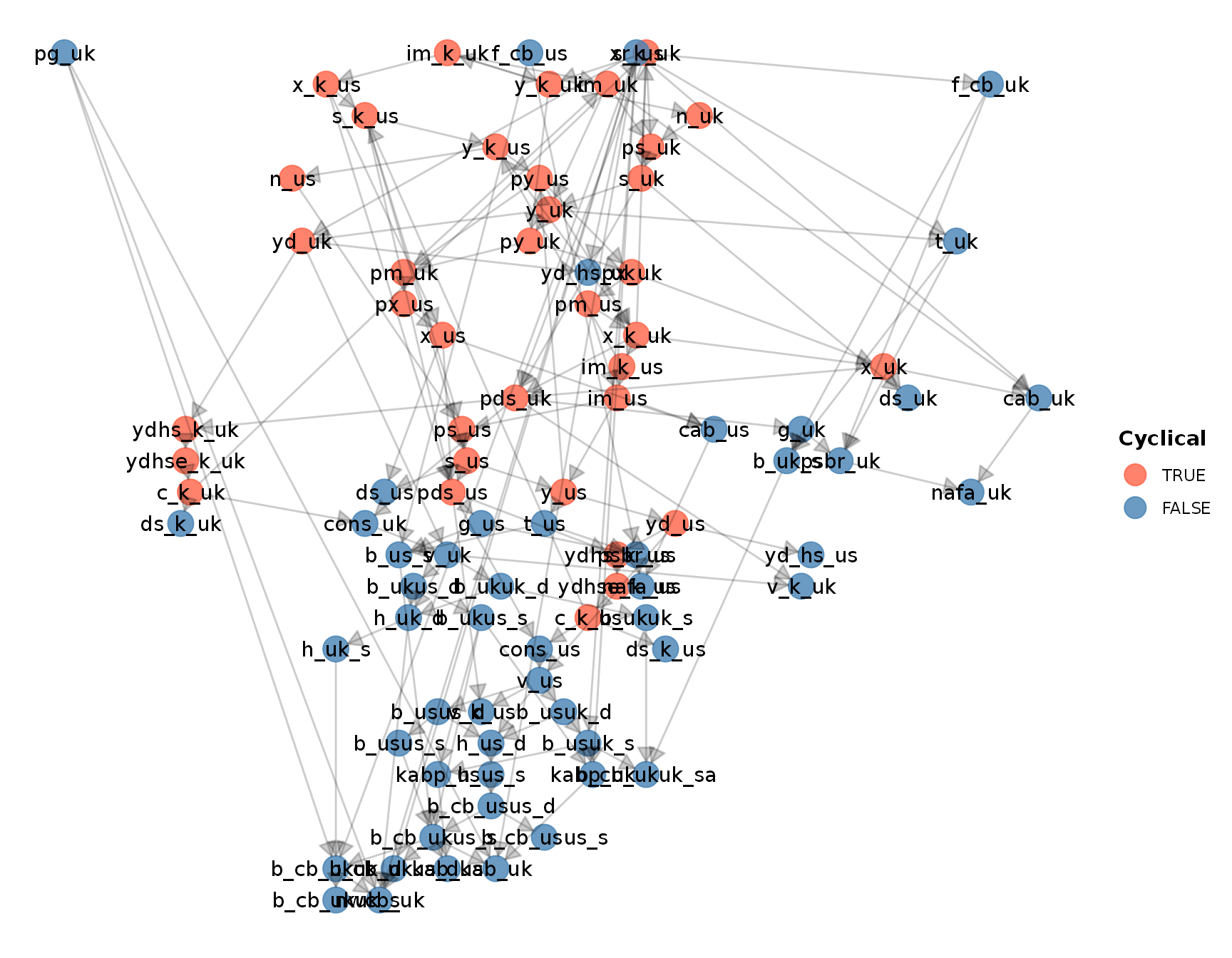

Let’s check its structure:

Sankey’s diagram: OPEN FIX

sfcr_sankey(tfm_openfix, openfix)Helper plot function

# (b_ukus_d_2/xr_us_2)/v_uk_2 b_ukus_d_2/v_uk_2

do_plot <- function(model, variables) {

model %>%

mutate(tab_uk = x_uk - im_uk,

tab_us = x_us - im_us,

gab_uk = -psbr_uk,

gab_us = -psbr_us,

dres_uk = b_cb_ukus_d - lag(b_cb_ukus_d),

db_cb_uk = b_cb_ukuk_d - lag(b_cb_ukuk_d),

dh_uk = h_uk_s - lag(h_uk_s),

dh_us = h_us_s - lag(h_us_s),

by_uk = b_uk_s / y_uk,

by_us = b_us_s / y_us,

bukus_p = (b_ukus_d/xr_us)/v_uk,

bukus_d = b_ukus_d / v_uk) %>%

pivot_longer(cols = -period) %>%

filter(name %in% variables) %>%

ggplot(aes(x = period, y = value)) +

geom_line(aes(linetype = name))

}Scenario 1: Increase in the US propensity to import

shock1 <- sfcr_shock(v = sfcr_set(eps0 ~ -2), s = 5, e = 100)

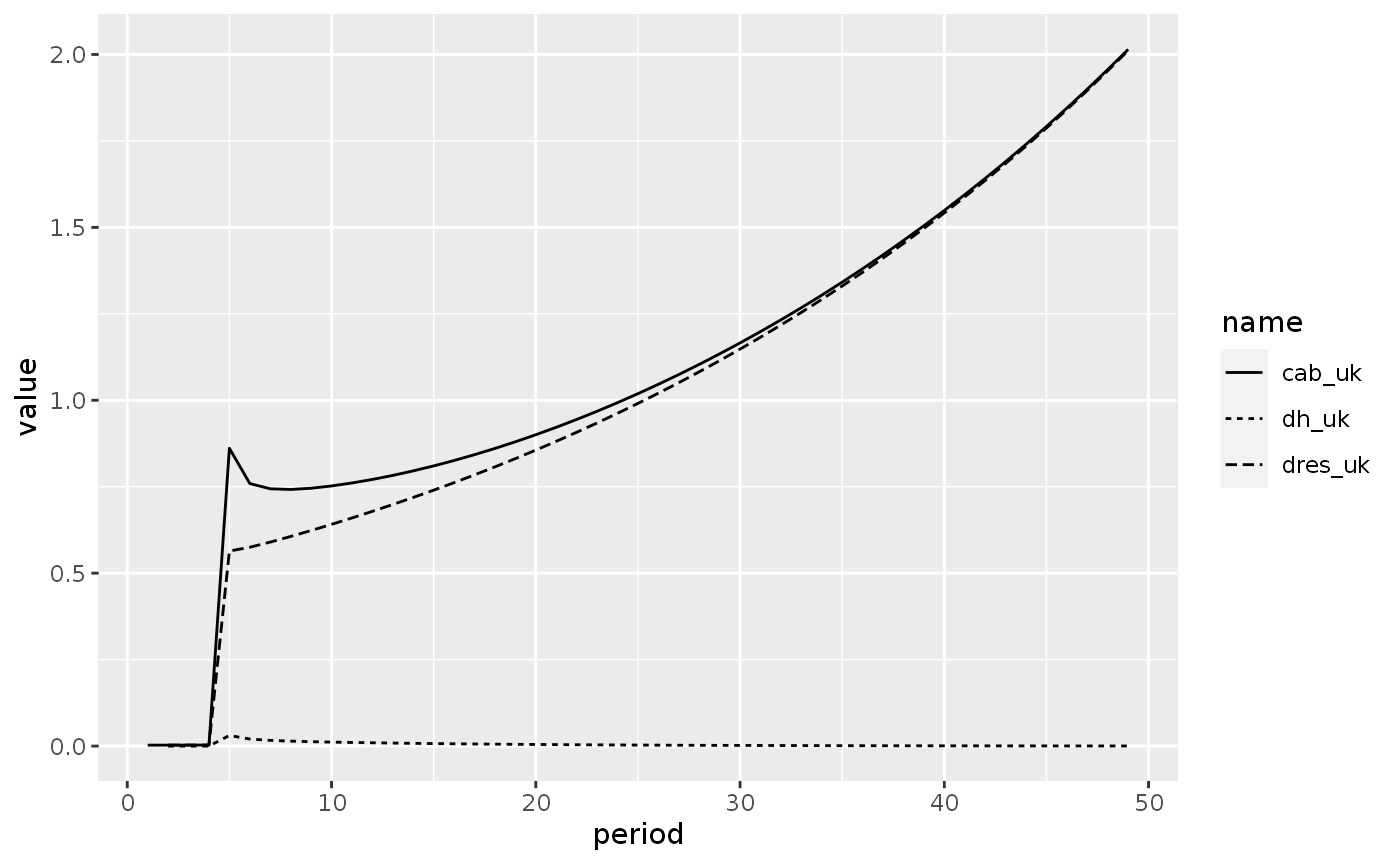

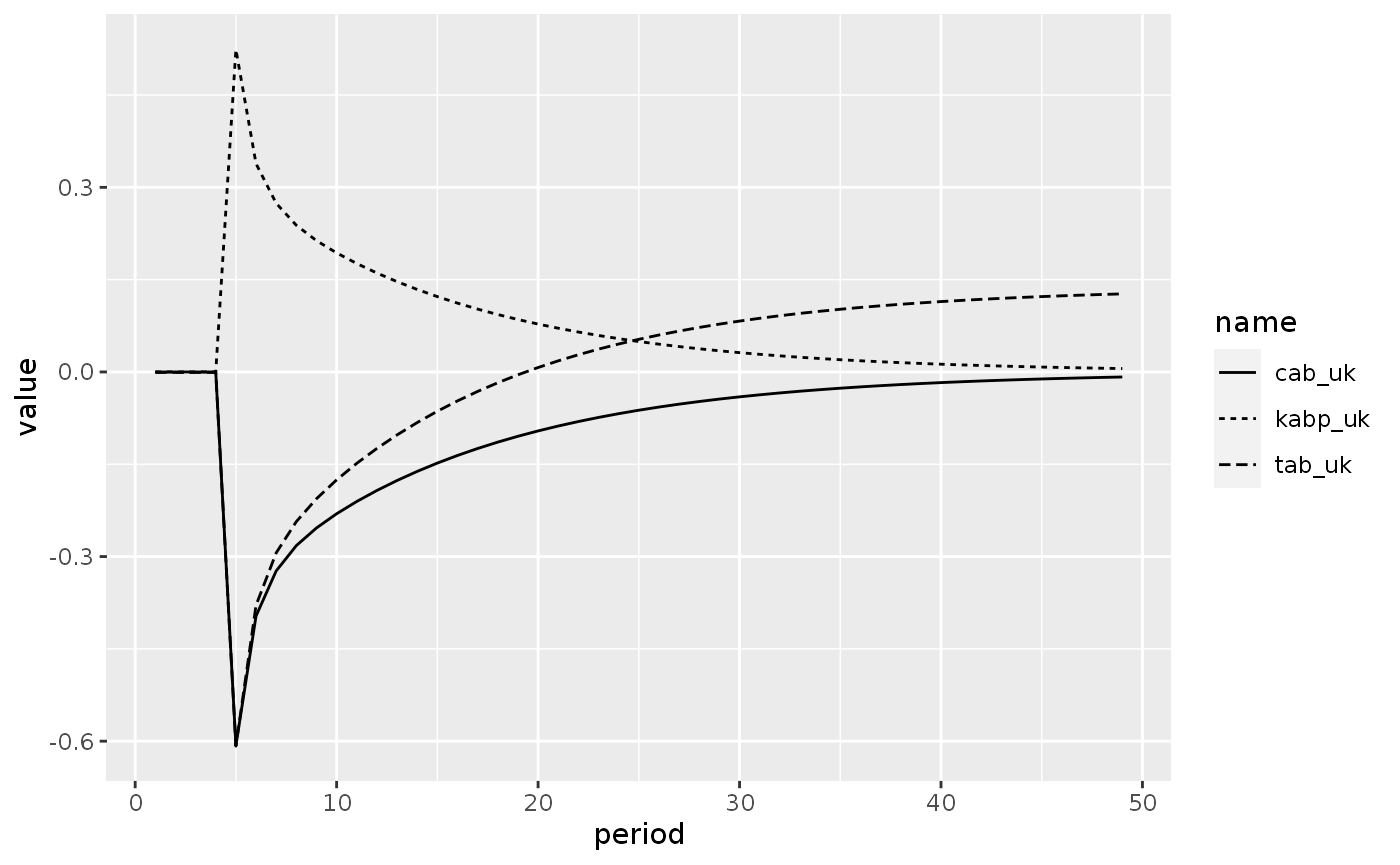

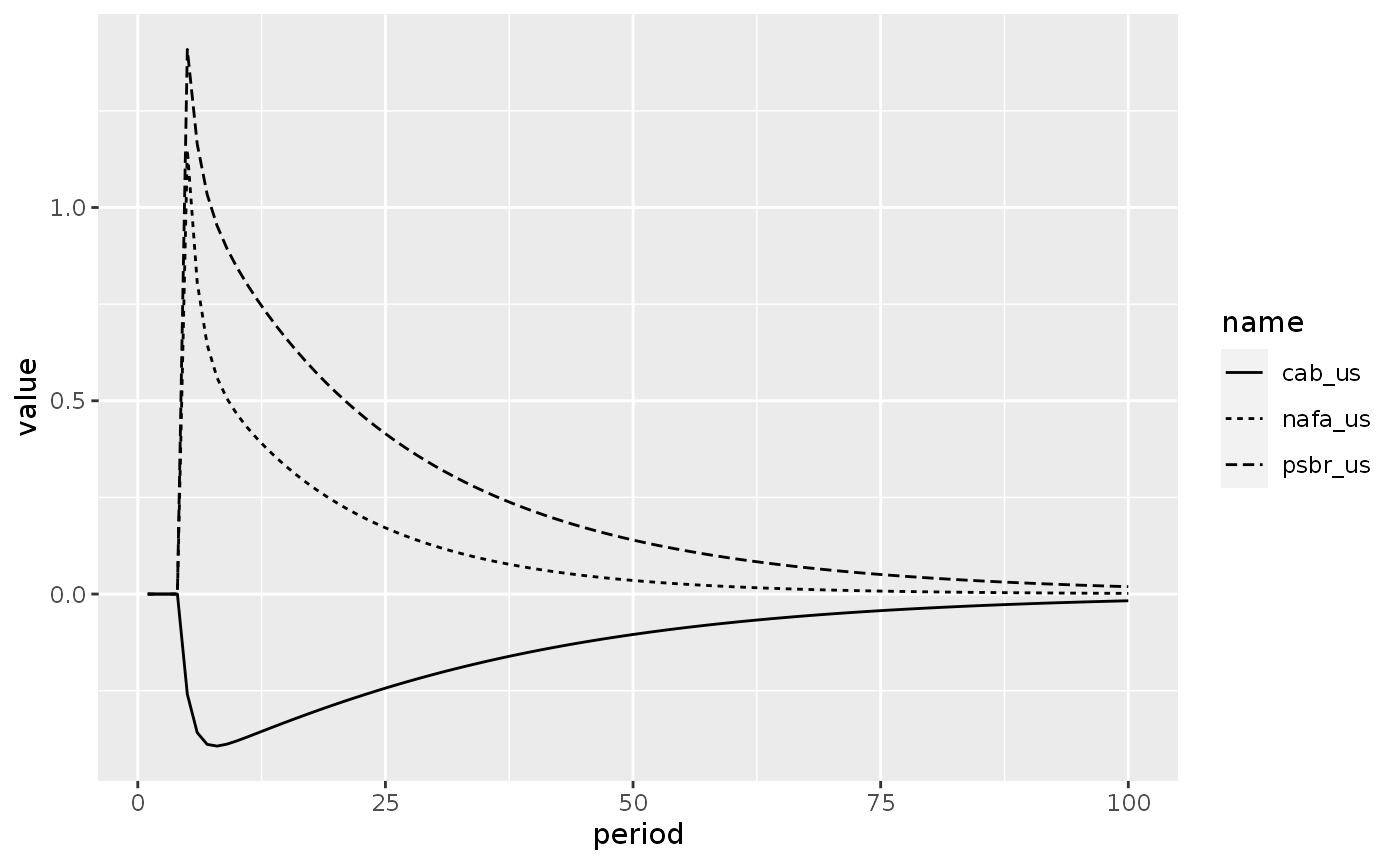

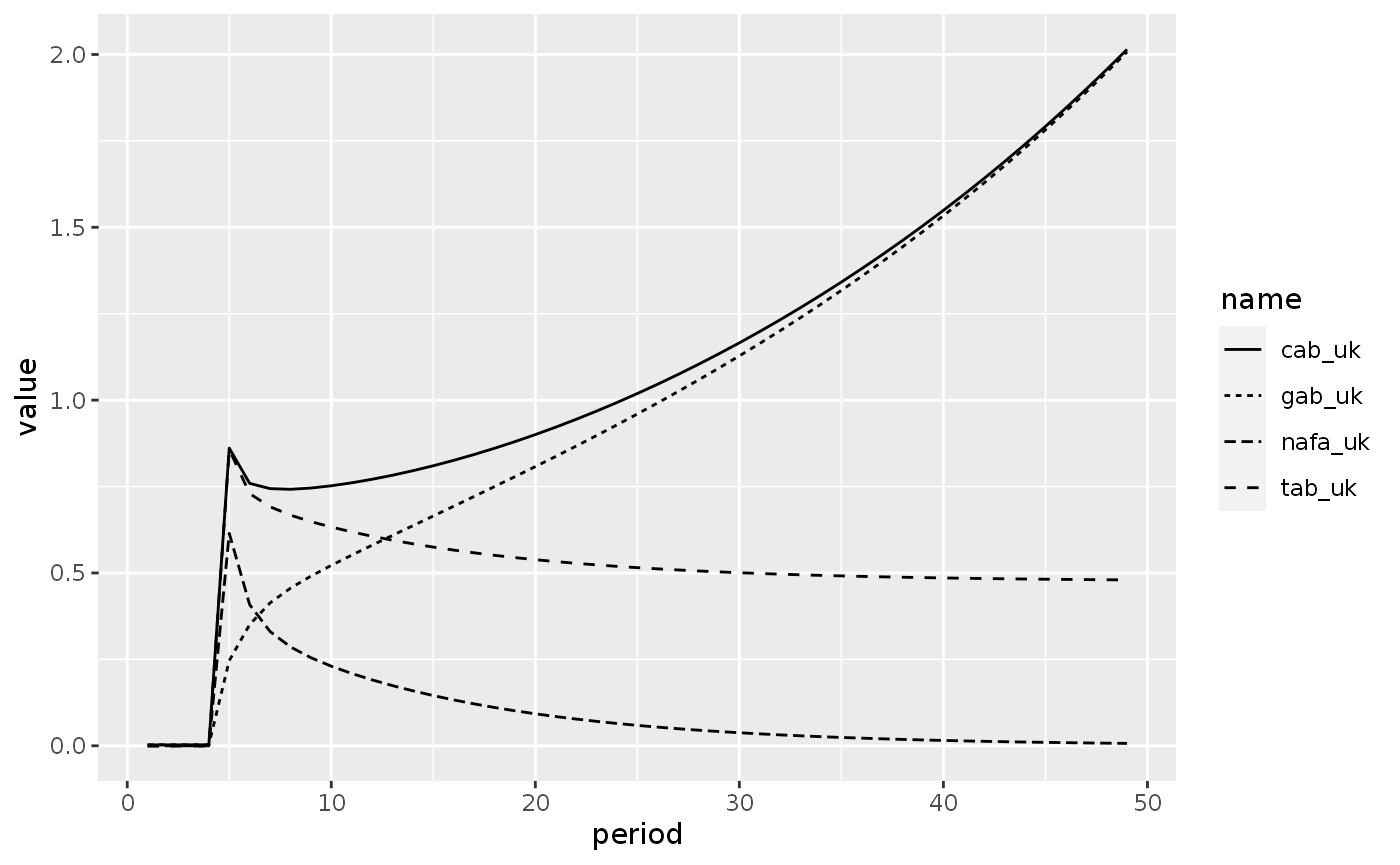

openfix1 <- sfcr_scenario(openfix, shock1, 100, method = "Broyden")Figure 12.A

openfix1 %>%

filter(period < 50) %>%

do_plot(variables = c("cab_uk", "nafa_uk", "gab_uk", "tab_uk"))

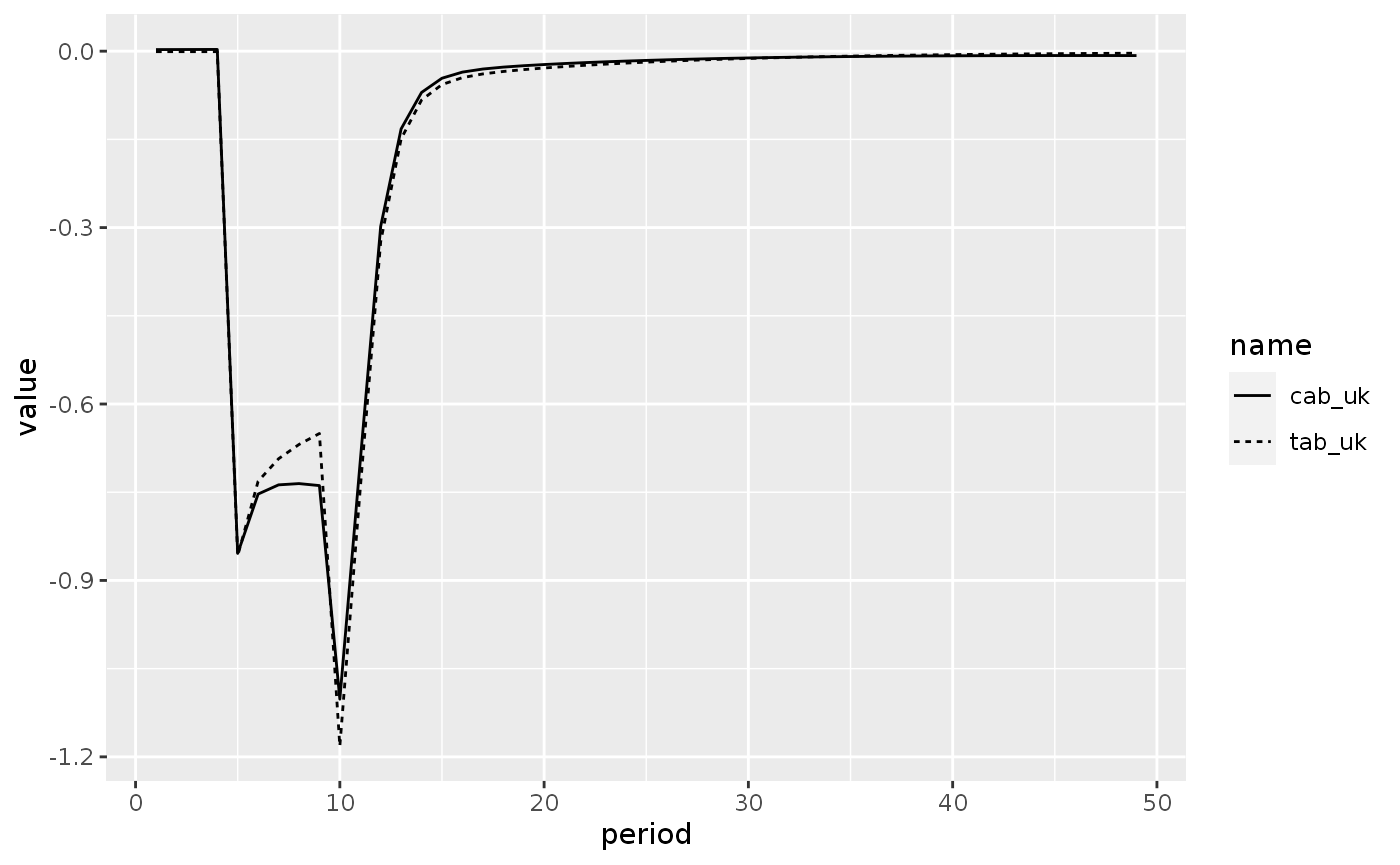

Scenario 2: A one-step devaluation after an increase in the UK propensity to import

shock2 <- sfcr_shock(v = sfcr_set(mu0 ~ -2), s = 5, e = 100)

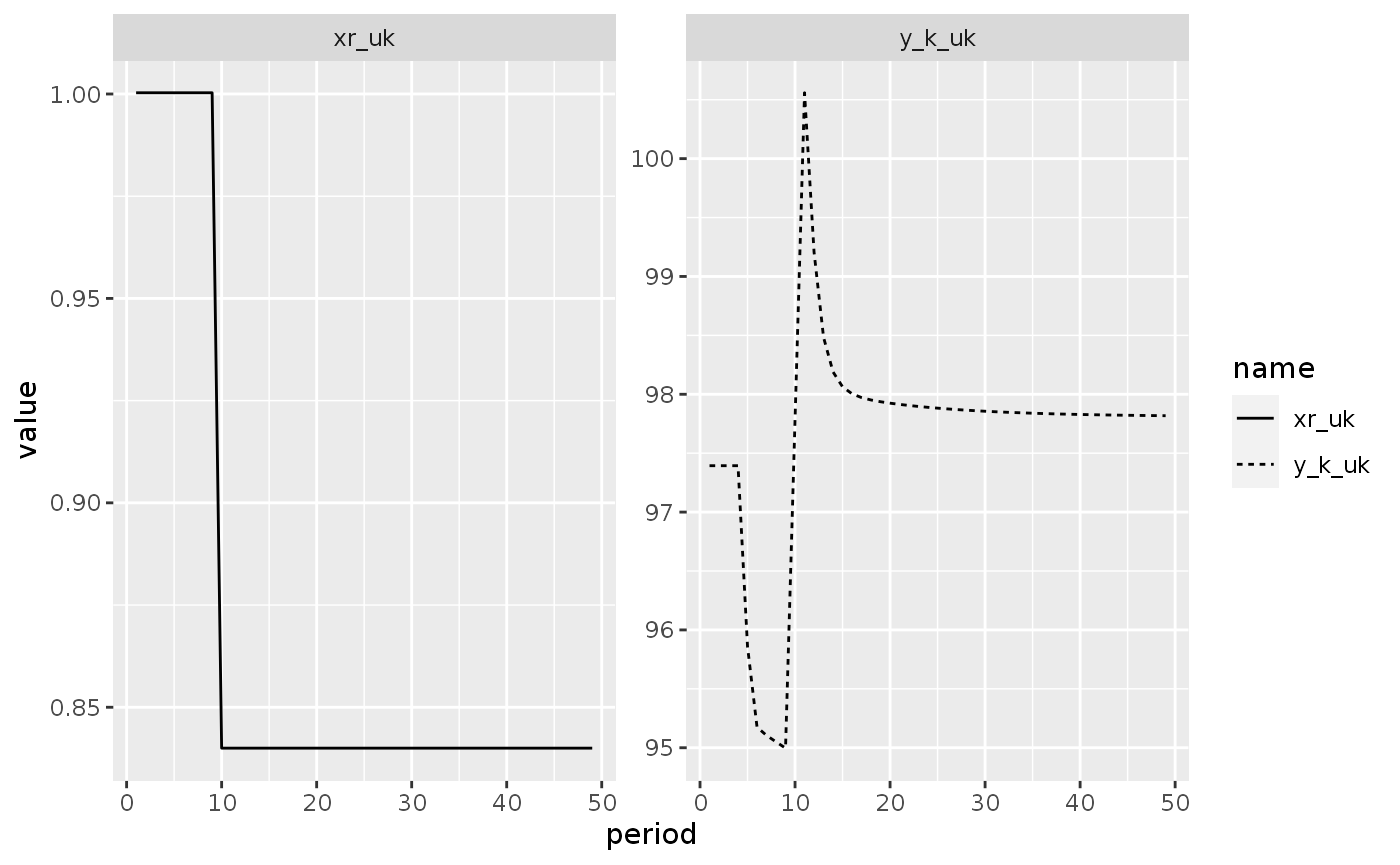

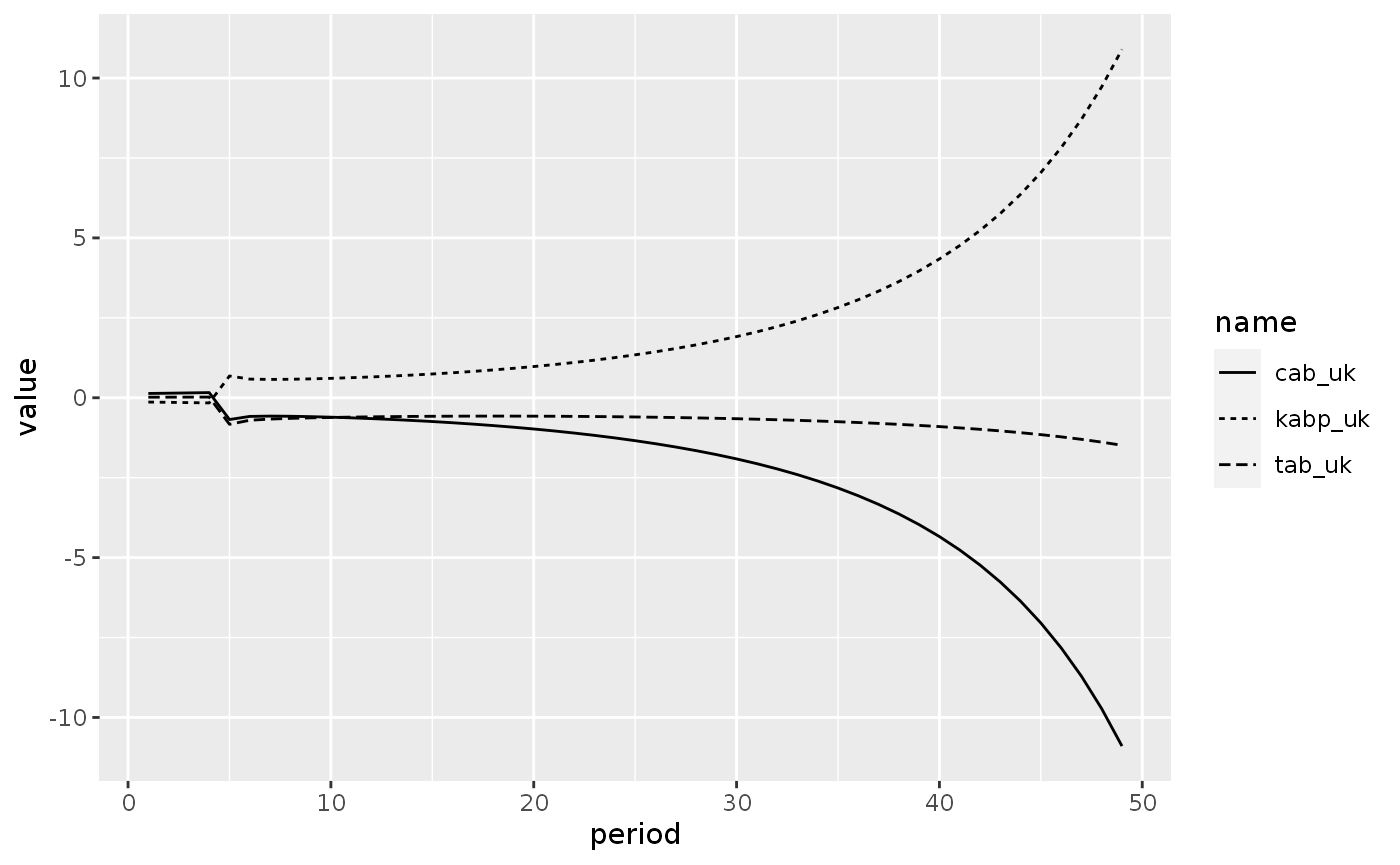

shock3 <- sfcr_shock(v = sfcr_set(xr_uk ~ 0.84), s = 10, e = 100)

openfix2 <- sfcr_scenario(openfix, list(shock2, shock3), 100, method = "Broyden")Model OPEN FIX R

Closure

# Find the equation to exclude

open12_eqs %>%

sfcr_set_index() %>%

filter(lhs == "b_ukus_d")

#> # A tibble: 1 × 3

#> id lhs rhs

#> <int> <chr> <chr>

#> 1 64 b_ukus_d v_uk * (lambda20 - lambda21 * r_uk + lambda22 * (r_us + dxre_u…

openfixr_eqs <- sfcr_set(

open12_eqs,

# 12.89R : Demand of UK Bills in US

b_ukus_d ~ b_ukus_s*xr_us,

# 12.90R : Supply of UK bills to us

b_ukus_s ~ b_us_s - b_usus_s - b_cb_usus_d - b_cb_ukus_s,

# 12.68R: Endogenous interest rate

r_uk ~ (lambda20 + lambda22*(r_us + dxre_us) - b_ukus_d/v_uk)/lambda21,

exclude = 64

)

openfixr_ext <- sfcr_set(

open12_ext,

# Eq. 12.91R

xr_uk ~ 1.0003,

b_cb_ukus_s ~ 0.02031

)Baseline

openfixr <- sfcr_baseline(

openfixr_eqs,

openfixr_ext,

periods = 100,

initial = open12_init,

method = "Broyden"

)

openfixr %>%

select(b_cb_ukuk_s, b_cb_ukuk_sa)

#> # A tibble: 100 × 2

#> b_cb_ukuk_s b_cb_ukuk_sa

#> <dbl> <dbl>

#> 1 0.280 0.280

#> 2 0.280 0.280

#> 3 0.280 0.280

#> 4 0.280 0.280

#> 5 0.280 0.280

#> 6 0.280 0.280

#> 7 0.280 0.280

#> 8 0.280 0.280

#> 9 0.280 0.280

#> 10 0.280 0.280

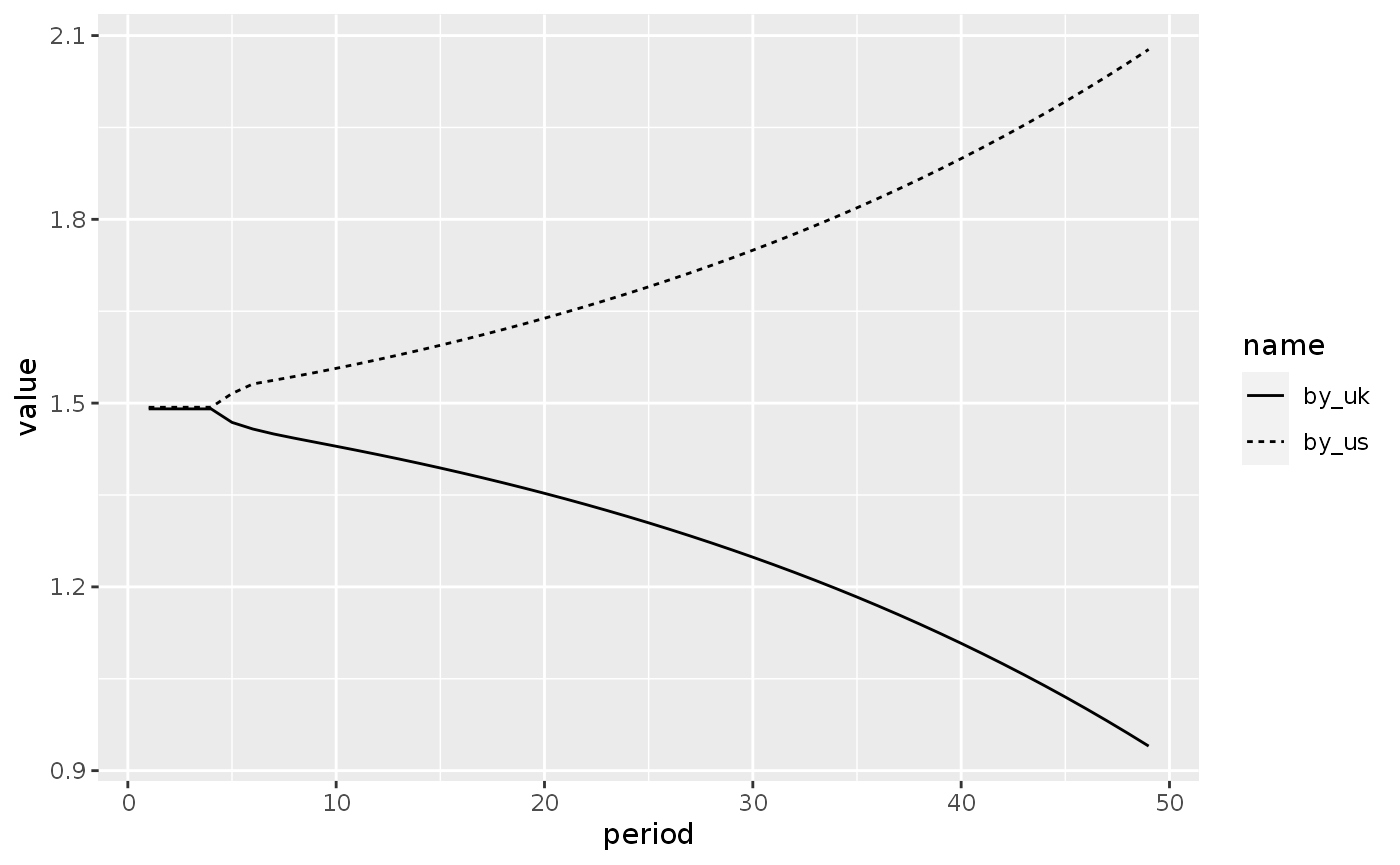

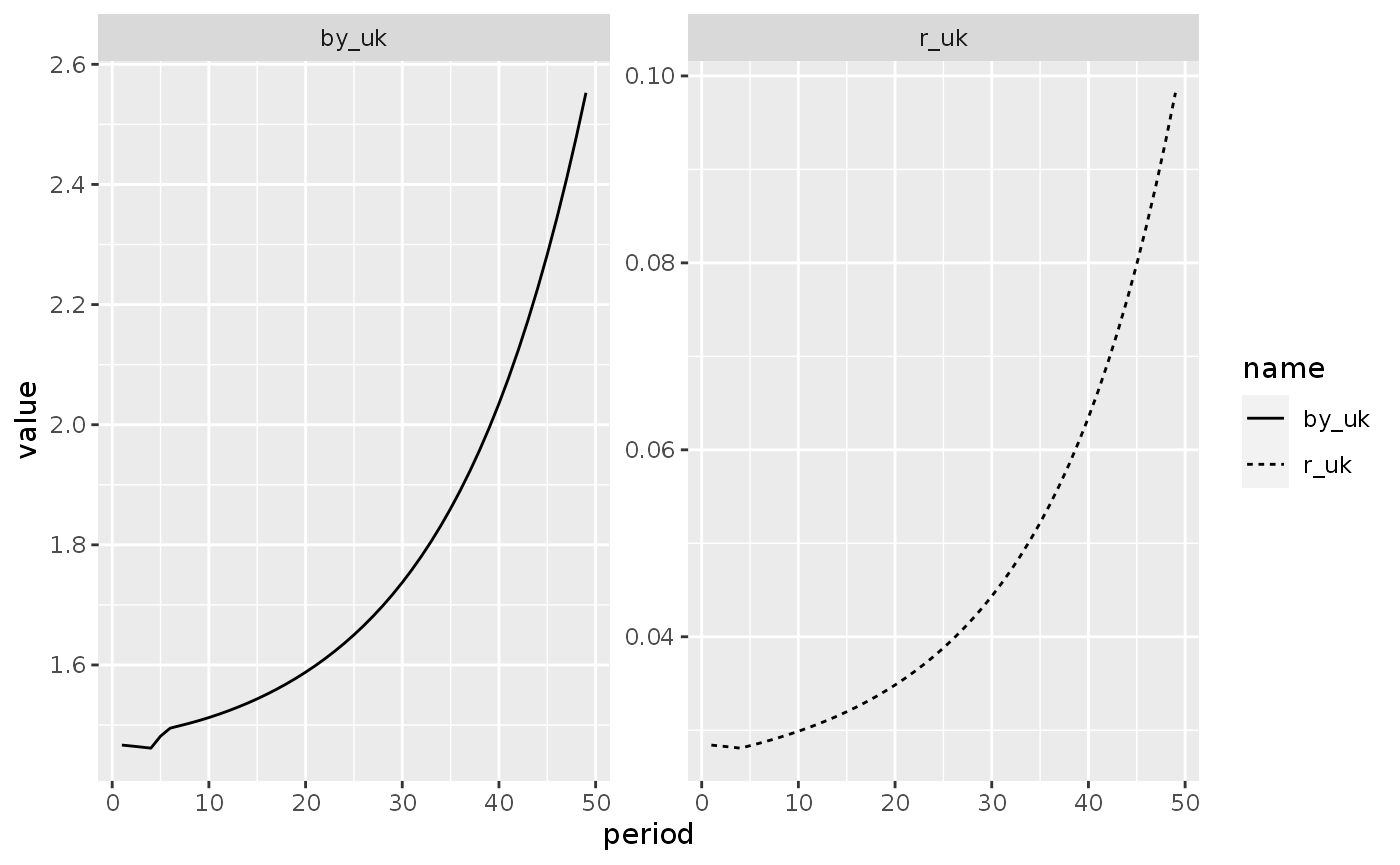

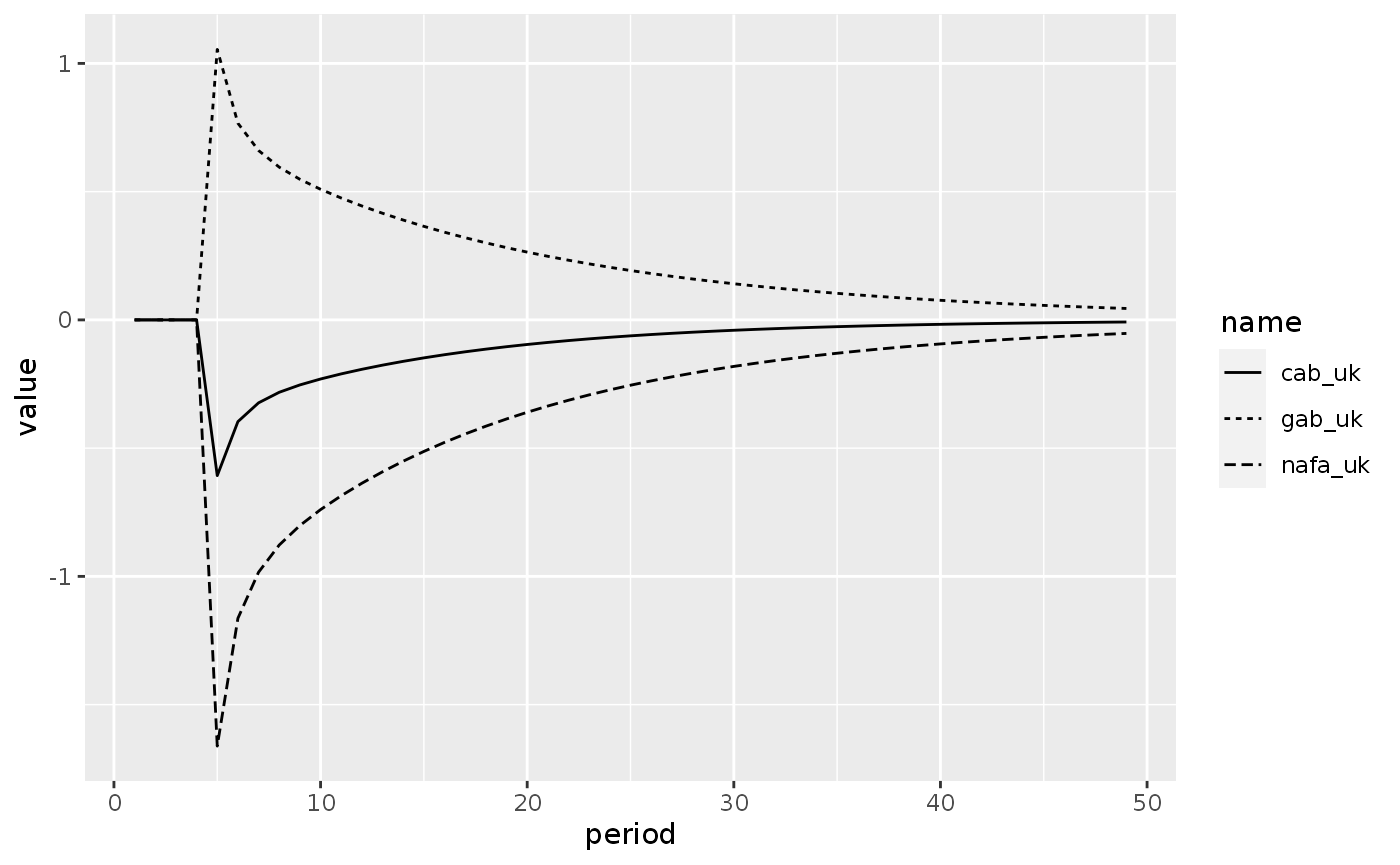

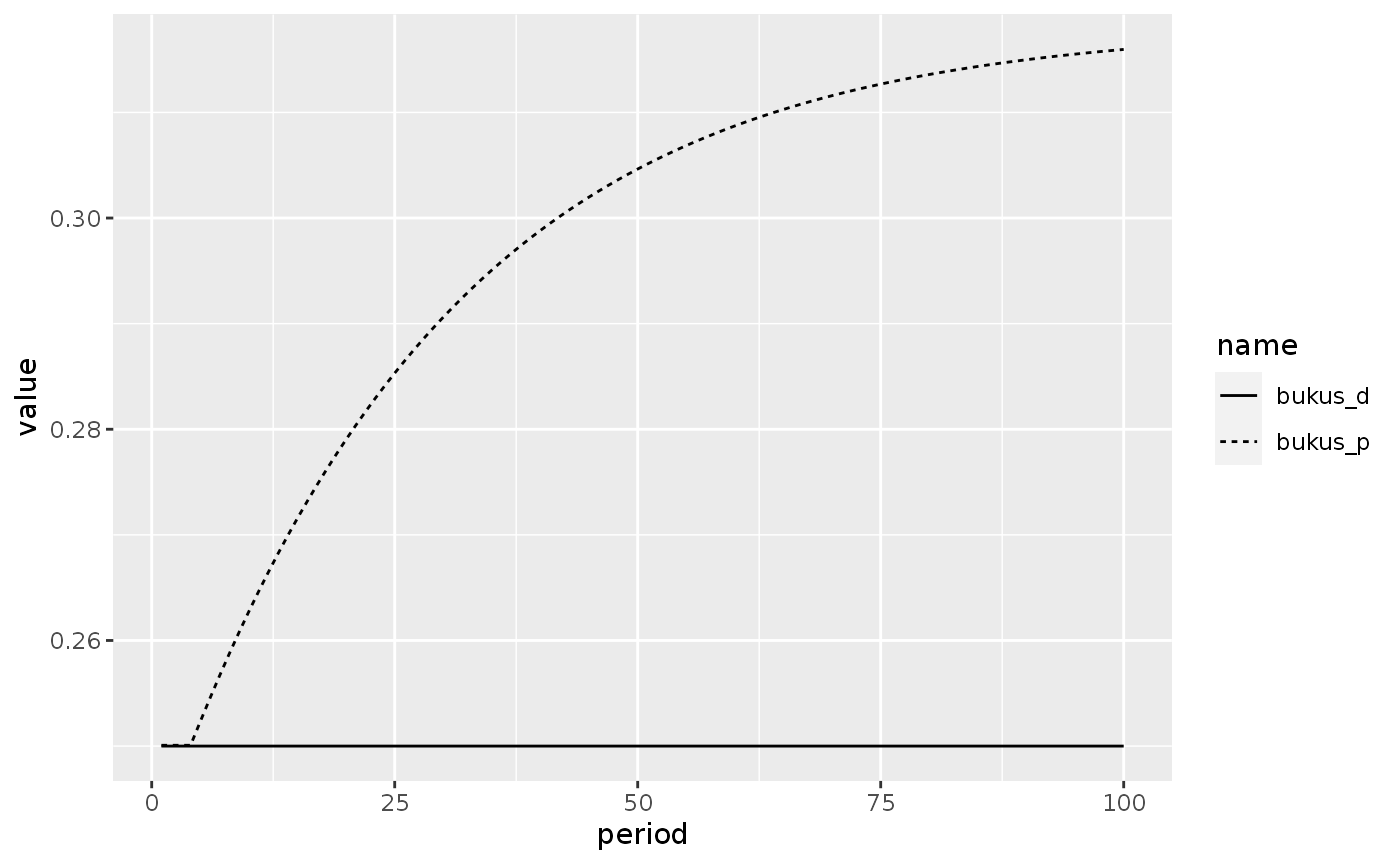

#> # … with 90 more rowsScenario 1: Increase in the UK propensity to import

shock1 <- sfcr_shock(v = sfcr_set(mu0 ~ -2), s = 5, e = 100)

openfixr1 <- sfcr_scenario(

openfixr, shock1, 100, method = "Broyden"

)Model OPEN FIX G

Closure

# Find the equations to exclude

open12_eqs %>%

sfcr_set_index() %>%

filter(lhs %in% c("b_uk_s", "b_cb_ukuk_s", "g_uk"))

#> # A tibble: 3 × 3

#> id lhs rhs

#> <int> <chr> <chr>

#> 1 11 b_uk_s b_uk_s[-1] + g_uk + r_uk[-1] * b_uk_s[-1] - t_uk - f_cb_uk

#> 2 59 g_uk g_k_uk * pds_uk

#> 3 74 b_cb_ukuk_s b_cb_ukuk_d

open12_ext %>%

sfcr_set_index() %>%

filter(lhs %in% "g_k_uk")

#> # A tibble: 1 × 3

#> id lhs rhs

#> <int> <chr> <chr>

#> 1 32 g_k_uk 16

openfixg_eqs <- sfcr_set(

open12_eqs,

# 12.89G : Bills supply from UK to US

b_ukus_s ~ xr_uk*b_ukus_d,

# 12.90G : Supply of UK bills to us

b_cb_ukus_s ~ b_us_s - b_usus_s - b_cb_usus_d - b_ukus_s,

# 12.13G: Endogenous govt. expenditures in UK

g_uk ~ b_uk_s - b_uk_s[-1] -(r_uk[-1]*b_uk_s[-1] - t_uk - f_cb_uk),

# 12.61G: Real government expenditures

g_k_uk ~ g_uk / pds_uk,

# 12.82AG: Supply of UK Bills

b_uk_s ~ b_usuk_s + b_ukuk_s + b_cb_ukuk_s,

exclude = c(11, 59, 74)

)

openfixg_ext <- sfcr_set(

open12_ext,

# Eq. 12.91R

xr_uk ~ 1.0003,

r_uk ~ 0.03,

b_cb_ukuk_s ~ 0.27984,

exclude = 32

)Baseline

openfixg <- sfcr_baseline(

equations = openfixg_eqs,

external = openfixg_ext,

initial = open12_init,

periods = 100,

method = "Broyden",

)

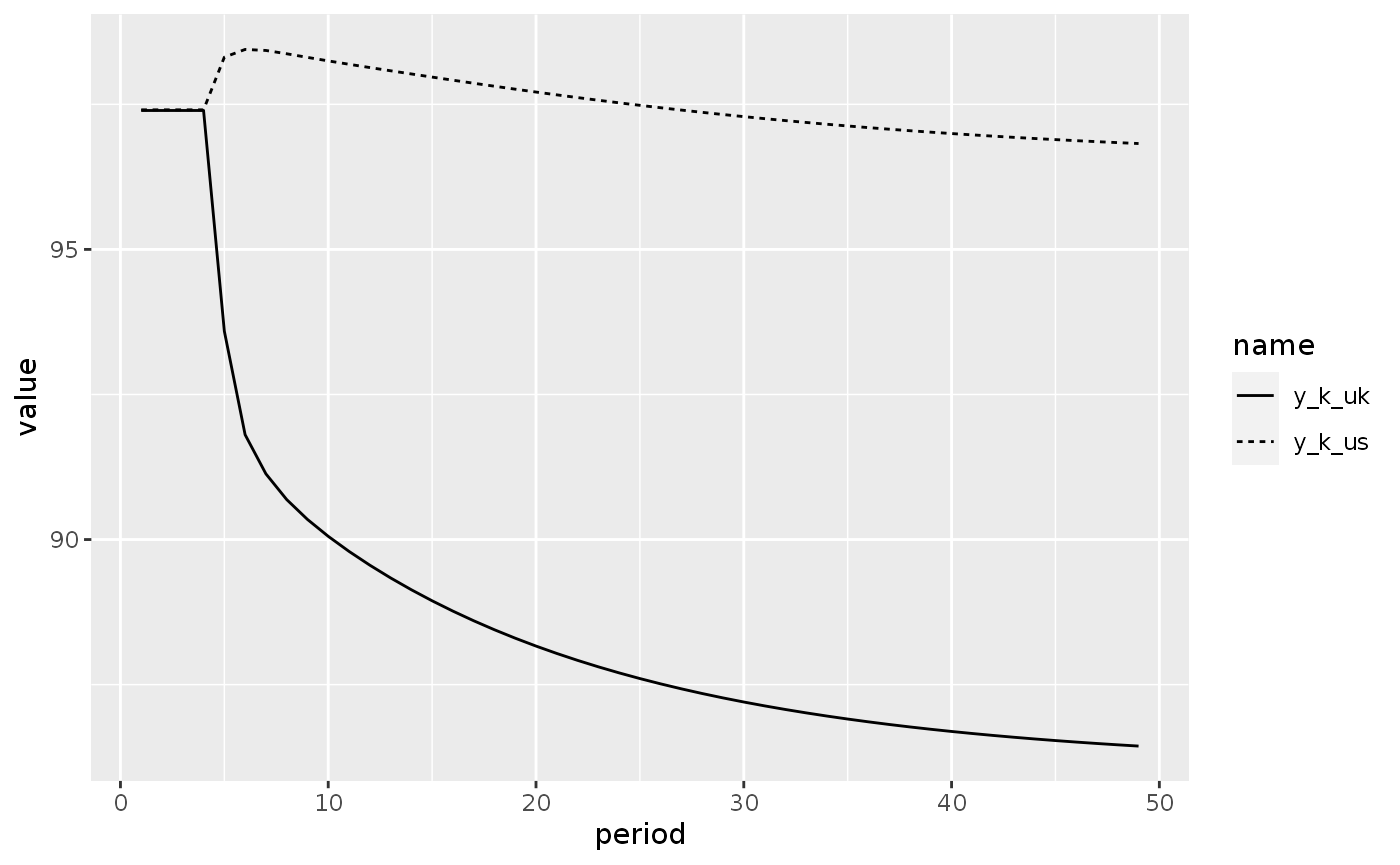

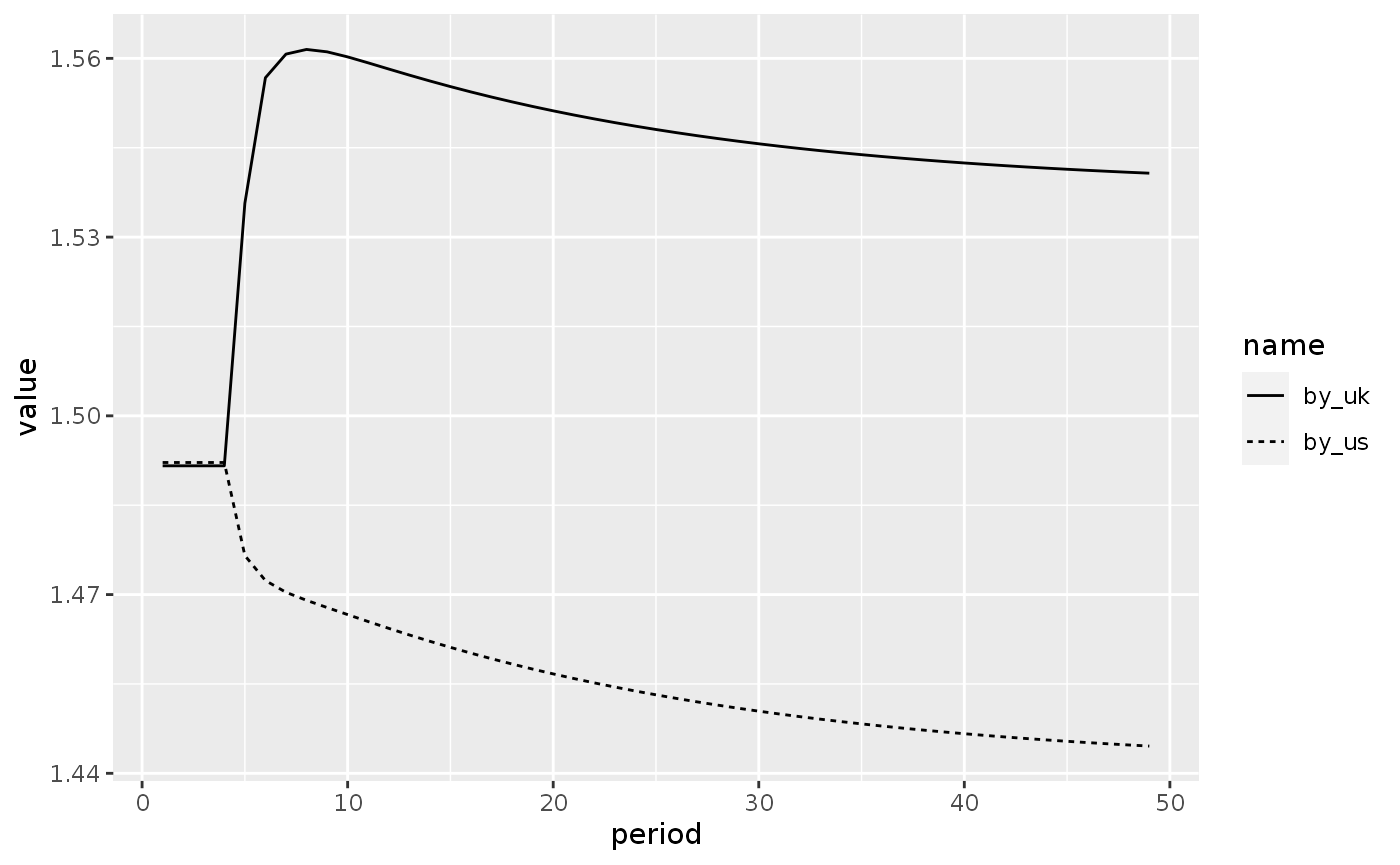

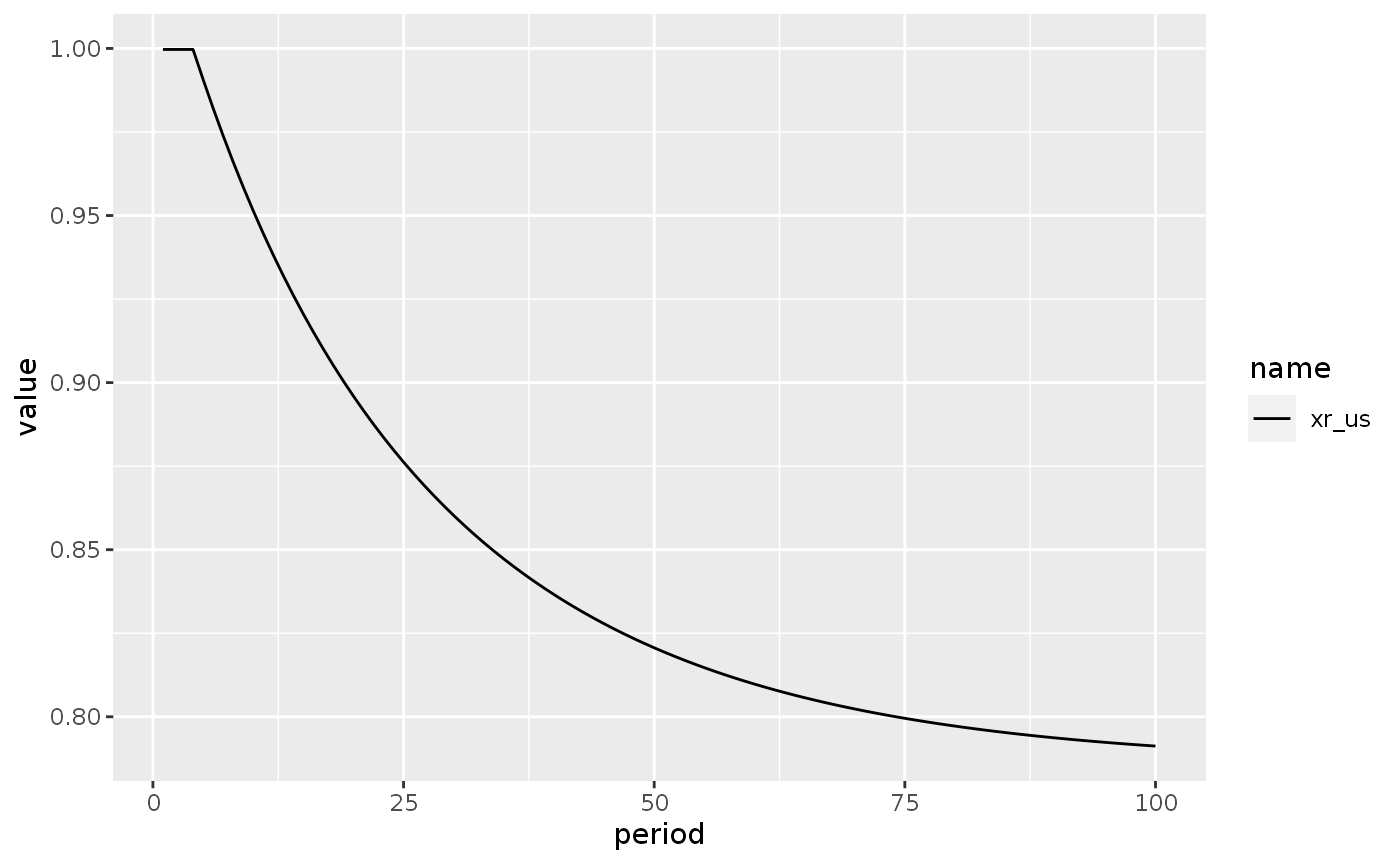

#Scenario 1

shock1 <- sfcr_shock(v = sfcr_set(mu0 ~ -2), s = 5, e = 100)

openfixg1 <- sfcr_scenario(

openfixg, shock1, 100, method = "Broyden"

)Model OPEN FLEX

Baseline

openflex <- sfcr_baseline(

equations = openflex_eqs,

external = openflex_ext,

initial = sfcr_set(open12_init),

periods = 100,

method = "Broyden",

hidden = c("b_cb_ukuk_s" = "b_cb_ukuk_sa")

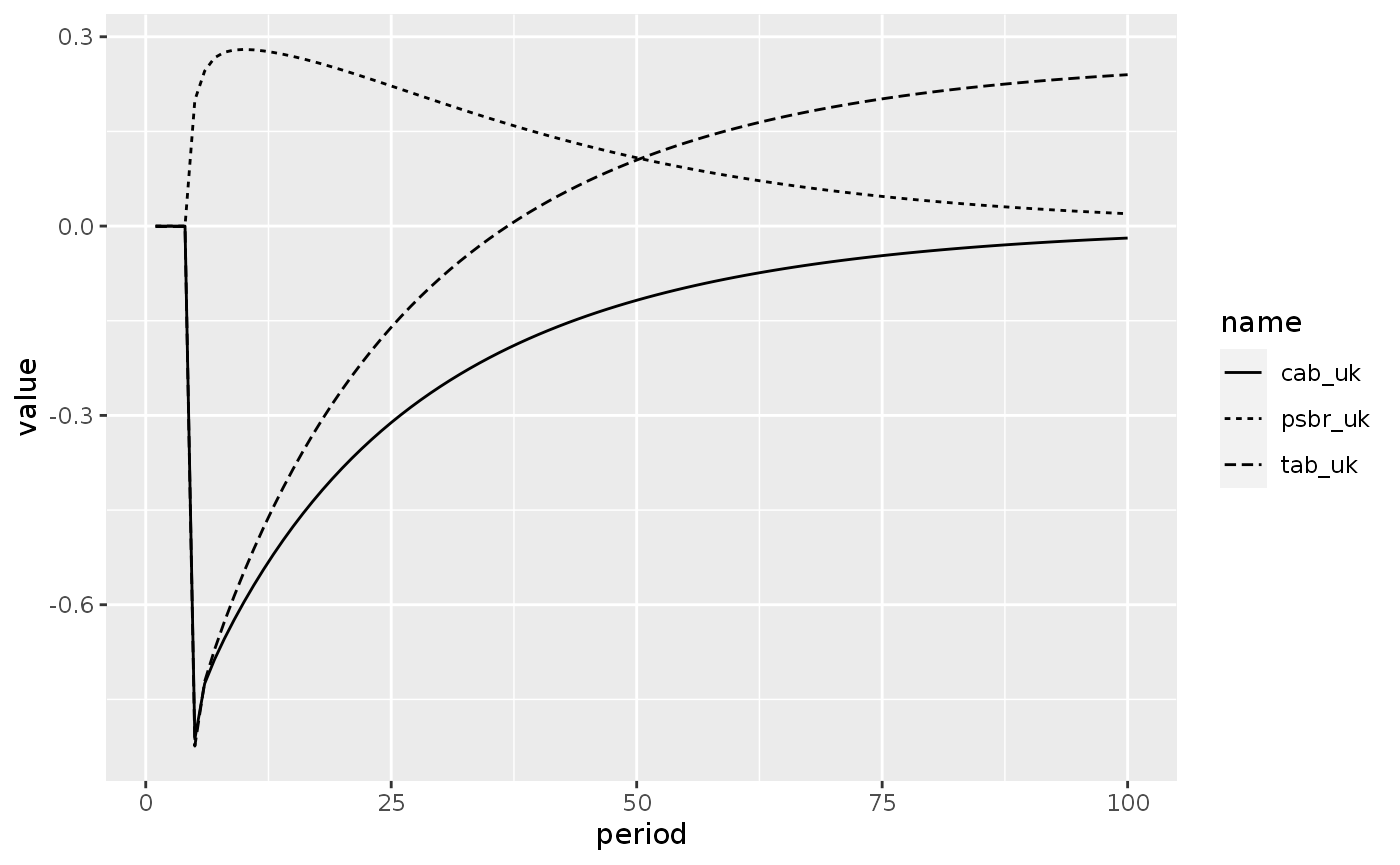

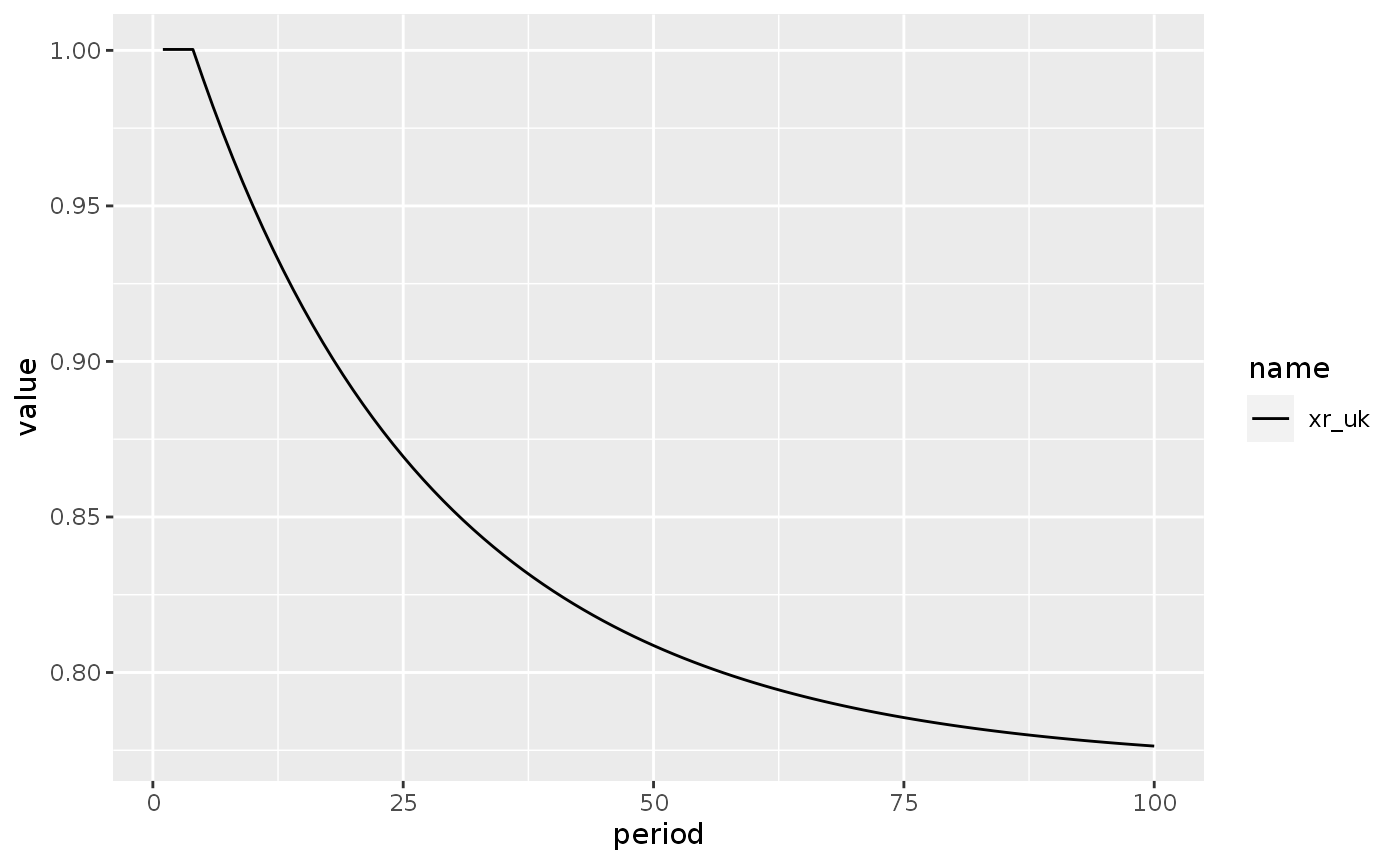

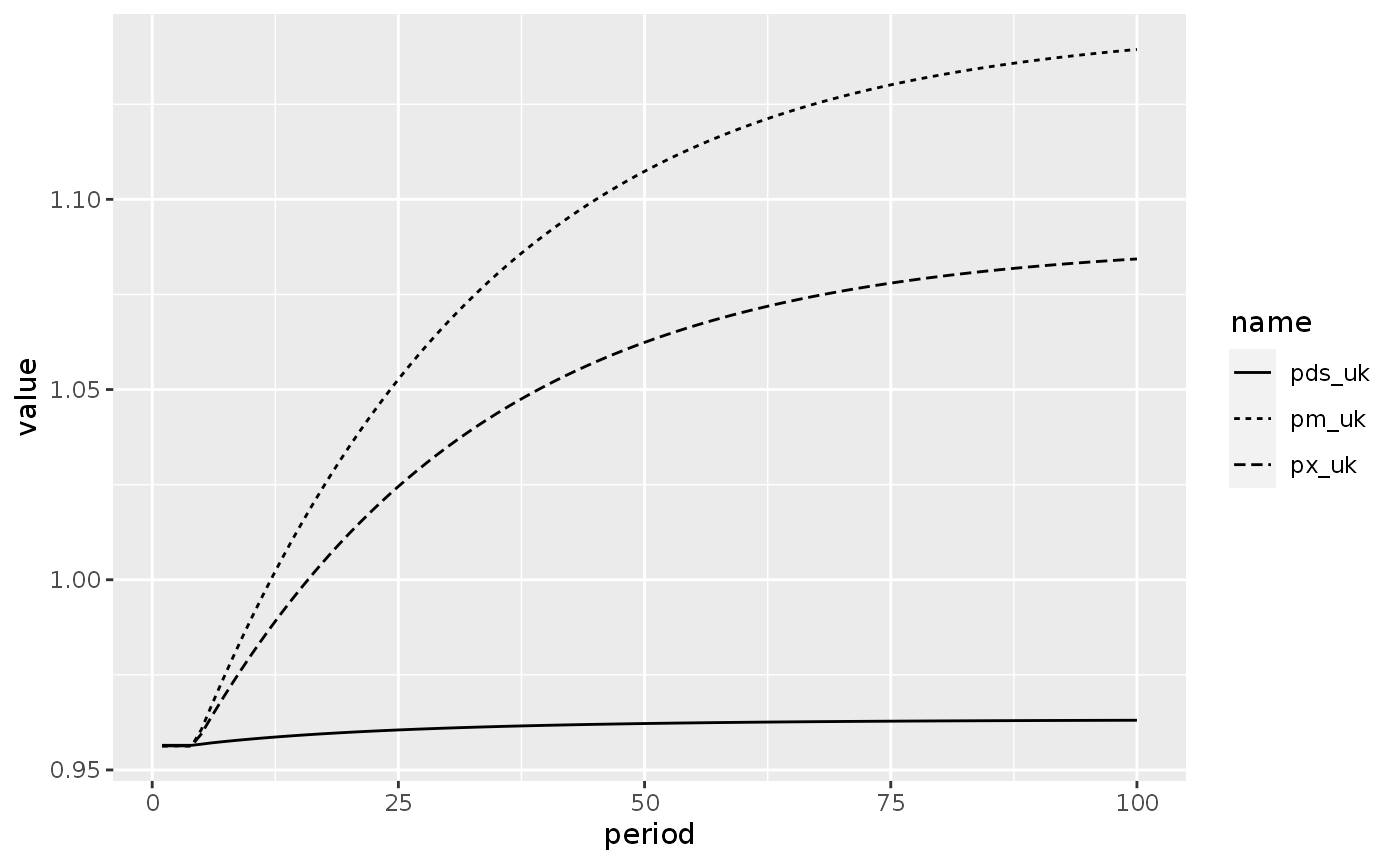

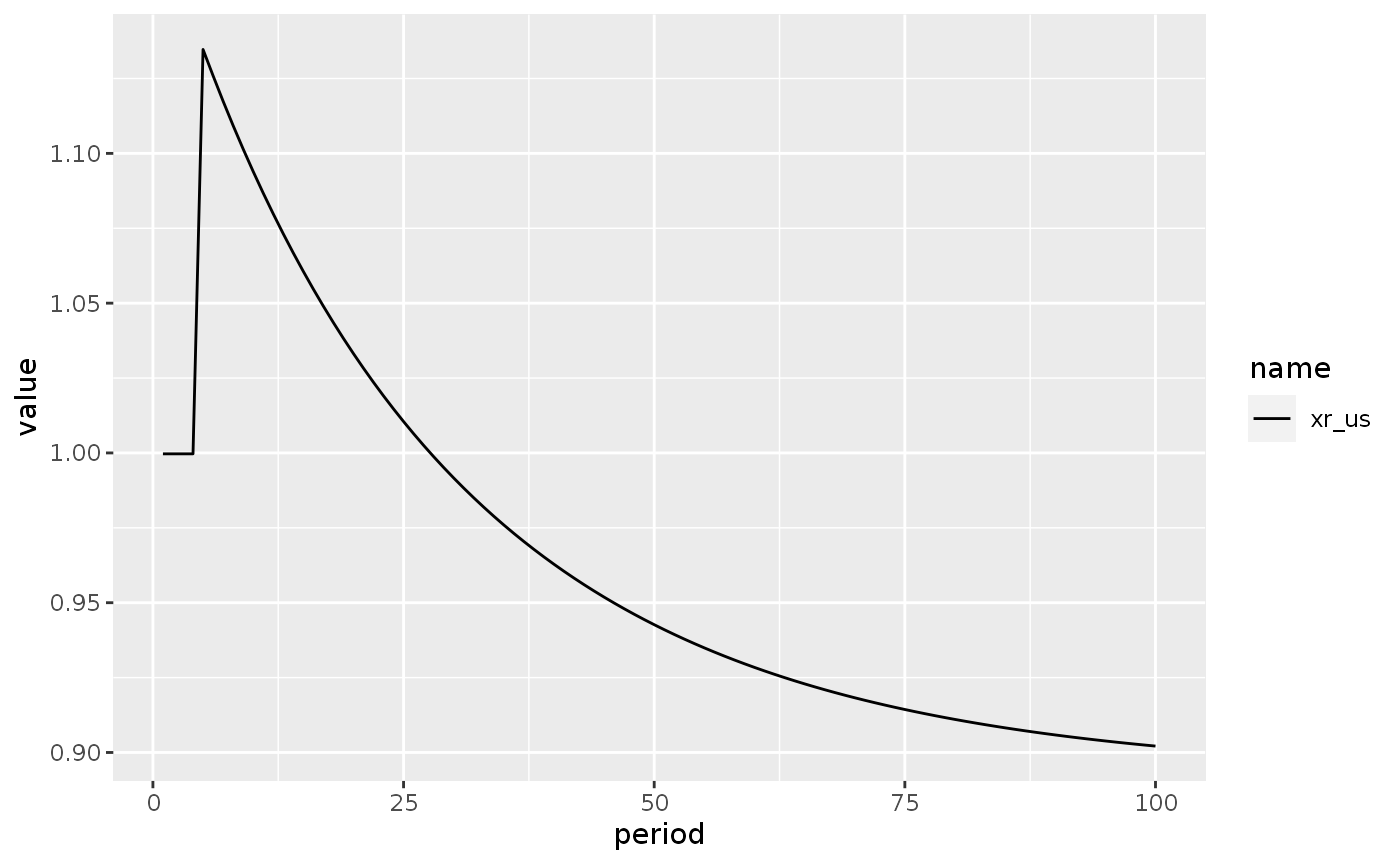

)Scenario 1: A decrease in the UK propensity to export

shock1 <- sfcr_shock(v = sfcr_set(eps0 ~ -2.2), s = 5, e = 100)

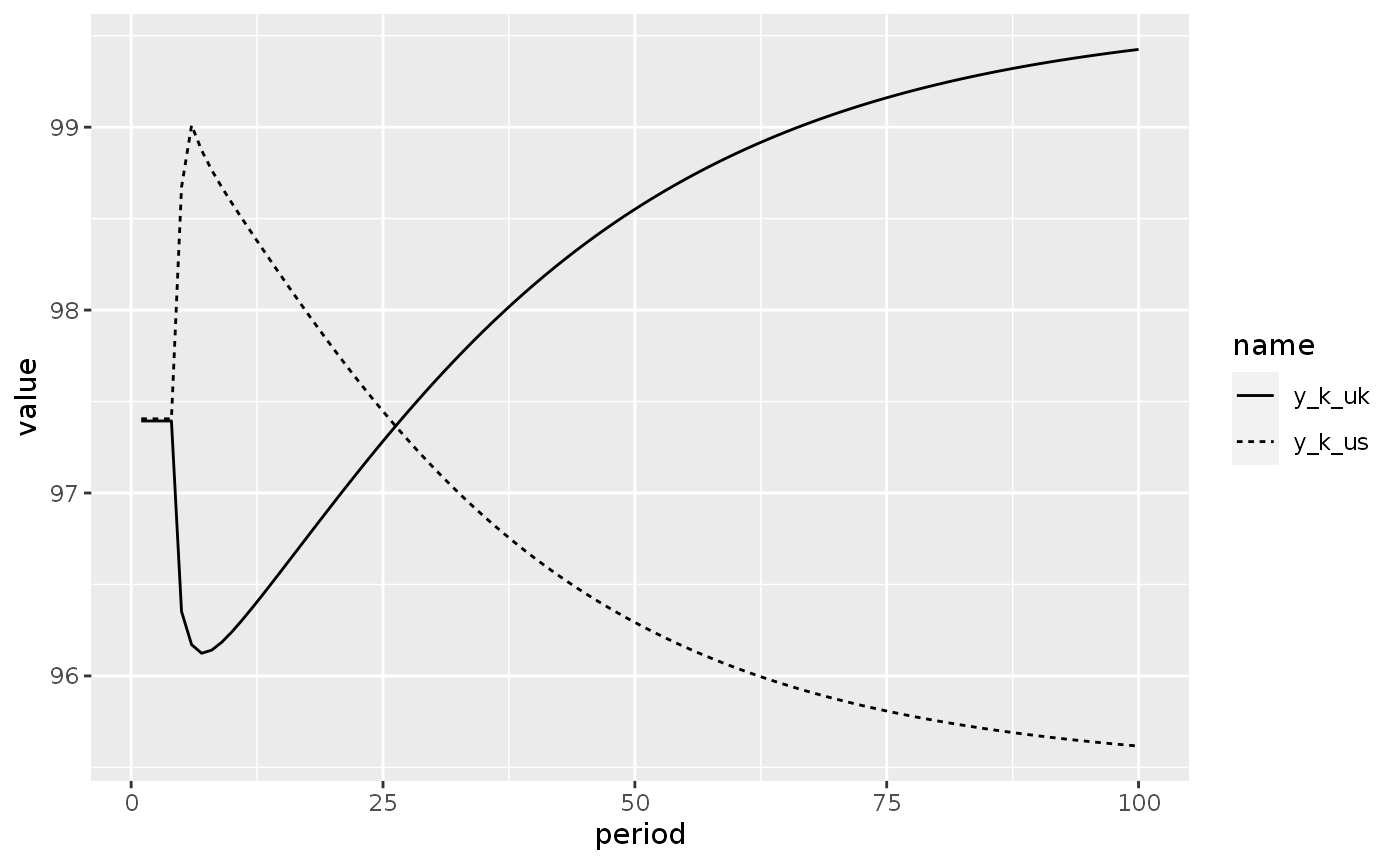

openflex1 <- sfcr_scenario(openflex, shock1, 100, method = "Broyden")Scenario 2: A step increase in US government expenditures

shock2 <- sfcr_shock(v = sfcr_set(g_k_us ~ 18), s = 5, e = 100)

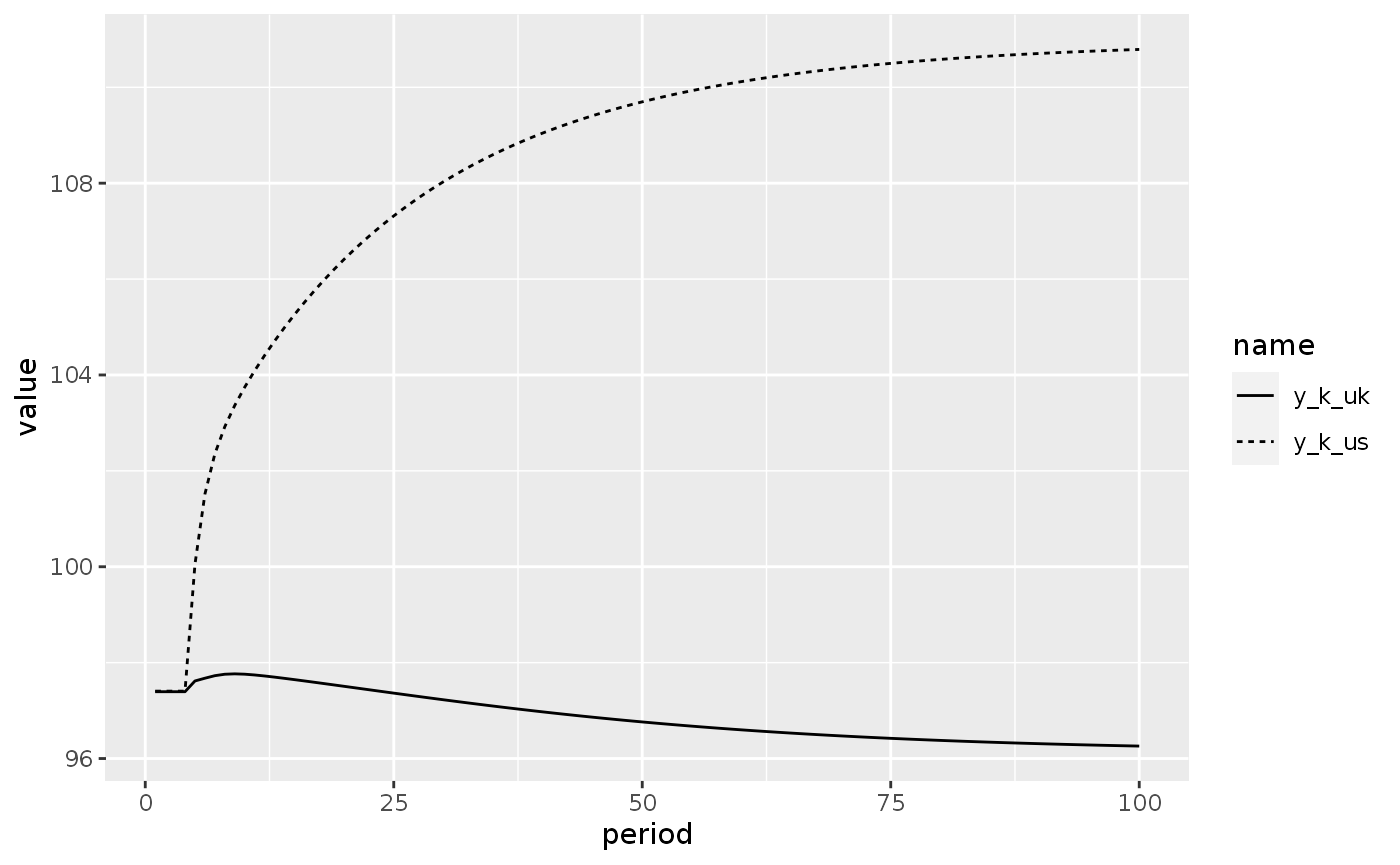

openflex2 <- sfcr_scenario(openflex, shock2, 100, method = "Broyden")Scenario 3 - Increase in the desire to hold US treasury bills

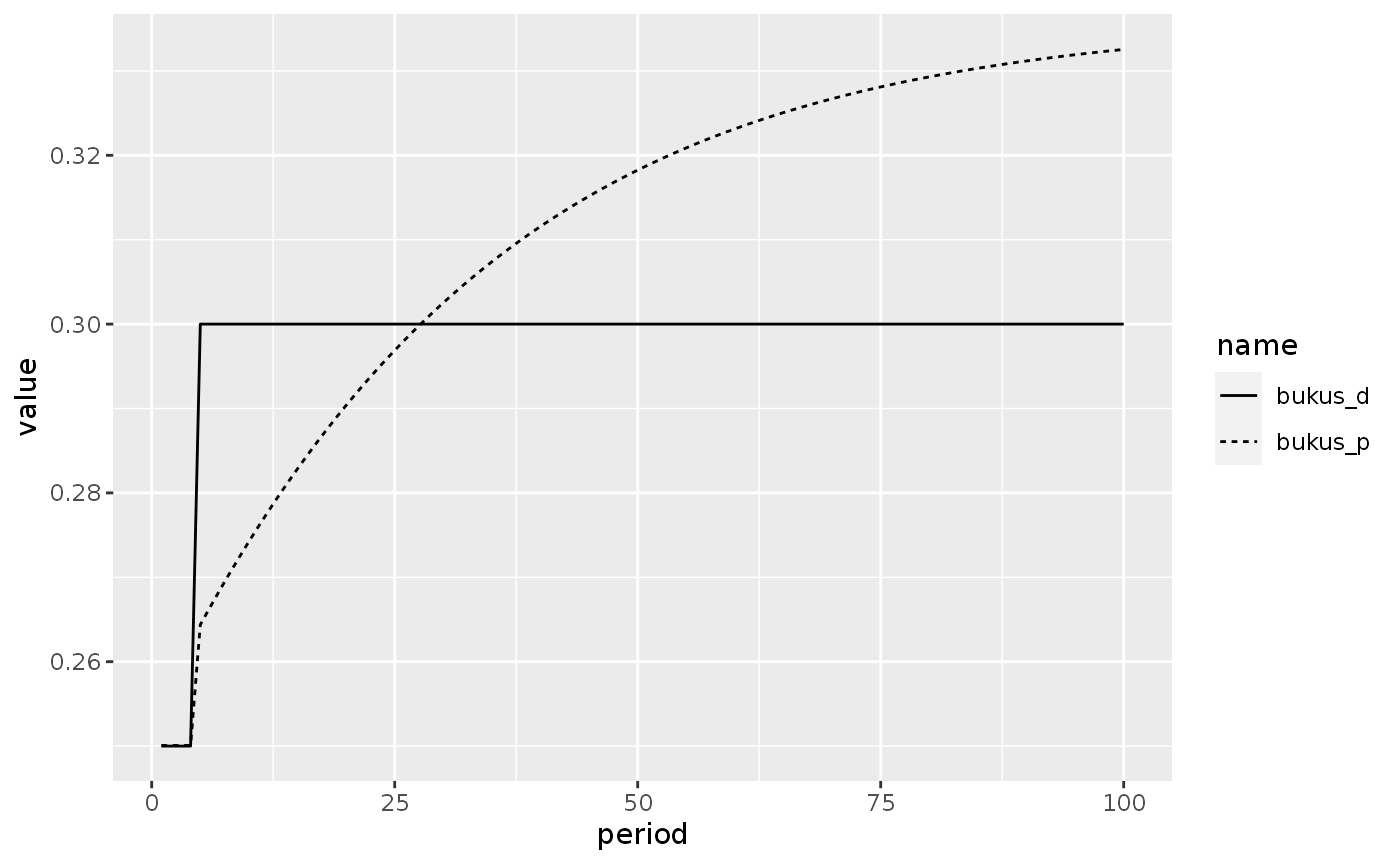

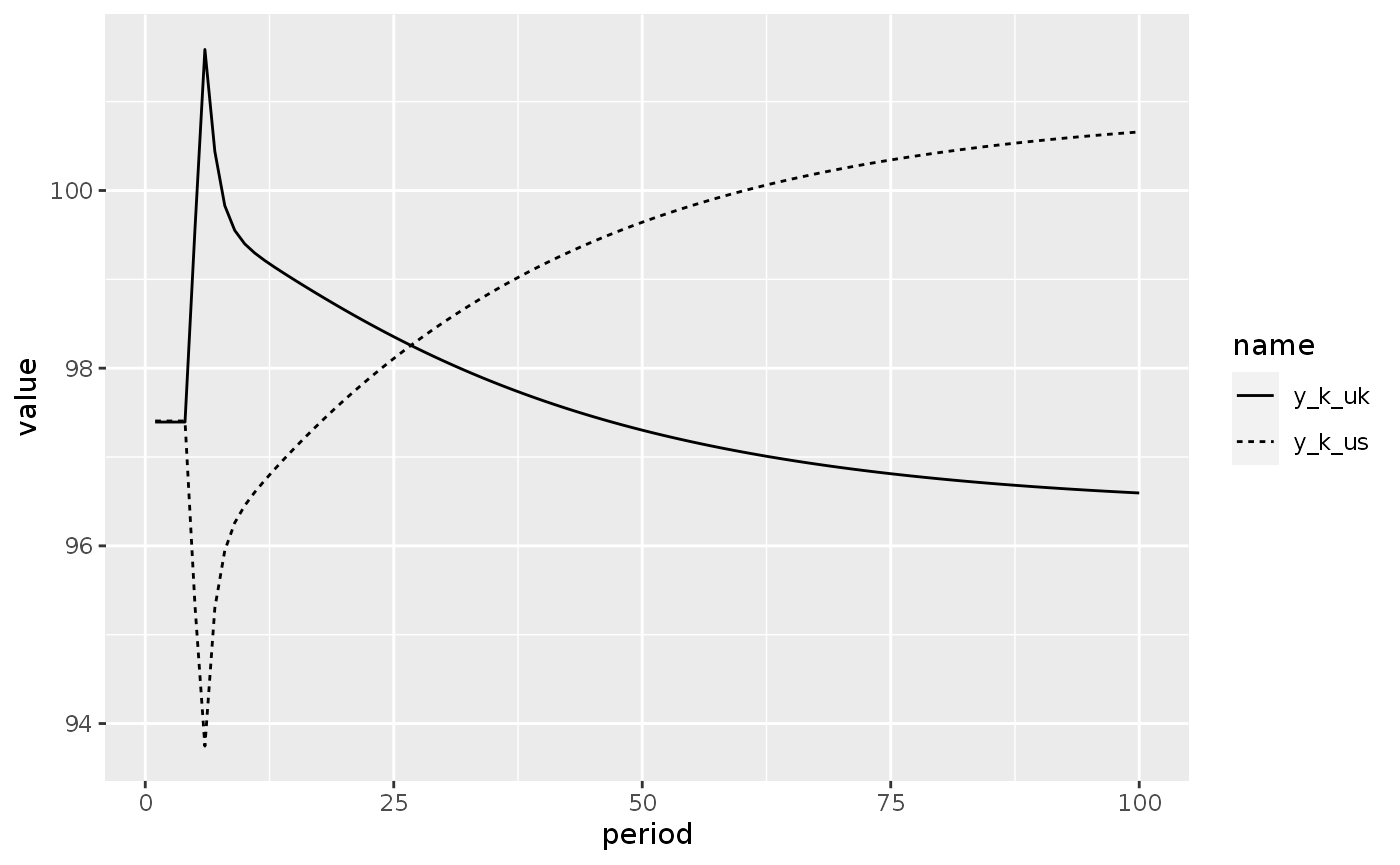

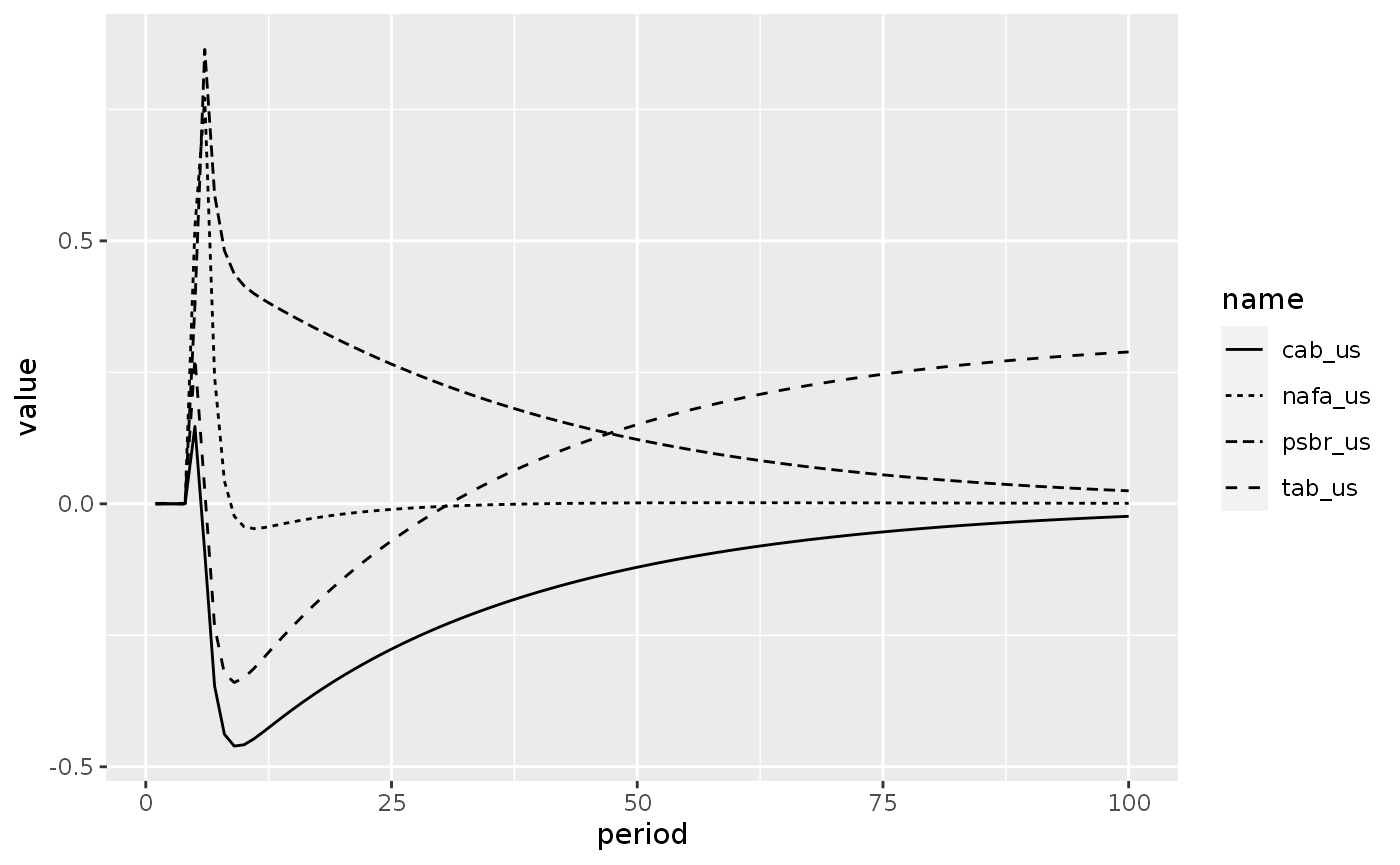

shock3 <- sfcr_shock(v = sfcr_set(lambda20 ~ 0.30, lambda40 ~ 0.75), s = 5, e = 100)

openflex3 <- sfcr_scenario(openflex, shock3, 100, method = "Broyden")