library(sfcr)

library(tidyverse)

#> ── Attaching packages ─────────────────────────────────────── tidyverse 1.3.1 ──

#> ✔ ggplot2 3.3.5 ✔ purrr 0.3.4

#> ✔ tibble 3.1.5 ✔ dplyr 1.0.7

#> ✔ tidyr 1.1.4 ✔ stringr 1.4.0

#> ✔ readr 2.0.2 ✔ forcats 0.5.1

#> ── Conflicts ────────────────────────────────────────── tidyverse_conflicts() ──

#> ✖ dplyr::filter() masks stats::filter()

#> ✖ dplyr::lag() masks stats::lag()In this notebook I present the implementation of the GROWTH model from Godley and Lavoie (2007 ch. 11).

As a side note, I must say that this model is quite complicated to simulate, and I only could do it by using exactly the same equations as Zezza in his code, although some of the equations are different from the ones in the book. In this case, it means replicating exactly the same initial values in order to get a meaningful result.

Equations, parameters, and initial values

growth_eqs <- sfcr_set(

Yk ~ Ske + INke - INk[-1], # 11.1 : Real output

Ske ~ beta*Sk + (1-beta)*Sk[-1]*(1 + (GRpr + RA)), # 11.2 : Expected real sales

INke ~ INk[-1] + gamma*(INkt - INk[-1]), # 11.3 : Long-run inventory target

INkt ~ sigmat*Ske, # 11.4 : Short-run inventory target

INk ~ INk[-1] + Yk - Sk - NPL/UC, # 11.5 : Actual real inventories

Kk ~ Kk[-1]*(1 + GRk), # 11.6 : Real capital stock

GRk ~ gamma0 + gammau*U[-1] - gammar*RRl, # 11.7 : Growth of real capital stock

U ~ Yk/Kk[-1], # 11.8 : Capital utilization proxy

RRl ~ ((1 + Rl)/(1 + PI)) - 1, # 11.9 : Real interest rate on loans

PI ~ (P - P[-1])/P[-1], # 11.10 : Rate of price inflation

#Ik ~ (Kk - Kk[-1]) + delta*Kk[-1], # 11.11 : Real gross investment

Ik ~ (Kk - Kk[-1]) + delta * Kk[-1],

# Box 11.2 : Firms equations

# ---------------------------

Sk ~ Ck + Gk + Ik, # 11.12 : Actual real sales

S ~ Sk*P, # 11.13 : Value of realized sales

IN ~ INk*UC, # 11.14 : Inventories valued at current cost

INV ~ Ik*P, # 11.15 : Nominal gross investment

K ~ Kk*P, # 11.16 : Nomincal value of fixed capital

Y ~ Sk*P + (INk - INk[-1])*UC, # 11.17 : Nomincal GDP

# Box 11.3 : Firms equations

# ---------------------------

# 11.18 : Real wage aspirations

omegat ~ exp(omega0 + omega1*log(PR) + omega2*log(ER + z3*(1 - ER) - z4*BANDt + z5*BANDb)),

ER ~ N[-1]/Nfe[-1], # 11.19 : Employment rate

# 11.20 : Switch variables

z3a ~ if (ER > (1-BANDb)) {1} else {0},

z3b ~ if (ER <= (1+BANDt)) {1} else {0},

z3 ~ z3a * z3b,

z4 ~ if (ER > (1+BANDt)) {1} else {0},

z5 ~ if (ER < (1-BANDb)) {1} else {0},

W ~ W[-1] + omega3*(omegat*P[-1] - W[-1]), # 11.21 : Nominal wage

PR ~ PR[-1]*(1 + GRpr), # 11.22 : Labor productivity

Nt ~ Yk/PR, # 11.23 : Desired employment

N ~ N[-1] + etan*(Nt - N[-1]), # 11.24 : Actual employment --> etan not in the book

WB ~ N*W, # 11.25 : Nominal wage bill

UC ~ WB/Yk, # 11.26 : Actual unit cost

NUC ~ W/PR, # 11.27 : Normal unit cost

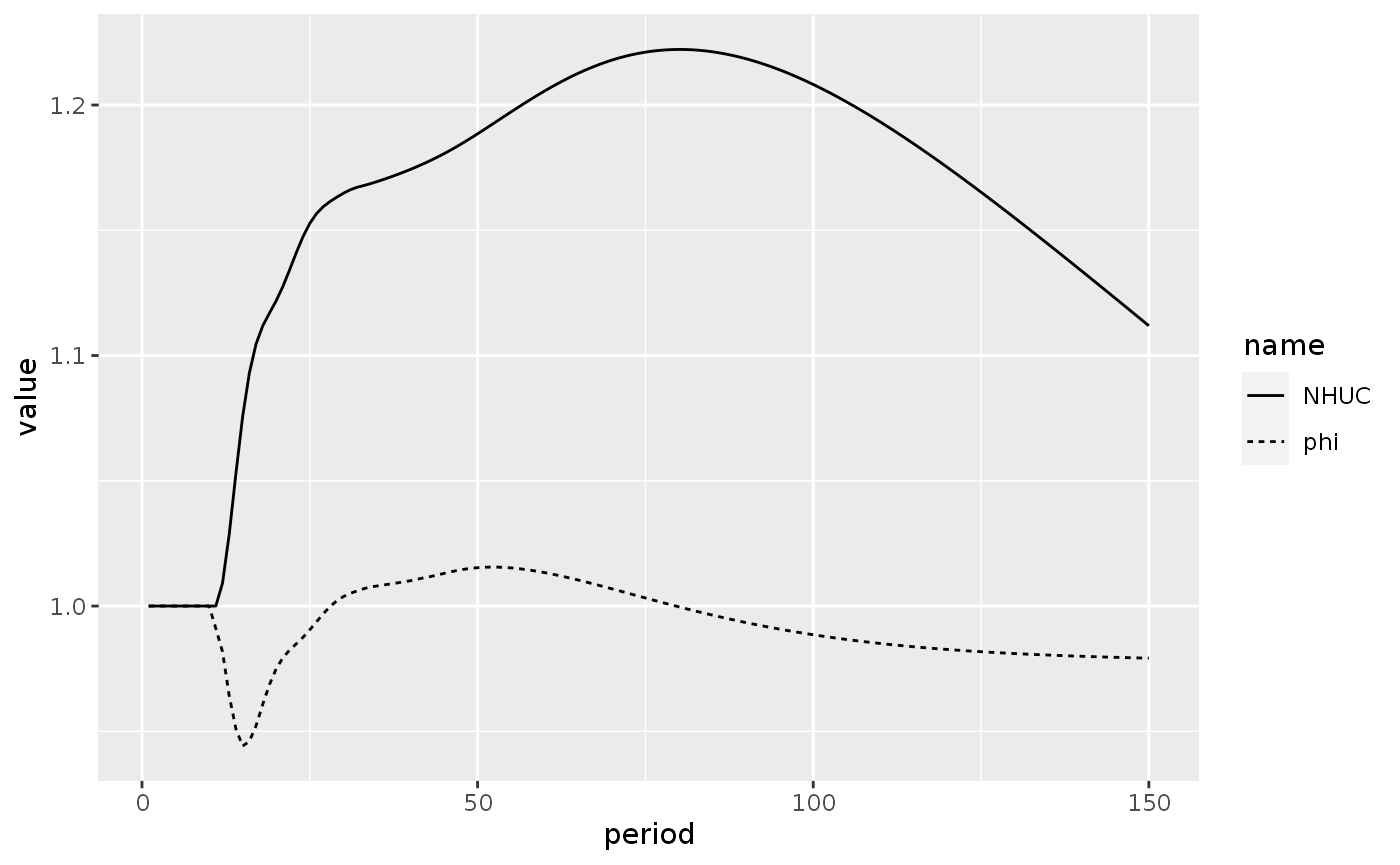

NHUC ~ (1 - sigman)*NUC + sigman*(1 + Rln[-1])*NUC[-1], # 11.28 : Normal historic unit cost

# Box 11.4 : Firms equations

# ---------------------------

P ~ (1 + phi)*NHUC, # 11.29 : Normal-cost pricing

phi ~ phi[-1] + eps2*(phit[-1] - phi[-1]), # 11.30 : Actual mark-up --> eps2 not in the book

# 11.31 : Ideal mark-up

#phit ~ (FDf + FUft + Rl[-1]*(Lfd[-1] - IN[-1]))/((1 - sigmase)*Ske*UC + (1 + Rl[-1])*sigmase*Ske*UC[-1]),

phit ~ (FUft + FDf + Rl[-1]*(Lfd[-1] - IN[-1])) / ((1 - sigmase)*Ske*UC + (1 + Rl[-1])*sigmase*Ske*UC[-1]),

HCe ~ (1 - sigmase)*Ske*UC + (1 + Rl[-1])*sigmase*Ske*UC[-1], # 11.32 : Expected historical costs

sigmase ~ INk[-1]/Ske, # 11.33 : Opening inventories to expected sales ratio

Fft ~ FUft + FDf + Rl[-1]*(Lfd[-1] - IN[-1]), # 11.34 : Planned entrepeneurial profits of firmss

FUft ~ psiu*INV[-1], # 11.35 : Planned retained earnings of firms

FDf ~ psid*Ff[-1], # 11.36 : Dividends of firms

# Box 11.5 : Firms equations

# ---------------------------

Ff ~ S - WB + (IN - IN[-1]) - Rl[-1]*IN[-1], # 11.37 : Realized entrepeneurial profits

FUf ~ Ff - FDf - Rl[-1]*(Lfd[-1] - IN[-1]) + Rl[-1]*NPL, # 11.38 : Retained earnings of firms

# 11.39 : Demand for loans by firms

Lfd ~ Lfd[-1] + INV + (IN - IN[-1]) - FUf - (Eks - Eks[-1])*Pe - NPL,

# NPL ~ NPLk*Lfs[-1], # 11.40 : Defaulted loans

NPL ~ NPLk * Lfs[-1],

Eks ~ Eks[-1] + ((1 - psiu)*INV[-1])/Pe, # 11.41 : Supply of equities issued by firms

# Rk ~ FDf/(Pe[-1]*Ekd[-1]), # 11.42 : Dividend yield of firms

Rk ~ FDf/(Pe[-1] * Ekd[-1]),

PE ~ Pe/(Ff/Eks[-1]), # 11.43 : Price earnings ratio

Q ~ (Eks*Pe + Lfd)/(K + IN), # 11.44 : Tobins Q ratio

# Box 11.6 : Households equations

# --------------------------------

# YP ~ WB + FDf + FDb + Rm[-1]*Md[-1] + Rb[-1]*Bhd[-1] + BLs[-1], # 11.45 : Personal income

YP ~ WB + FDf + FDb + Rm[-1]*Mh[-1] + Rb[-1]*Bhd[-1] + BLs[-1],

#YP ~ WB + FDf + FDb + Rm[-1]*Mh[-1] + Rb[-1]*Bhd[-1] + BLs[-1] + NL,

TX ~ theta*YP, # 11.46 : Income taxes

YDr ~ YP - TX - Rl[-1]*Lhd[-1], # 11.47 : Regular disposable income

YDhs ~ YDr + CG, # 11.48 : Haig-Simons disposable income

# !1.49 : Capital gains

CG ~ (Pbl - Pbl[-1])*BLd[-1] + (Pe - Pe[-1])*Ekd[-1] + (OFb - OFb[-1]),

# 11.50 : Wealth

V ~ V[-1] + YDr - CONS + (Pbl - Pbl[-1])*BLd[-1] + (Pe - Pe[-1])*Ekd[-1] + (OFb - OFb[-1]),

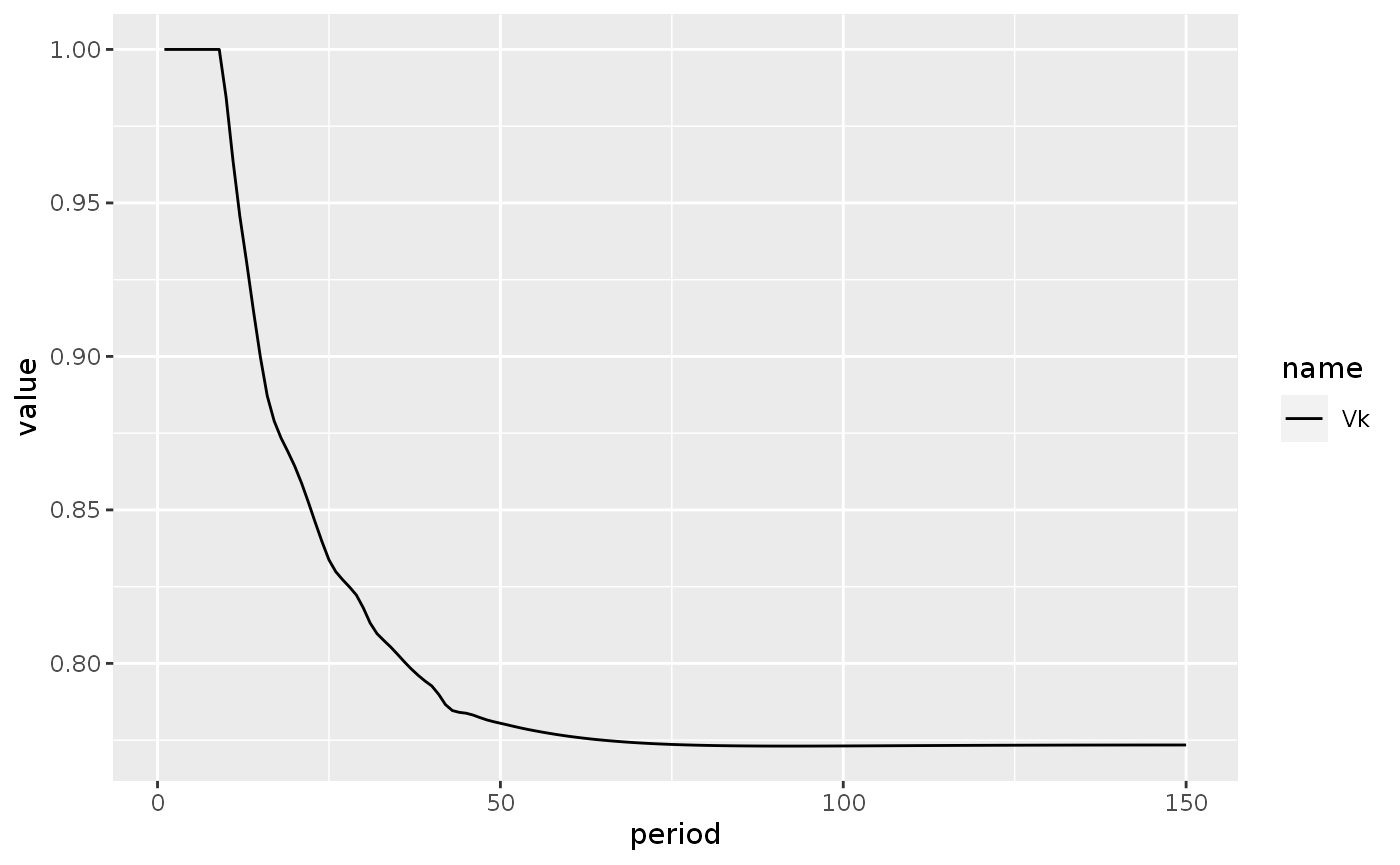

Vk ~ V/P, # 11.51 : Real staock of wealth

CONS ~ Ck*P, # 11.52 : Consumption

Ck ~ alpha1*(YDkre + NLk) + alpha2*Vk[-1], # 11.53 : Real consumption

YDkre ~ eps*YDkr + (1 - eps)*(YDkr[-1]*(1 + GRpr)), # 11.54 : Expected real regular disposable income

# YDkr ~ YDr/P - (P - P[-1])*Vk[-1]/P, # 11.55 : Real regular disposable income

YDkr ~ YDr/P - ((P - P[-1]) * Vk[-1])/P,

# Box 11.7 : Households equations

# --------------------------------

GL ~ eta*YDr, # 11.56 : Gross amount of new personal loans ---> new eta here

eta ~ eta0 - etar*RRl, # 11.57 : New loans to personal income ratio

NL ~ GL - REP, # 11.58 : Net amount of new personal loans

REP ~ deltarep*Lhd[-1], # 11.59 : Personal loans repayments

Lhd ~ Lhd[-1] + GL - REP, # 11.60 : Demand for personal loans

NLk ~ NL/P, # 11.61 : Real amount of new personal loans

# BUR ~ (REP + Rl[-1]*Lhd[-1])/YDr[-1], # 11.62 : Burden of personal debt

BUR ~ (REP + Rl[-1] * Lhd[-1]) / YDr[-1],

# Box 11.8 : Households equations - portfolio decisions

# -----------------------------------------------------

# 11.64 : Demand for bills

# YDr/V

#Md ~ Vfma[-1] * (lambda10 + lambda11*Rm[-1] - lambda12 * Rb[-1] - lambda13 * Rbl[-1] - lambda14 * Rk[-1] + lambda25 * (YP/V)),

Bhd ~ Vfma[-1]*(lambda20 + lambda22*Rb[-1] - lambda21*Rm[-1] - lambda24*Rk[-1] - lambda23*Rbl[-1] - lambda25*(YDr/V)),

# 11.65 : Demand for bonds

BLd ~ Vfma[-1]*(lambda30 - lambda32*Rb[-1] - lambda31*Rm[-1] - lambda34*Rk[-1] + lambda33*Rbl[-1] - lambda35*(YDr/V))/Pbl,

# 11.66 : Demand for equities - normalized to get the price of equitities

Pe ~ Vfma[-1]*(lambda40 - lambda42*Rb[-1] - lambda41*Rm[-1] + lambda44*Rk[-1] - lambda43*Rbl[-1] - lambda45*(YDr/V))/Ekd,

Mh ~ Vfma - Bhd - Pe*Ekd - Pbl*BLd + Lhd, # 11.67 : Money deposits - as a residual

Vfma ~ V - Hhd - OFb, # 11.68 : Investible wealth

VfmaA ~ Mh + Bhd + Pbl * BLd + Pe * Ekd,

Hhd ~ lambdac*CONS, # 11.69 : Households demand for cash

Ekd ~ Eks, # 11.70 : Stock market equilibrium

# Box 11.9 : Governments equations

# ---------------------------------

G ~ Gk*P, # 11.71 : Pure government expenditures

Gk ~ Gk[-1]*(1 + GRg), # 11.72 : Real government expenditures

PSBR ~ G + BLs[-1] + Rb[-1]*(Bbs[-1] + Bhs[-1]) - TX, # 11.73 : Government deficit --> BLs[-1] missing in the book

# 11.74 : New issues of bills

Bs ~ Bs[-1] + G - TX - (BLs - BLs[-1])*Pbl + Rb[-1]*(Bhs[-1] + Bbs[-1]) + BLs[-1],

GD ~ Bbs + Bhs + BLs*Pbl + Hs, # 11.75 : Government debt

# Box 11.10 : The Central banks equations

# ----------------------------------------

Fcb ~ Rb[-1]*Bcbd[-1], # 11.76 : Central bank profits

BLs ~ BLd, # 11.77 : Bonds are supplied on demand

Bhs ~ Bhd, # 11.78 : Household bills supplied on demand

Hhs ~ Hhd, # 11.79 : Cash supplied on demand --> Mistake on the book

Hbs ~ Hbd, # 11.80 : Reserves supplied on demand

Hs ~ Hbs + Hhs, # 11.81 : Total supply of cash

Bcbd ~ Hs, # 11.82 : Central bankd

Bcbs ~ Bcbd, # 11.83 : Supply of bills to Central bank

Rb ~ Rbbar, # 11.84 : Interest rate on bills set exogenously

Rbl ~ Rb + ADDbl, # 11.85 : Long term interest rate

Pbl ~ 1/Rbl, # 11.86 : Price of long-term bonds

# Box 11.11 : Commercial Banks equations

# ---------------------------------------

Ms ~ Mh, # 11.87 : Bank deposits supplied on demand

Lfs ~ Lfd, # 11.88 : Loans to firms supplied on demand

Lhs ~ Lhd, # 11.89 : Personal loans supplied on demand

Hbd ~ ro*Ms, # 11.90 Reserve requirements of banks

# 11.91 : Bills supplied to banks

Bbs ~ Bbs[-1] + (Bs - Bs[-1]) - (Bhs - Bhs[-1]) - (Bcbs - Bcbs[-1]),

# 11.92 : Balance sheet constraint of banks

Bbd ~ Ms + OFb - Lfs - Lhs - Hbd,

BLR ~ Bbd/Ms, # 11.93 : Bank liquidity ratio

# 11.94 : Deposit interest rate

Rm ~ Rm[-1] + z1a*xim1 + z1b*xim2 - z2a*xim1 - z2b*xim2,

# 11.95-97 : Mechanism for determining changes to the interest rate on deposits

z2a ~ if (BLR[-1] > (top + .05)) {1} else {0},

z2b ~ if (BLR[-1] > top) {1} else {0},

z1a ~ if (BLR[-1] <= bot) {1} else {0},

z1b ~ if (BLR[-1] <= (bot -.05)) {1} else {0},

# Box 11.12 : Commercial banks equations

# ---------------------------------------

Rl ~ Rm + ADDl, # 11.98 : Loan interest rate

OFbt ~ NCAR*(Lfs[-1] + Lhs[-1]), # 11.99 : Long-run own funds target

OFbe ~ OFb[-1] + betab*(OFbt - OFb[-1]), # 11.100 : Short-run own funds target

FUbt ~ OFbe - OFb[-1] + NPLke*Lfs[-1], # 11.101 : Target retained earnings of banks

NPLke ~ epsb*NPLke[-1] + (1 - epsb)*NPLk[-1], # 11.102 : Expected proportion of non-performaing loans

# FDb ~ Fb - FUb, # 11.103 : Dividends of banks

FDb ~ Fb - FUb,

Fbt ~ lambdab*Y[-1] + (OFbe - OFb[-1] + NPLke*Lfs[-1]), # 11.104 : Target profits of banks

# 11.105 : Actual profits of banks

Fb ~ Rl[-1]*(Lfs[-1] + Lhs[-1] - NPL) + Rb[-1]*Bbd[-1] - Rm[-1]*Ms[-1],

# 11.106 : Lending mark-up over deposit rate

ADDl ~ (Fbt - Rb[-1]*Bbd[-1] + Rm[-1]*(Ms[-1] - (1 - NPLke)*Lfs[-1] - Lhs[-1]))/((1 - NPLke)*Lfs[-1] + Lhs[-1]), # --> I added the lag term to Rm

FUb ~ Fb - lambdab*Y[-1], # 11.107 : Actual retained earnings

OFb ~ OFb[-1] + FUb - NPL, # 11.108 : Own funds of banks

CAR ~ OFb/(Lfs + Lhs),

Vf ~ IN + K - Lfd - Ekd * Pe, # Firm's wealth (memo for matrices)

#Vg ~ -Bs - BLs * Pbl,\

Ls ~ Lfs + Lhs, # Loans supply (memo for matrices)

)

growth_parameters = sfcr_set(

alpha1 ~ 0.75,

alpha2 ~ 0.064,

beta ~ 0.5,

betab ~ 0.4,

gamma ~ 0.15,

gamma0 ~ 0.00122,

gammar ~ 0.1,

gammau ~ 0.05,

delta ~ 0.10667,

deltarep ~ 0.1,

eps ~ 0.5,

eps2 ~ 0.8,

epsb ~ 0.25,

epsrb ~ 0.9,

eta0 ~ 0.07416,

etan ~ 0.6,

etar ~ 0.4,

theta ~ 0.22844,

# lambda10 ~ -0.17071,

# lambda11 ~ 0,

# lambda12 ~ 0,

# lambda13 ~ 0,

# lambda14 ~ 0,

# lambda15 ~ 0.18,

lambda20 ~ 0.25,

lambda21 ~ 2.2,

lambda22 ~ 6.6,

lambda23 ~ 2.2,

lambda24 ~ 2.2,

lambda25 ~ 0.1,

lambda30 ~ -0.04341,

lambda31 ~ 2.2,

lambda32 ~ 2.2,

lambda33 ~ 6.6,

lambda34 ~ 2.2,

lambda35 ~ 0.1,

lambda40 ~ 0.67132,

lambda41 ~ 2.2,

lambda42 ~ 2.2,

lambda43 ~ 2.2,

lambda44 ~ 6.6,

lambda45 ~ 0.1,

lambdab ~ 0.0153,

lambdac ~ 0.05,

xim1 ~ 0.0008,

xim2 ~ 0.0007,

ro ~ 0.05,

sigman ~ 0.1666,

sigmat ~ 0.2,

psid ~ 0.15255,

psiu ~ 0.92,

omega0 ~ -0.20594,

omega1 ~ 1,

omega2 ~ 2,

omega3 ~ 0.45621,

# Exogenous

ADDbl ~ 0.02,

BANDt ~ 0.01,

BANDb ~ 0.01,

bot ~ 0.05,

GRg ~ 0.03,

GRpr ~ 0.03,

Nfe ~ 87.181,

NCAR ~ 0.1,

NPLk ~ 0.02,

Rbbar ~ 0.035,

Rln ~ 0.07,

RA ~ 0,

top ~ 0.12,

# sigmase ~ 0.16667,

# eta ~ 0.04918,

# phi ~ 0.26417,

# phit ~ 0.26417,

)

growth_initial <- sfcr_set(

sigmase ~ 0.16667,

eta ~ 0.04918,

phi ~ 0.26417,

phit ~ 0.26417,

ADDbl ~ 0.02,

BANDt ~ 0.01,

BANDb ~ 0.01,

bot ~ 0.05,

GRg ~ 0.03,

GRpr ~ 0.03,

Nfe ~ 87.181,

NCAR ~ 0.1,

NPLk ~ 0.02,

Rbbar ~ 0.035,

Rln ~ 0.07,

RA ~ 0,

top ~ 0.12,

ADDl ~ 0.04592,

BLR ~ 0.1091,

BUR ~ 0.06324,

Ck ~ 7334240,

CAR ~ 0.09245,

CONS ~ 52603100,

ER ~ 1,

Fb ~ 1744130,

Fbt ~ 1744140,

Ff ~ 18081100,

Fft ~ 18013600,

FDb ~ 1325090,

FDf ~ 2670970,

FUb ~ 419039,

FUf ~ 15153800,

FUft ~ 15066200,

G ~ 16755600,

Gk ~ 2336160,

GL ~ 2775900,

GRk ~ 0.03001,

INV ~ 16911600,

Ik ~ 2357910,

N ~ 87.181,

Nt ~ 87.181,

NHUC ~ 5.6735,

NL ~ 683593,

NLk ~ 95311,

NPL ~ 309158,

NPLke ~ 0.02,

NUC ~ 5.6106,

omegat ~ 112852,

P ~ 7.1723,

Pbl ~ 18.182,

Pe ~ 17937,

PE ~ 5.07185,

PI ~ 0.0026,

PR ~ 138659,

PSBR ~ 1894780,

Q ~ 0.77443,

Rb ~ 0.035,

Rbl ~ 0.055,

Rk ~ 0.03008,

Rl ~ 0.06522,

Rm ~ 0.0193,

REP ~ 2092310,

#RRb ~ 0.03232,

RRl ~ 0.06246,

S ~ 86270300,

Sk ~ 12028300,

Ske ~ 12028300,

TX ~ 17024100,

U ~ 0.70073,

UC ~ 5.6106,

W ~ 777968,

WB ~ 67824000,

Y ~ 86607700,

Yk ~ 12088400,

YDr ~ 56446400,

YDkr ~ 7813270,

YDkre ~ 7813290,

YP ~ 73158700,

z1a ~ 0,

z1b ~ 0,

z2a ~ 0,

z2b ~ 0,

##

#Bbd ~ 4388930,

#Bbs ~ 4388930,

Bbd ~ 4389790,

Bbs ~ 4389790,

Bcbd ~ 4655690,

Bcbs ~ 4655690,

Bhd ~ 33439320,

Bhs ~ 33439320,

#Bhd ~ 33396900,

#Bhs ~ 33396900,

Bs ~ 42484800,

#Bs ~ 42441520,

BLd ~ 840742,

BLs ~ 840742,

GD ~ 57728700,

Ekd ~ 5112.6001,

Eks ~ 5112.6001,

Hbd ~ 2025540,

Hbs ~ 2025540,

Hhd ~ 2630150,

Hhs ~ 2630150,

Hs ~ 4655690,

IN ~ 11585400,

INk ~ 2064890,

INke ~ 2405660,

INkt ~ 2064890,

#K ~ 127444000,

K ~ 127486471,

#Kk ~ 17768900,

Kk ~ 17774838,

Lfd ~ 15962900,

Lfs ~ 15962900,

Lhd ~ 21606600,

Lhs ~ 21606600,

Ls ~ 37569500,

#Md ~ 40510800,

Mh ~ 40510800,

Ms ~ 40510800,

OFb ~ 3474030,

OFbe ~ 3474030,

#OFb ~ 3473280,

#OFbe ~ 3782430,

OFbt ~ 3638100,

#V ~ 165395000,

V ~ 165438779,

#Vfma ~ 159291000,

Vfma ~ 159334599,

Vk ~ 23066350,

Vf ~ 31361792

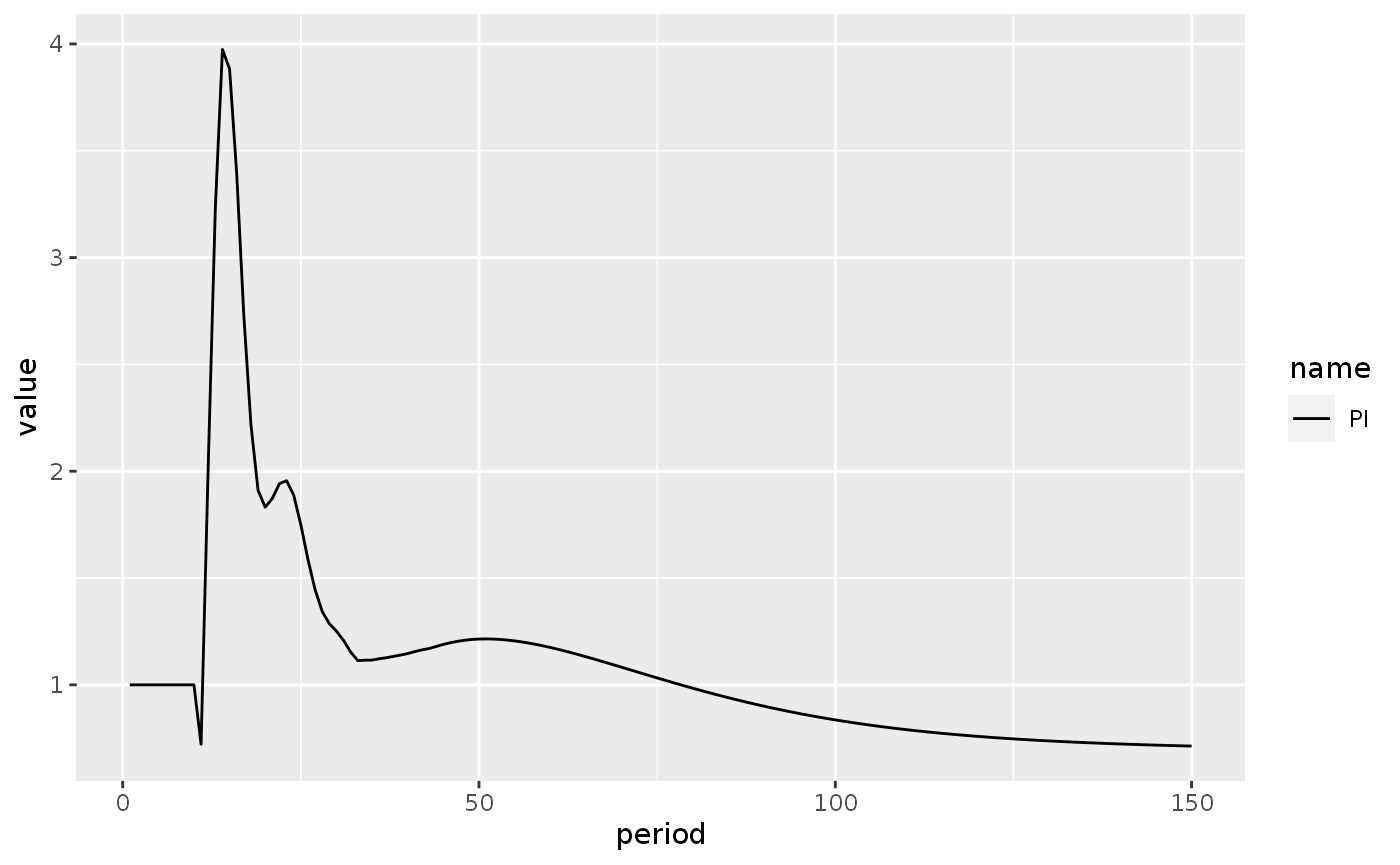

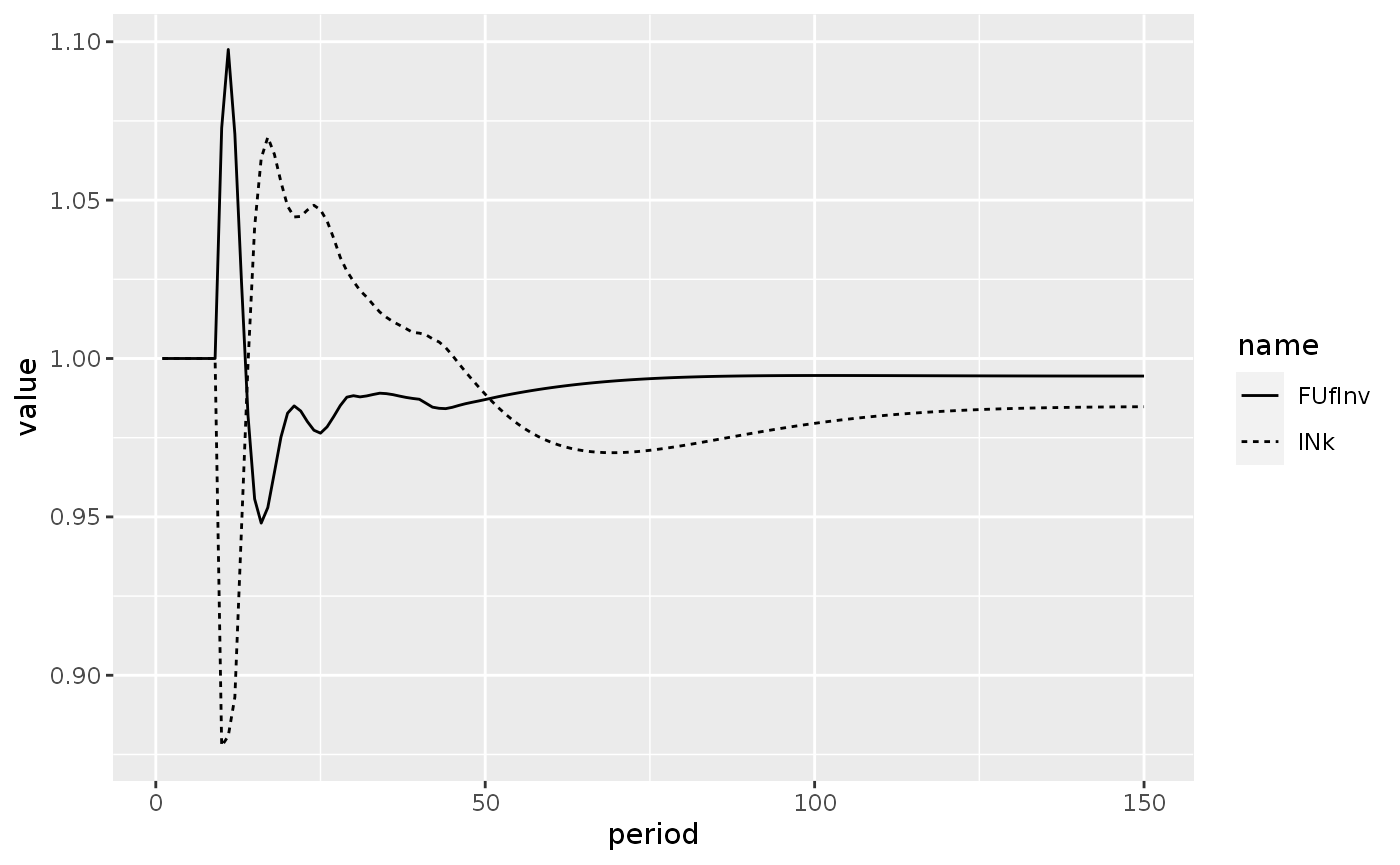

)Model GROWTH: Baseline

growth <- sfcr_baseline(

equations = growth_eqs,

external = growth_parameters,

initial = growth_initial,

periods = 350,

method = "Broyden",

hidden = c("Bbs" = "Bbd"),

tol = 1e-15,

max_iter = 350,

rhtol = TRUE,

.hidden_tol = 1e-6

)Steady state

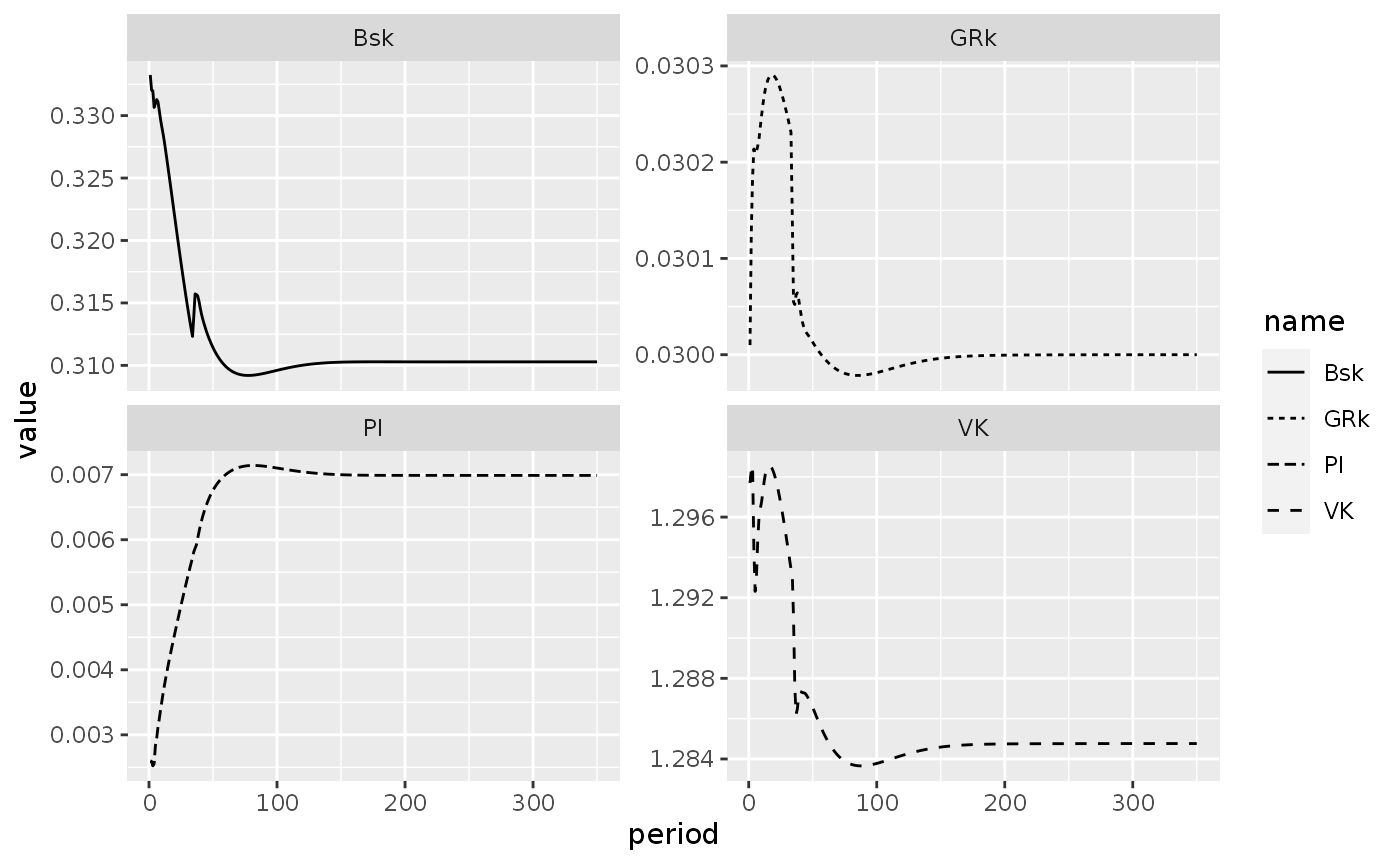

growth %>%

do_plot(variables = c("Uk", "Bsk", "VK", 'GRk', "PI")) +

facet_wrap(~name, scales = "free_y")

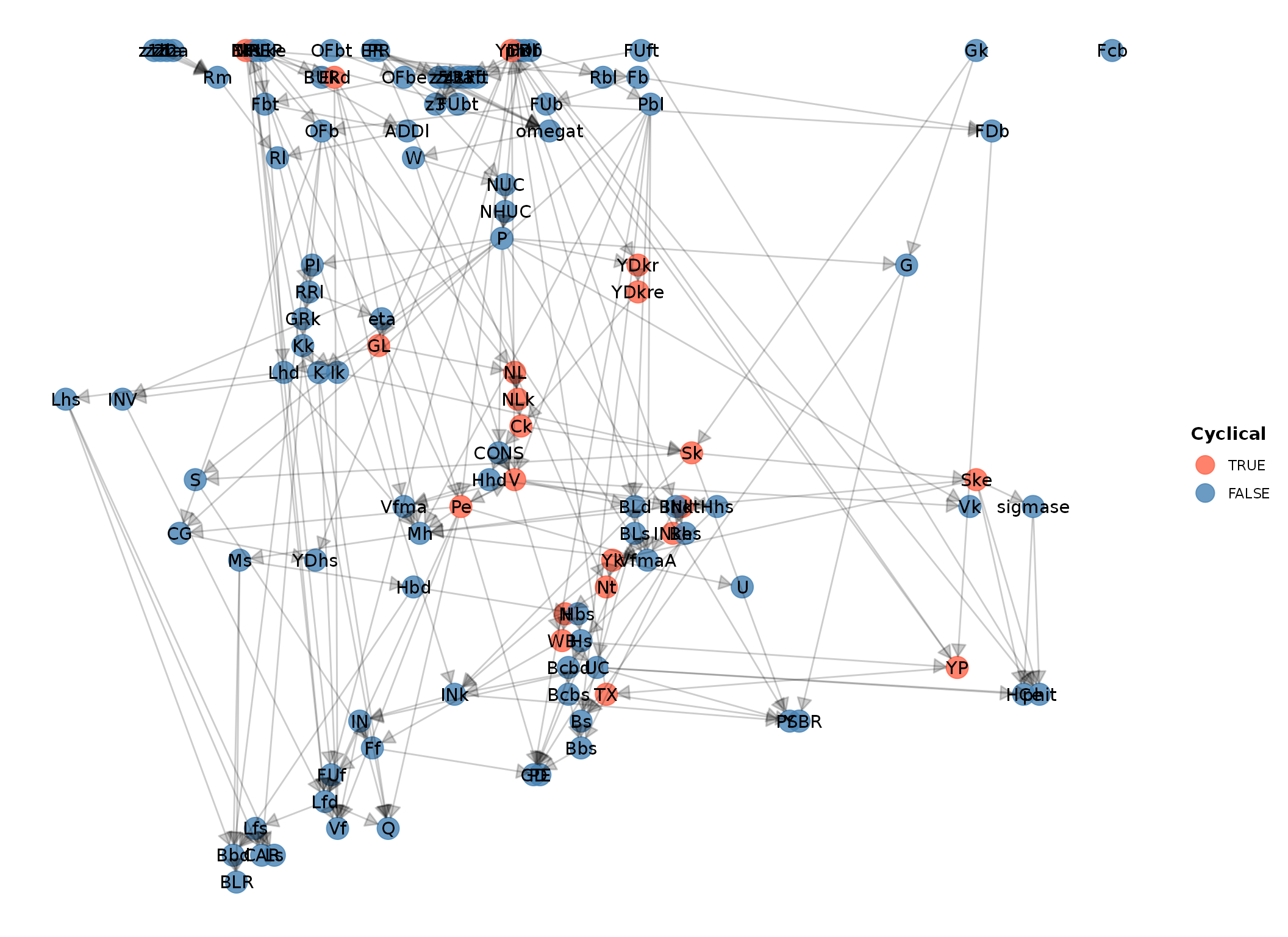

As we can see, the hidden equation is fulfilled (up to certain amount of computational error), key ratios and growth rations are stable. We can now check the balance-sheet and the transactions-flow matrices:

Matrices of model GROWTH

Balance-sheet matrix

bs_growth <- sfcr_matrix(

columns = c("Households", "Firms", "Govt", "Central Bank", "Banks", "Sum"),

codes = c("h", "f", "g", "cb", "b", "s"),

c("Inventories", f = "+IN", s = "+IN"),

c("Fixed Capital", f = "+K", s = "+K"),

c("HPM", h = "+Hhd", cb = "-Hs", b = "+Hbd"),

c("Money", h = "+Mh", b = "-Ms"),

c("Bills", h = "+Bhd", g = "-Bs", cb = "+Bcbd", b = "+Bbd"),

c("Bonds", h = "+BLd * Pbl", g = "-BLs * Pbl"),

c("Loans", h = "-Lhd", f = "-Lfd", b = "+Ls"),

c("Equities", h = "+Ekd * Pe", f = "-Eks * Pe"),

c("Bank capital", h = "+OFb", b = "-OFb"),

c("Balance", h = "-V", f = "-Vf", g = "GD", s = "-(IN + K)")

)

sfcr_matrix_display(bs_growth, which = "bs")| Households | Firms | Govt | Central Bank | Banks | \(\sum\) | |

|---|---|---|---|---|---|---|

| Inventories | \(+IN\) | \(+IN\) | ||||

| Fixed Capital | \(+K\) | \(+K\) | ||||

| HPM | \(+Hhd\) | \(-Hs\) | \(+Hbd\) | \(0\) | ||

| Money | \(+Mh\) | \(-Ms\) | \(0\) | |||

| Bills | \(+Bhd\) | \(-Bs\) | \(+Bcbd\) | \(+Bbd\) | \(0\) | |

| Bonds | \(+BLd\cdot Pbl\) | \(-BLs\cdot Pbl\) | \(0\) | |||

| Loans | \(-Lhd\) | \(-Lfd\) | \(+Ls\) | \(0\) | ||

| Equities | \(+Ekd\cdot Pe\) | \(-Eks\cdot Pe\) | \(0\) | |||

| Bank capital | \(+OFb\) | \(-OFb\) | \(0\) | |||

| Balance | \(-V\) | \(-Vf\) | \(GD\) | \(-(IN+K)\) | ||

| \(\sum\) | \(0\) | \(0\) | \(0\) | \(0\) | \(0\) | \(0\) |

Next we validate the model with the data:

sfcr_validate(bs_growth, growth, "bs", rtol = TRUE, tol = 1e-8)

#> Water tight! The balance-sheet matrix is consistent with the simulated model.Transactions-flow matrix

tfm_growth <- sfcr_matrix(

columns = c("Households", "Firms curr.", "Firms cap.", "Govt.", "CB curr.", "CB cap.", "Banks curr.", "Banks cap."),

code = c("h", "fc", "fk", "g", "cbc", "cbk", "bc", "bk"),

c("Consumption", h = '-CONS', fc = "+CONS"),

c("Govt. Exp.", fc = "+G", g = "-G"),

c("Investment", fc = "+INV", fk = "-INV"),

c("Inventories", fc = "+(IN - IN[-1])", fk = "-(IN - IN[-1])"),

c("Taxes", h = "-TX", g = "+TX"),

c("Wages", h = "+WB", fc = "-WB"),

c("Inventory financing cost", fc = "-Rl[-1] * IN[-1]", bc = "+Rl[-1] * (IN[-1])"),

c("Entr. Profits", h = "+FDf", fc = "-Ff", fk = "+FUf", bc = "+Rl[-1] * (Lfs[-1] - IN[-1] - NPL)"),

c("Banks Profits", h = "+FDb", bc = "-Fb", bk = "+FUb"),

# Interests

c("Int. hh loans", h = "-Rl[-1] * Lhd[-1]", bc = "+Rl[-1] * Lhs[-1]"),

c("Int. deposits", h = "+Rm[-1] * Mh[-1]", bc = "-Rm[-1] * Ms[-1]"),

c("Int. bills", h = "+Rb[-1] * Bhd[-1]", g = "-Rb[-1] * Bs[-1]", cbc = "+Rb[-1] * Bcbd[-1]", bc = "+Rb[-1] * Bbd[-1]"),

c("Int. bonds", h = "+BLd[-1]", g = "-BLd[-1]"),

# Change in stocks

c("Ch. loans", h = "+(Lhd - Lhd[-1])", fk = "+(Lfd - Lfd[-1])", bk = "-(Ls - Ls[-1])"),

c("Ch. cash", h = "-(Hhd - Hhd[-1])", cbk = "+(Hs - Hs[-1])", bk = "-(Hbd - Hbd[-1])"),

c("Ch. deposits", h = "-(Mh - Mh[-1])", bk = "+(Ms - Ms[-1])"),

c("Ch. bills", h = "-(Bhd - Bhd[-1])", g = "+(Bs - Bs[-1])", cbk = "-(Bcbd - Bcbd[-1])", bk = "-(Bbd - Bbd[-1])"),

c("Ch. bonds", h = "-(BLd - BLd[-1]) * Pbl", g = "+(BLs - BLs[-1]) * Pbl"),

c("Ch. equities", h = "-(Ekd - Ekd[-1]) * Pe", fk = "+(Eks - Eks[-1]) * Pe"),

# Loan defaults

c("Loan defaults", fk = "+NPL", bk = "-NPL")

)

sfcr_matrix_display(tfm_growth, "tfm")| Households | Firms curr. | Firms cap. | Govt. | CB curr. | CB cap. | Banks curr. | Banks cap. | \(\sum\) | |

|---|---|---|---|---|---|---|---|---|---|

| Consumption | \(-CONS\) | \(+CONS\) | \(0\) | ||||||

| Govt. Exp. | \(+G\) | \(-G\) | \(0\) | ||||||

| Investment | \(+INV\) | \(-INV\) | \(0\) | ||||||

| Inventories | \(+\Delta IN\) | \(-\Delta IN\) | \(0\) | ||||||

| Taxes | \(-TX\) | \(+TX\) | \(0\) | ||||||

| Wages | \(+WB\) | \(-WB\) | \(0\) | ||||||

| Inventory financing cost | \(-Rl_{-1}\cdot IN_{-1}\) | \(+Rl_{-1}\cdot (IN_{-1})\) | \(0\) | ||||||

| Entr. Profits | \(+FDf\) | \(-Ff\) | \(+FUf\) | \(+Rl_{-1}\cdot (Lfs_{-1}-IN_{-1}-NPL)\) | \(0\) | ||||

| Banks Profits | \(+FDb\) | \(-Fb\) | \(+FUb\) | \(0\) | |||||

| Int. hh loans | \(-Rl_{-1}\cdot Lhd_{-1}\) | \(+Rl_{-1}\cdot Lhs_{-1}\) | \(0\) | ||||||

| Int. deposits | \(+Rm_{-1}\cdot Mh_{-1}\) | \(-Rm_{-1}\cdot Ms_{-1}\) | \(0\) | ||||||

| Int. bills | \(+Rb_{-1}\cdot Bhd_{-1}\) | \(-Rb_{-1}\cdot Bs_{-1}\) | \(+Rb_{-1}\cdot Bcbd_{-1}\) | \(+Rb_{-1}\cdot Bbd_{-1}\) | \(0\) | ||||

| Int. bonds | \(+BLd_{-1}\) | \(-BLd_{-1}\) | \(0\) | ||||||

| Ch. loans | \(+\Delta Lhd\) | \(+\Delta Lfd\) | \(-\Delta Ls\) | \(0\) | |||||

| Ch. cash | \(-\Delta Hhd\) | \(+\Delta Hs\) | \(-\Delta Hbd\) | \(0\) | |||||

| Ch. deposits | \(-\Delta Mh\) | \(+\Delta Ms\) | \(0\) | ||||||

| Ch. bills | \(-\Delta Bhd\) | \(+\Delta Bs\) | \(-\Delta Bcbd\) | \(-\Delta Bbd\) | \(0\) | ||||

| Ch. bonds | \(-\Delta BLd\cdot Pbl\) | \(+\Delta BLs\cdot Pbl\) | \(0\) | ||||||

| Ch. equities | \(-\Delta Ekd\cdot Pe\) | \(+\Delta Eks\cdot Pe\) | \(0\) | ||||||

| Loan defaults | \(+NPL\) | \(-NPL\) | \(0\) | ||||||

| \(\sum\) | \(0\) | \(0\) | \(0\) | \(0\) | \(0\) | \(0\) | \(0\) | \(0\) | \(0\) |

And we validate the model with the data:

sfcr_validate(tfm_growth, growth, "tfm", tol = 1e-7, rtol = TRUE)

#> Water tight! The transactions-flow matrix is consistent with the simulated model.Sankey’s diagram:

sfcr_sankey(tfm_growth, growth)Scenario BENCHMARK: A continuation of baseline model

growthbl <- sfcr_scenario(

baseline = growth,

scenario = NULL,

periods = 150,

method = "Broyden"

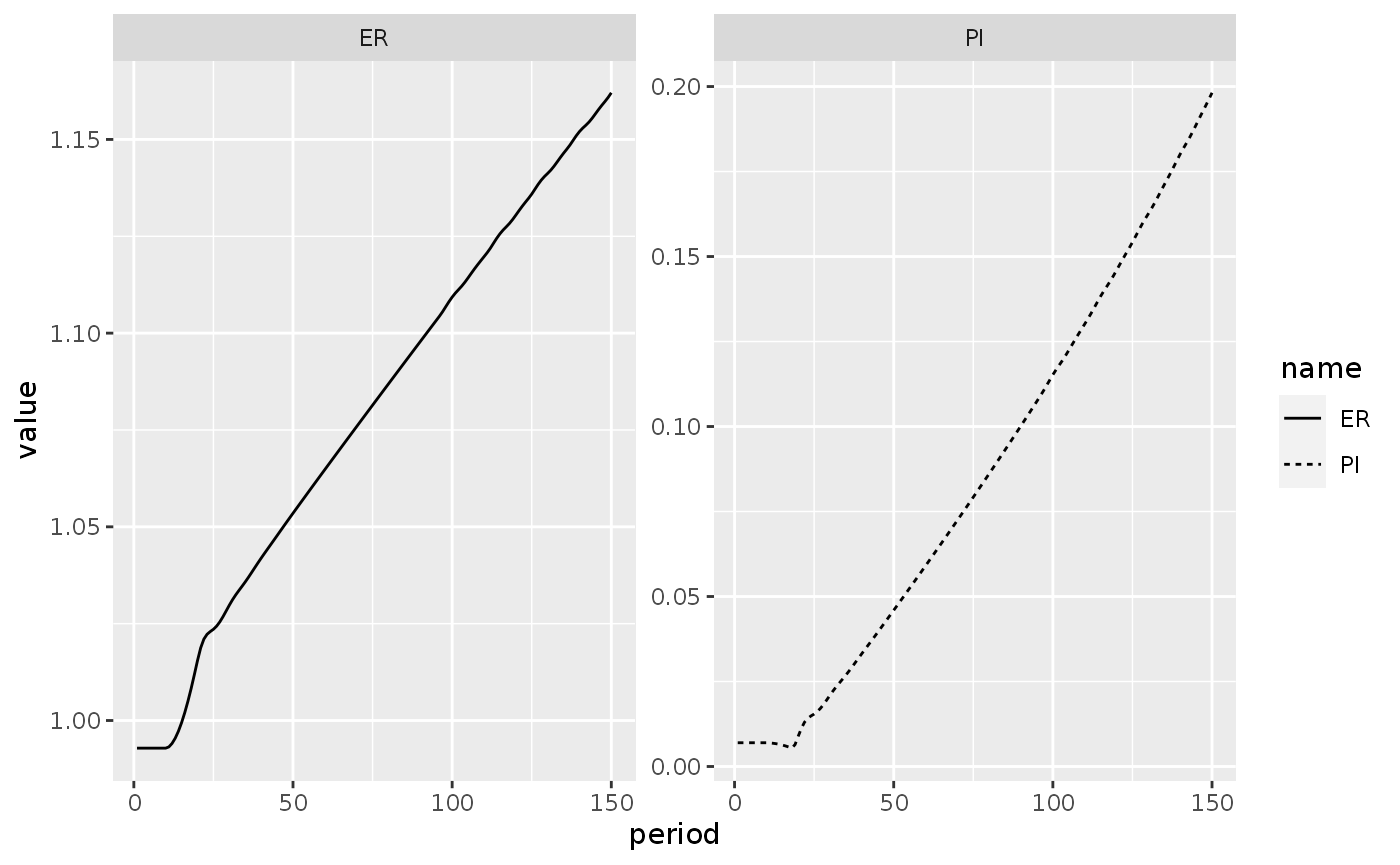

)Scenario 1: Autonomous increase in the target real wage

shock1 <- sfcr_shock(

variables = sfcr_set(

omega0 ~ -0.1

),

start = 5,

end = 150

)

growtha <- sfcr_scenario(

baseline = growth,

scenario = shock1,

periods = 150,

method = "Broyden"

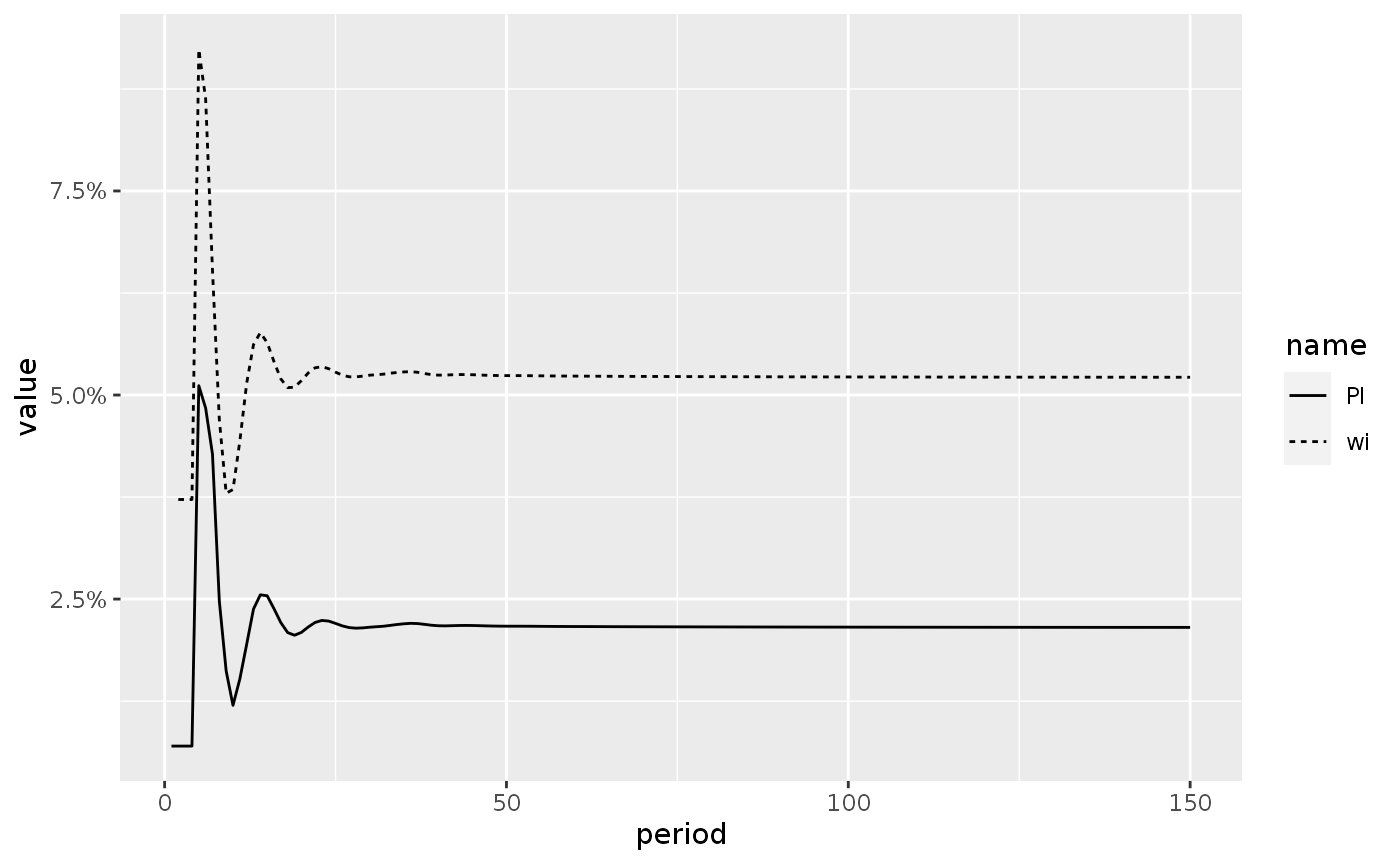

)Figure 11.2A

growtha %>%

do_plot(variables = c("PI", "wi")) +

scale_y_continuous(labels = scales::percent)

#> Warning: Removed 1 row(s) containing missing values (geom_path).

To generate the comparison of Figure 11.2A, we need to compare model growth1 against the counterfactual baseline evolution growthbl. The code below creates two helper functions that will divide the selected variables by their counterparts in the growthbl model and then apply the do_plot function to it.

do_cbind <- function(m1, m2, variables) {

bind_cols(

m1,

select(m2, c(!!variables)) %>% set_names(paste0(names(.), "_bl"))

)

}

do_cplot <- function(m1, variables, plot = NULL, m2 = growthbl) {

vars = paste0(variables, "_bl")

ntbl <- do_cbind(m1, m2, variables)

for (.v in seq_along(variables)) {

ntbl[, variables[[.v]]] <- ntbl[, variables[[.v]]] / ntbl[, vars[[.v]]]

}

ntbl %>%

do_plot(variables, plot)

}Scenario 1, second experiment

shock2 <- sfcr_shock(

variables = sfcr_set(

Rbbar ~ 0.055

),

start = 5,

end = 150

)

growthab <- sfcr_scenario(

baseline = growth,

scenario = list(shock1, shock2),

periods = 150,

method = "Broyden"

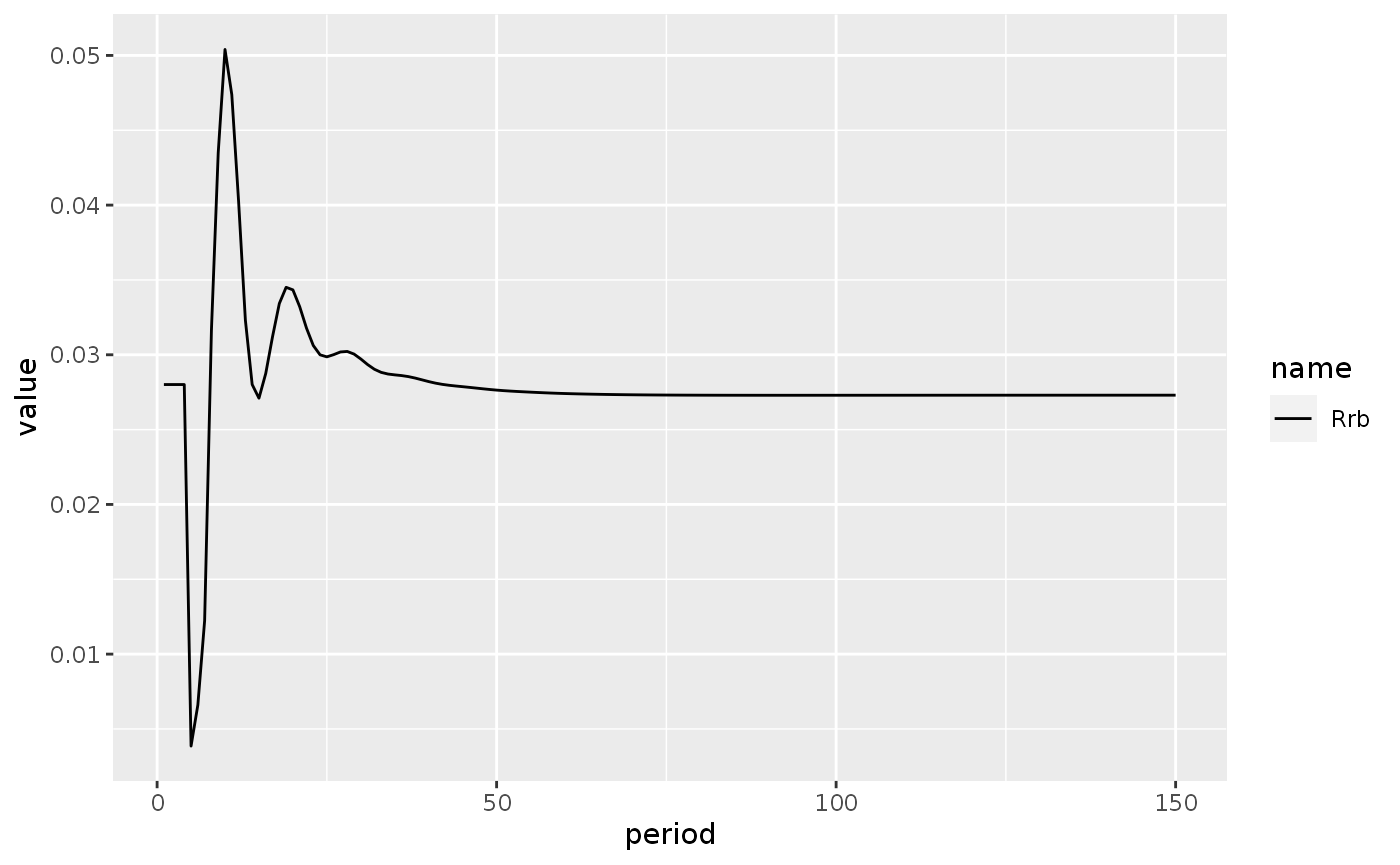

)Figure 11.2C

This figure required some trial and error to find a value of Rbbar that makes the real interest on bills to end more or less where it started. Is there a way to automate this procedure?

Also note that the real interest rate in Godley and Lavoie (2007, 407) first increases and then it decreases. The only way to make something similar to that is to set the shock on interest rates to happens before the shock on inflation, which contradicts the book.

growthab %>%

mutate(Rrb = Rb - PI) %>%

do_plot(variables = "Rrb")

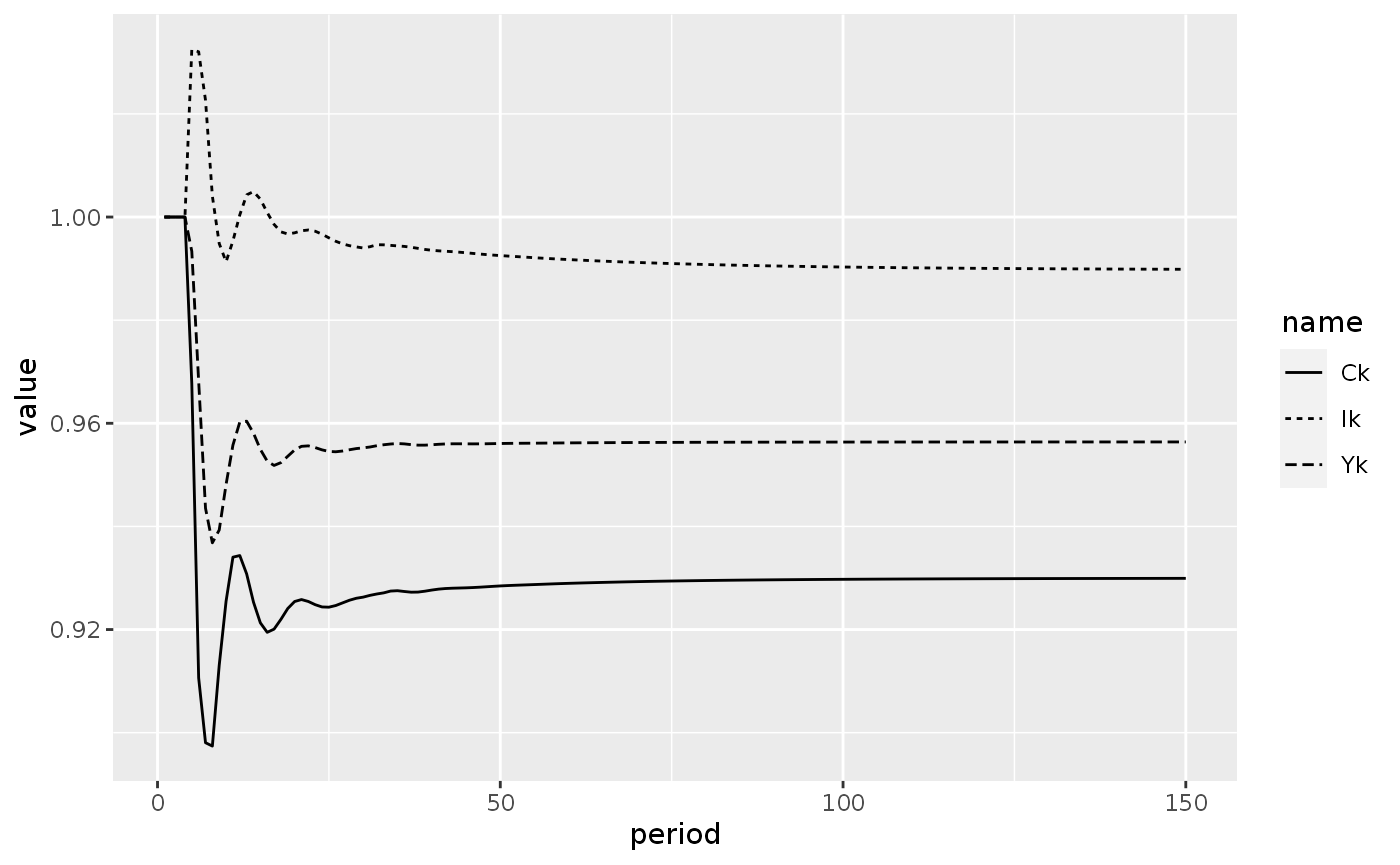

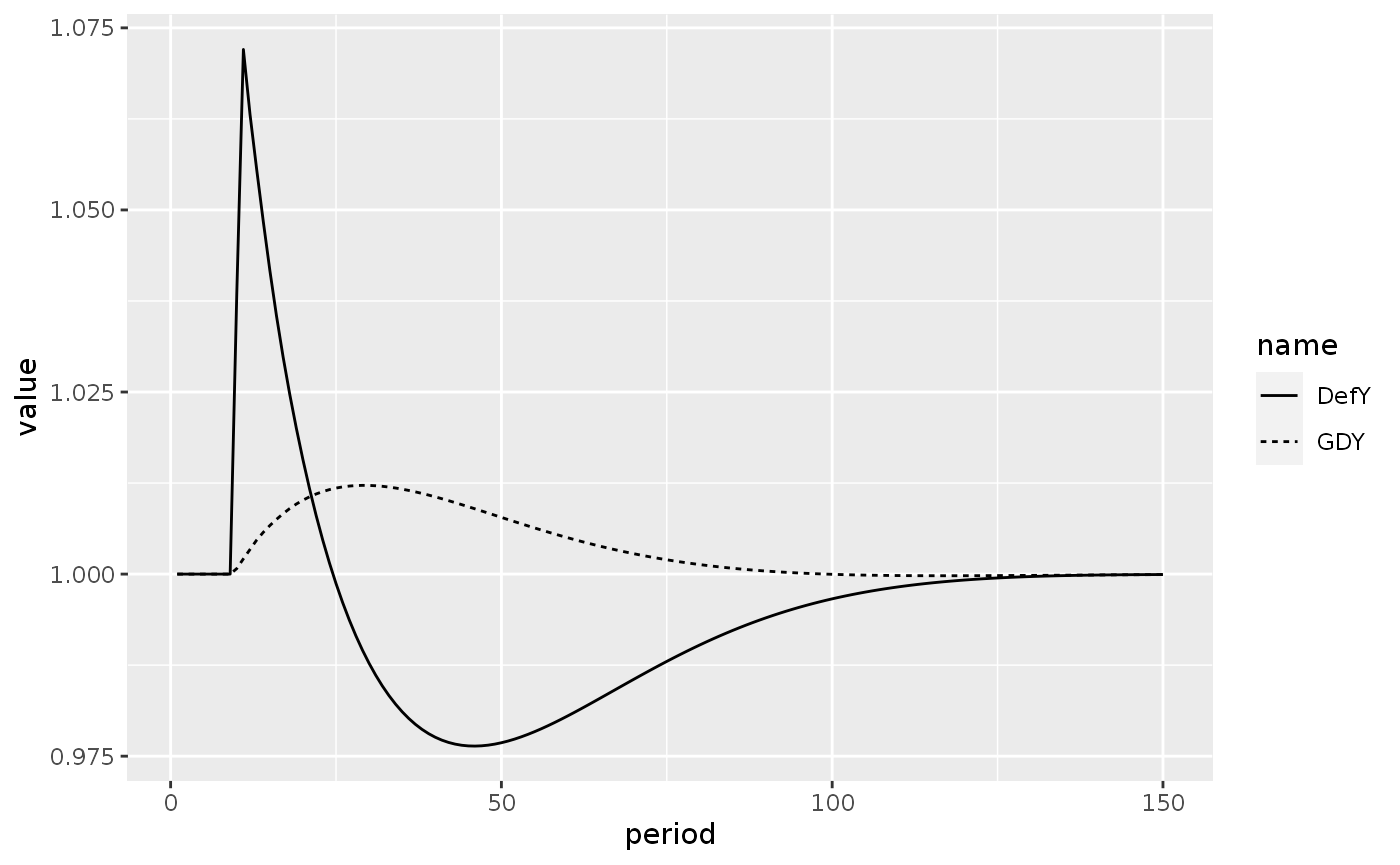

Scenario 2: One-period only increase in the growth rate of pure government expenditures

shock3 <- sfcr_shock(

variables = sfcr_set(

GRg ~ 0.035

),

start = 10,

end = 11

)

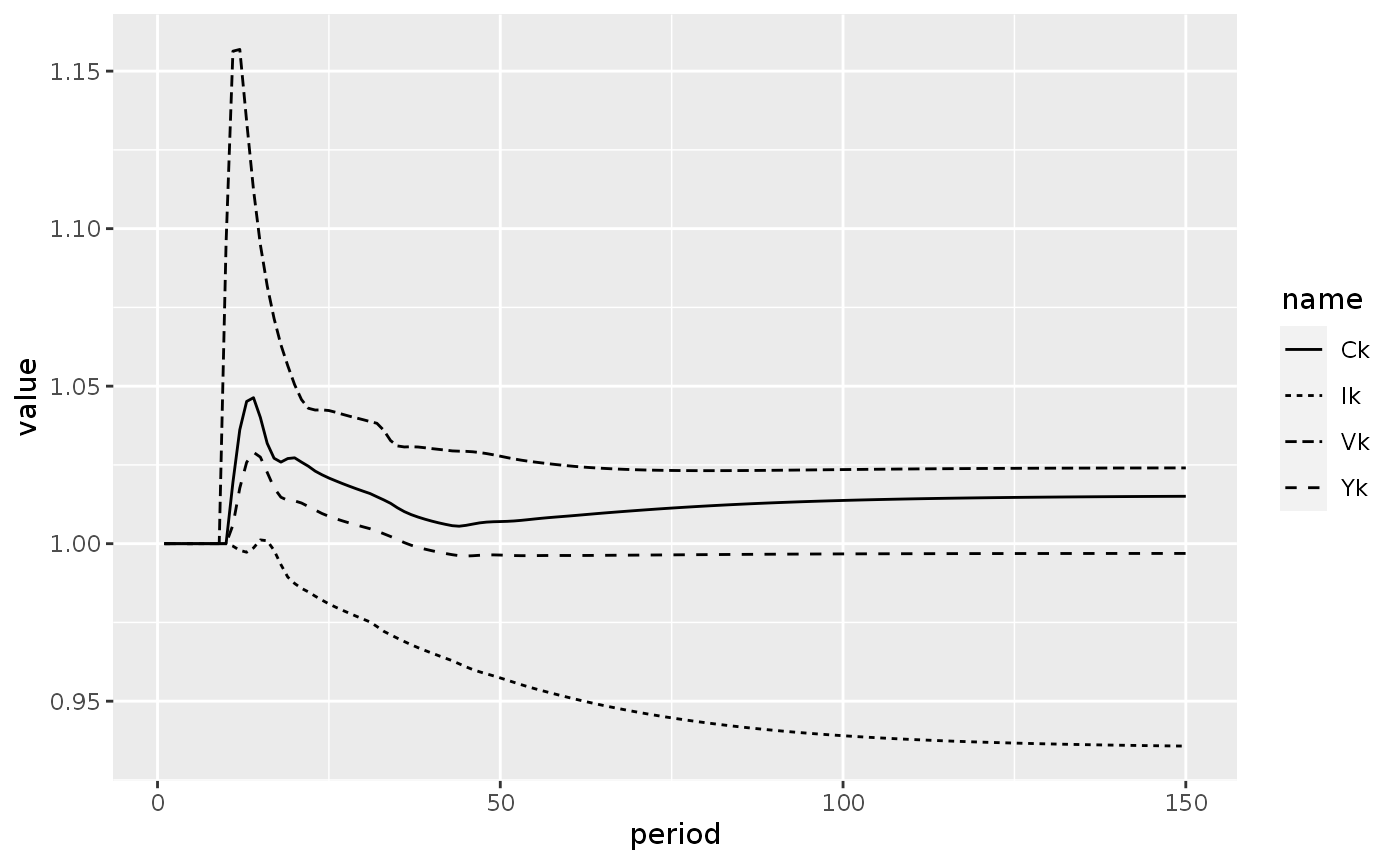

growthb <- sfcr_scenario(

baseline = growth,

scenario = shock3,

periods = 150,

method = "Broyden"

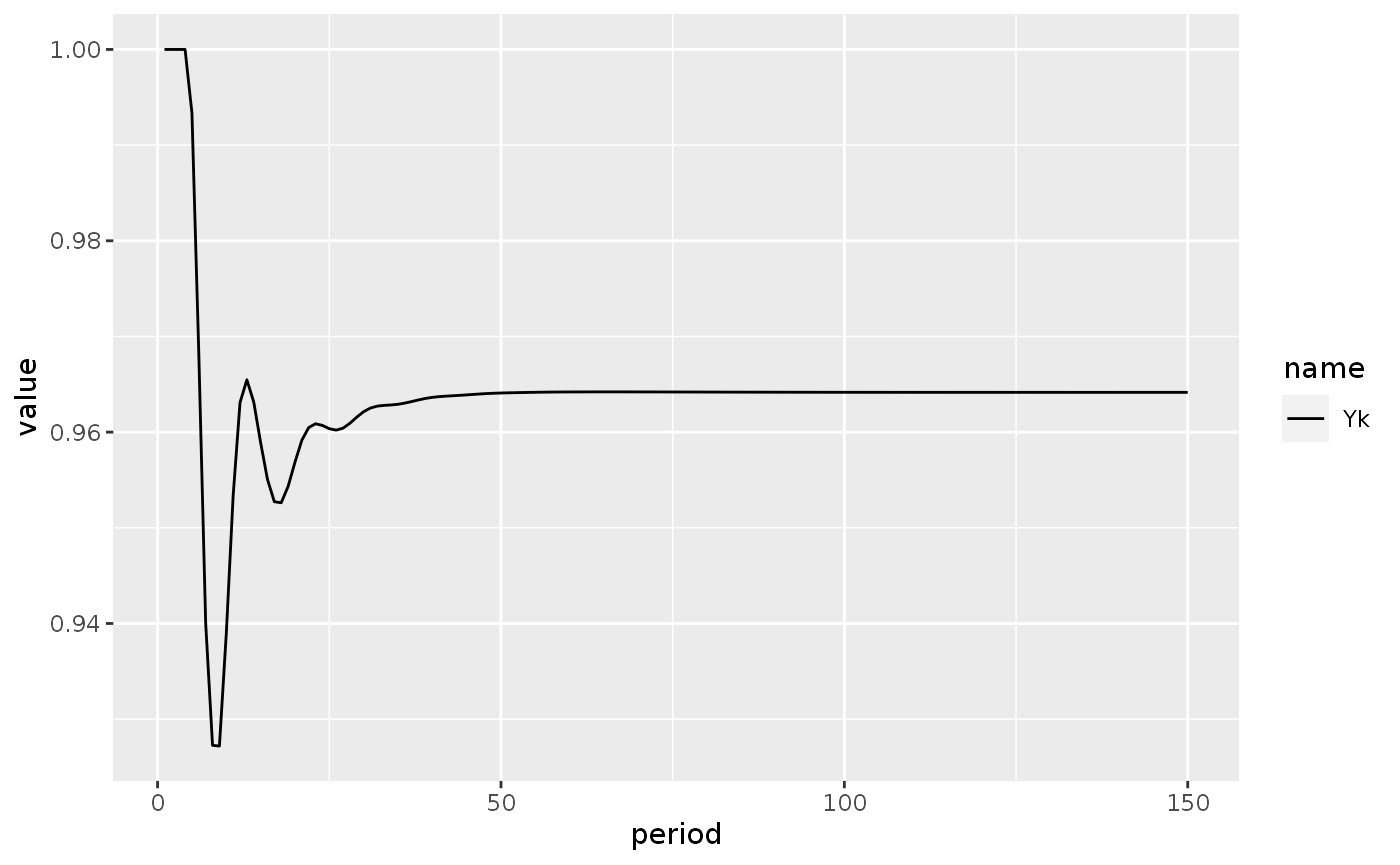

)Scenario 2.B: One-shot decrease in the income tax

shock4 <- sfcr_shock(

variables = sfcr_set(

theta ~ 0.22

),

start = 10,

end = 150

)

growthbb <- sfcr_scenario(

baseline = growth,

scenario = shock4,

periods = 150,

method = "Broyden"

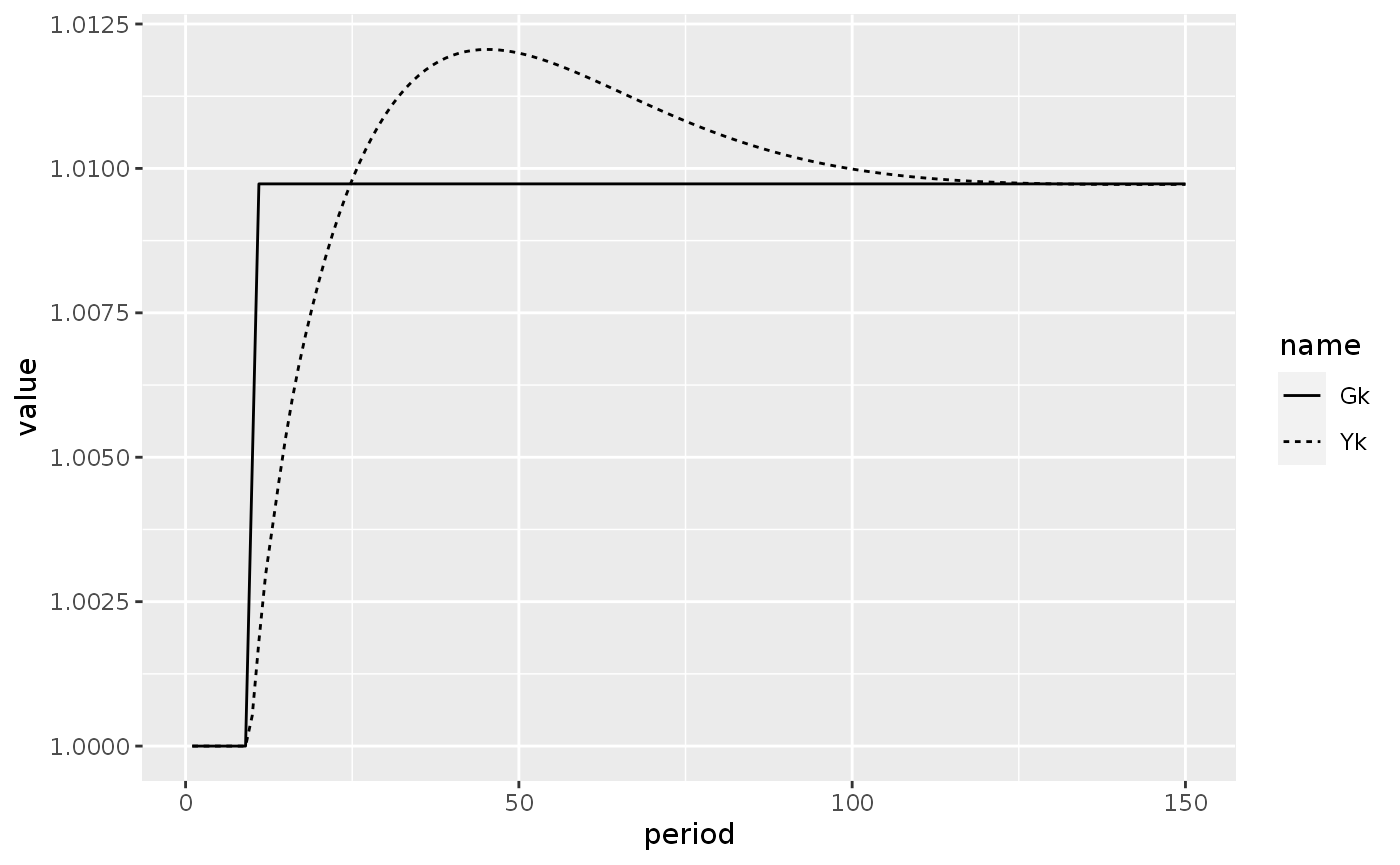

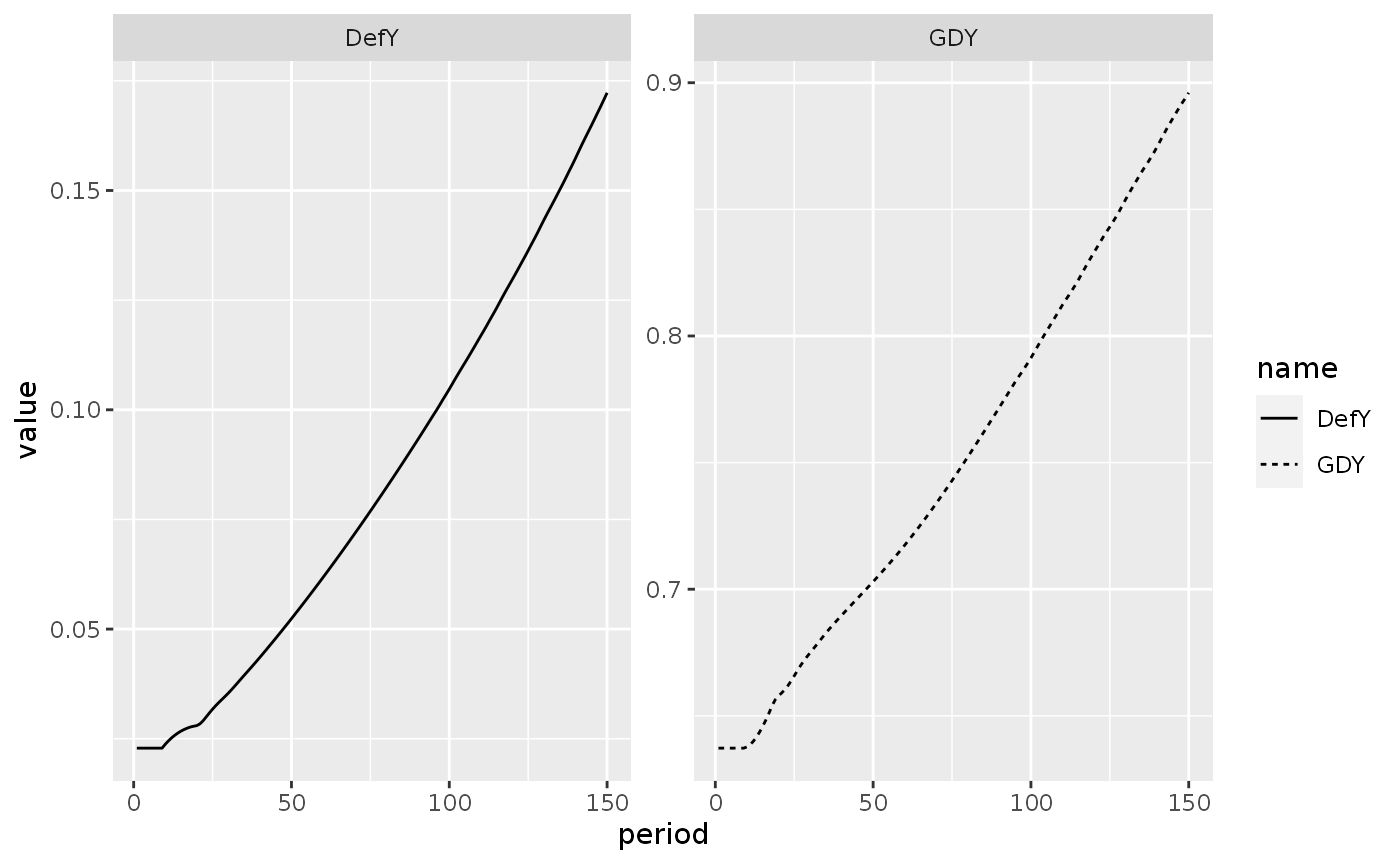

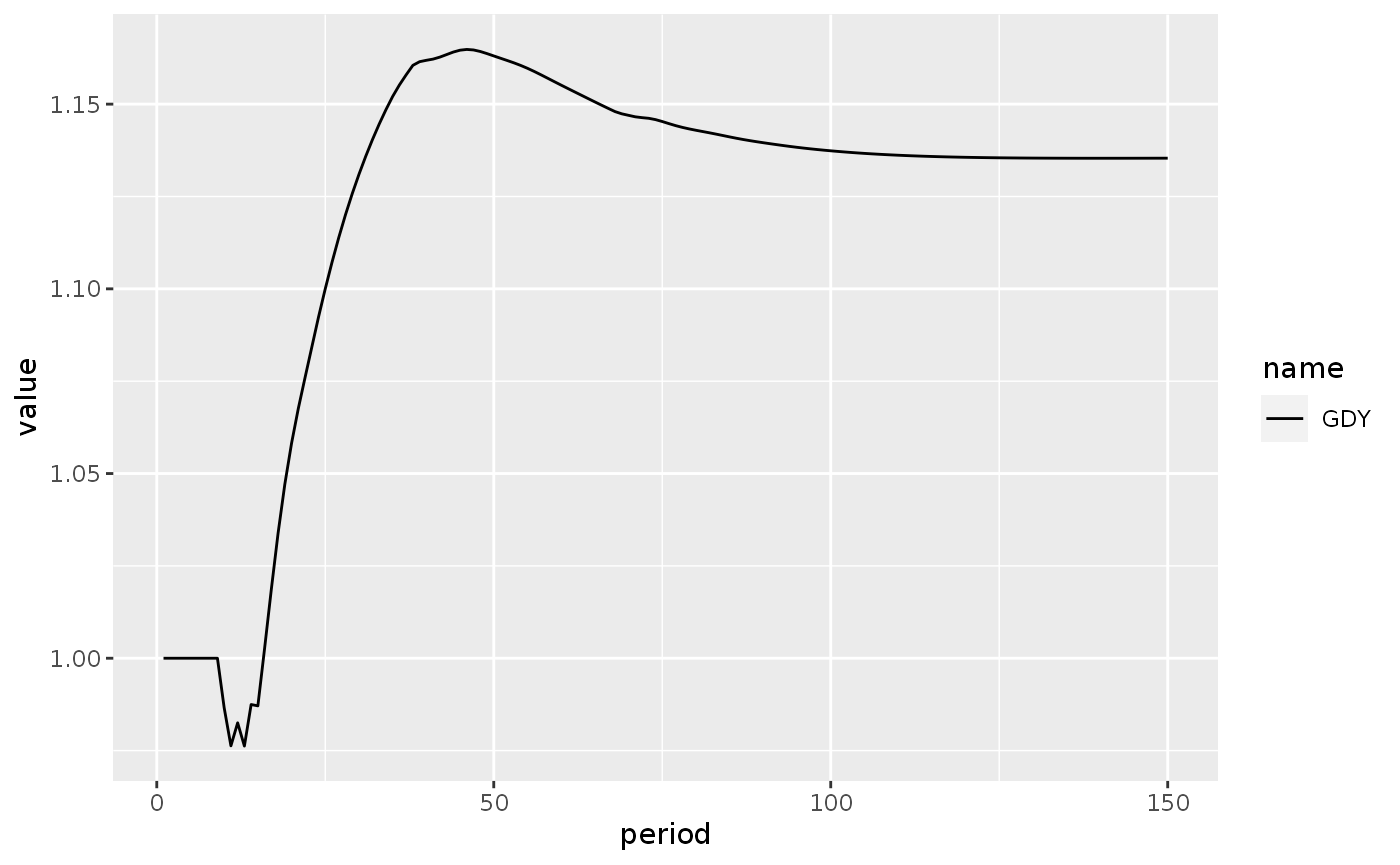

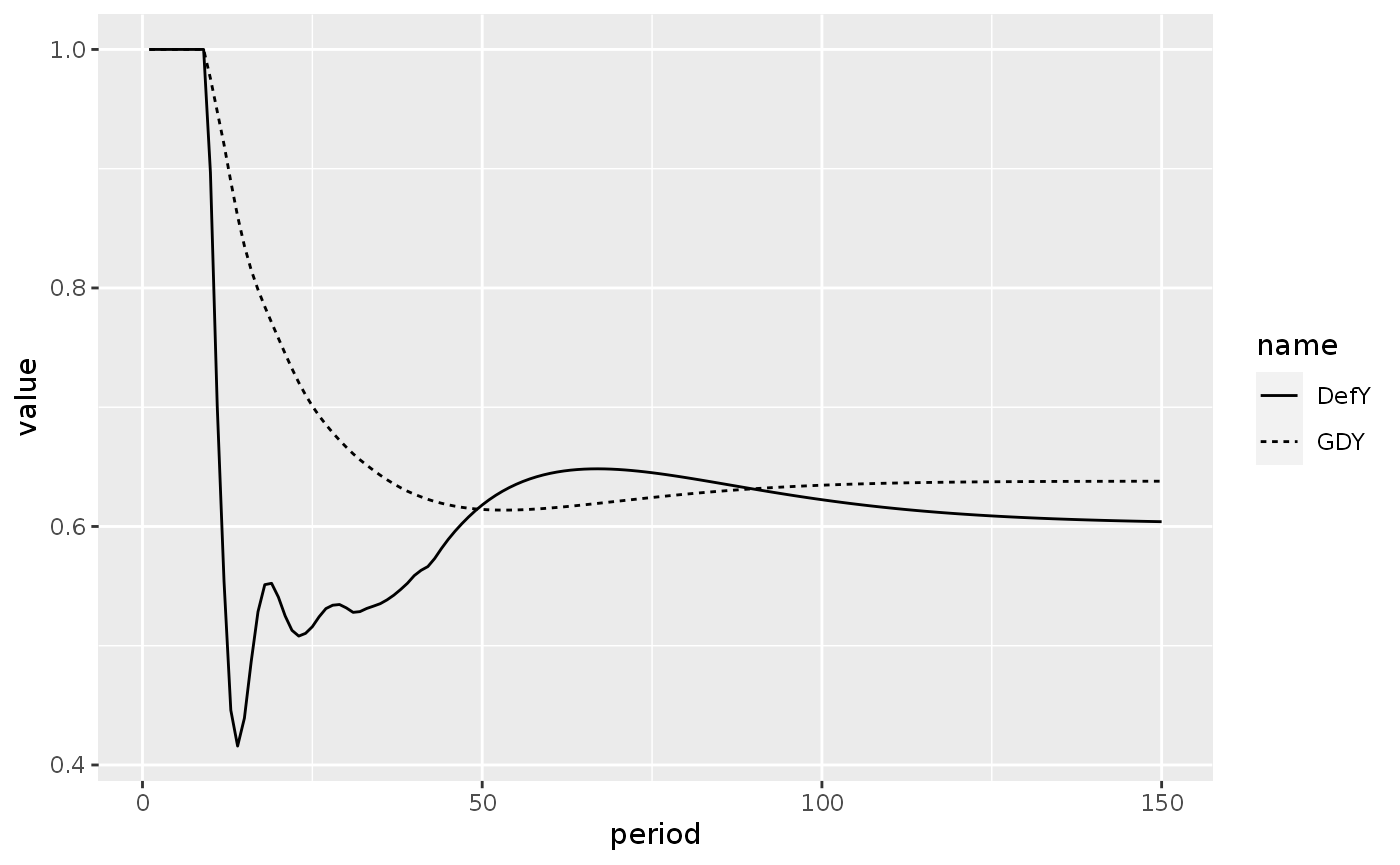

)Scenario 3: A permanent increase in the growth rate of pure government expenditures

shock5 <- sfcr_shock(

variables = sfcr_set(

GRg ~ 0.035

),

start = 10,

end = 150

)

growthc <- sfcr_scenario(

baseline = growth,

scenario = shock5,

periods = 150,

method = "Broyden"

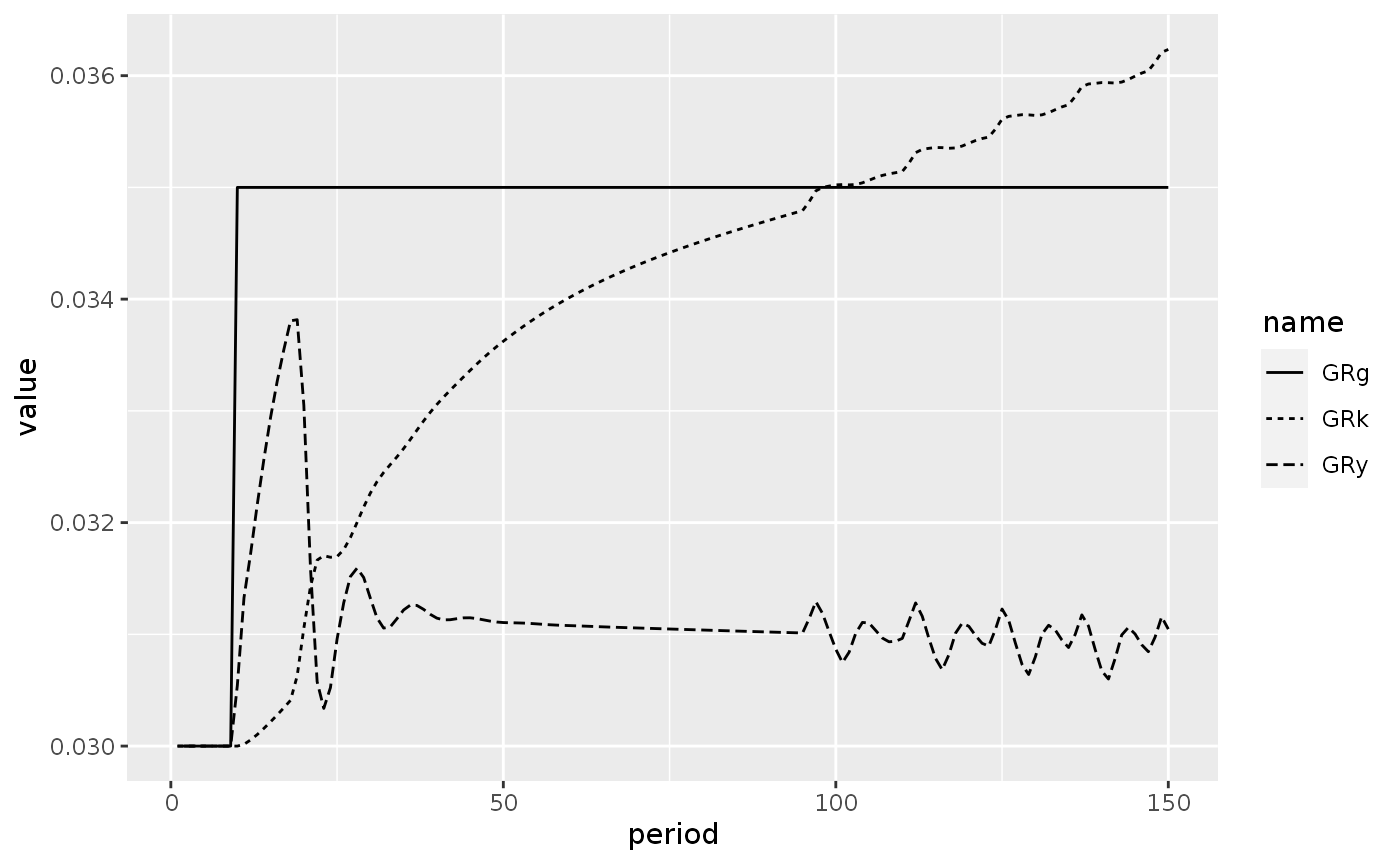

)Figure 11.4B

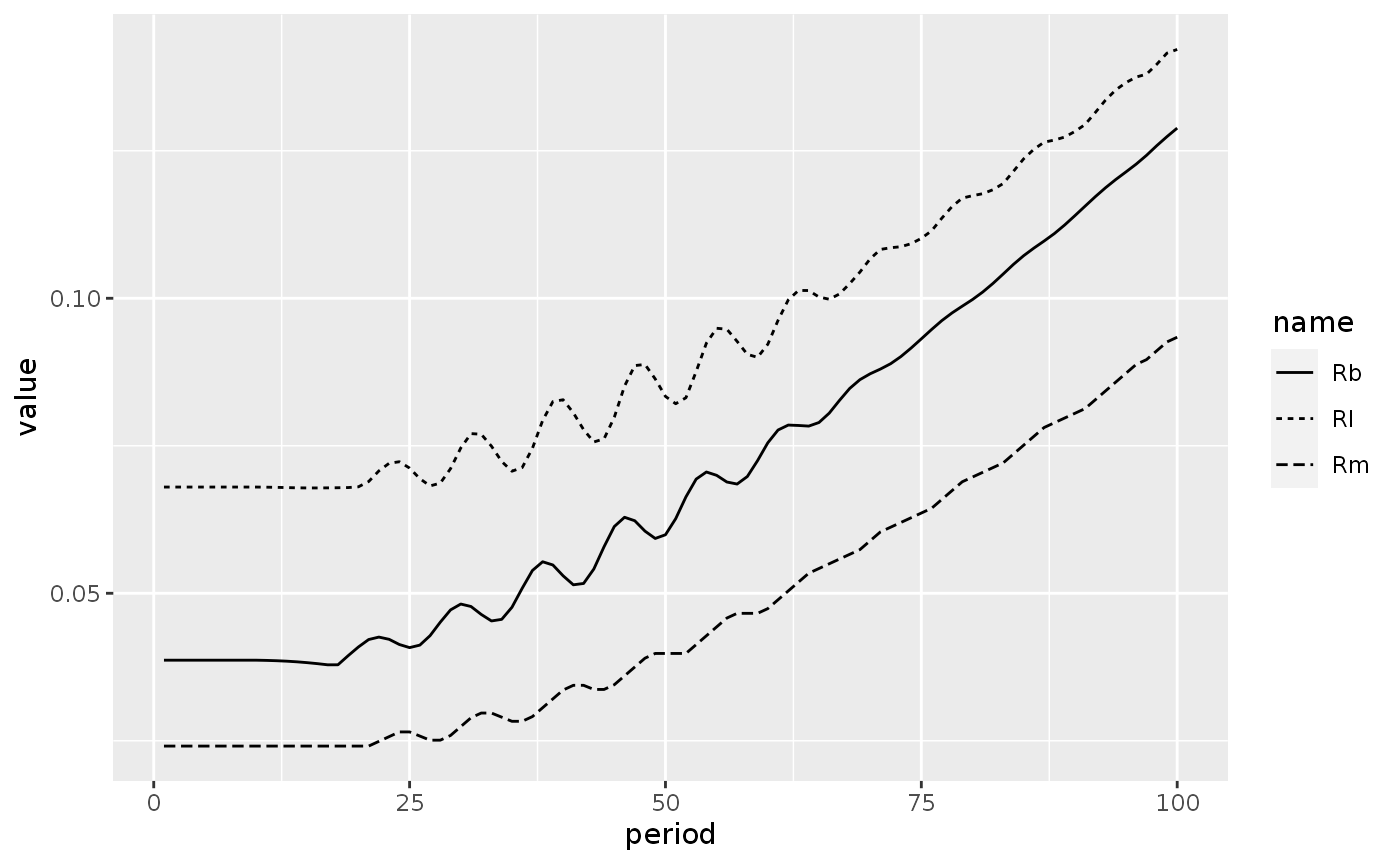

do_plot(growthc, p = c("GRg", "GRk", "GRy"))

#> Warning: Removed 1 row(s) containing missing values (geom_path).

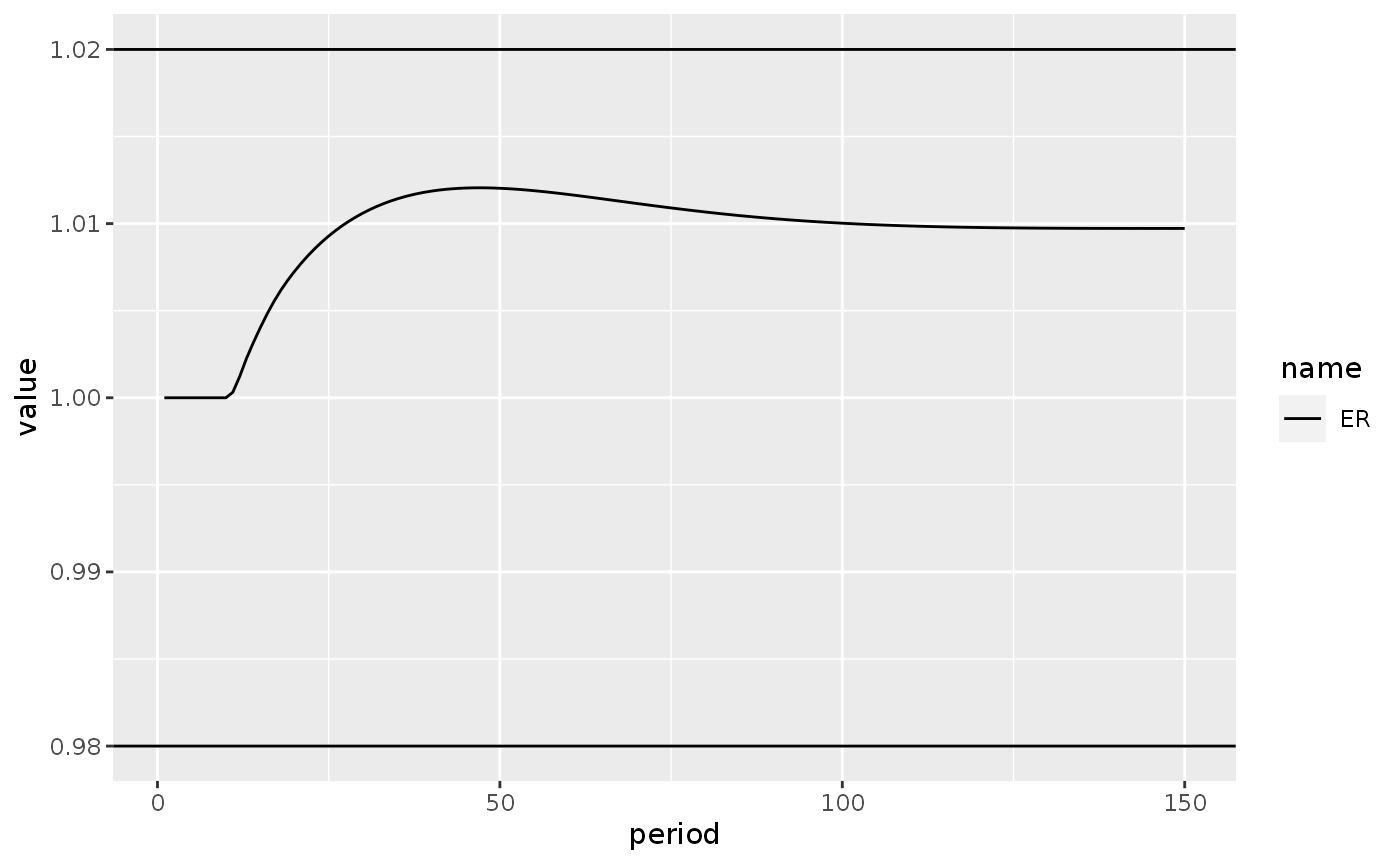

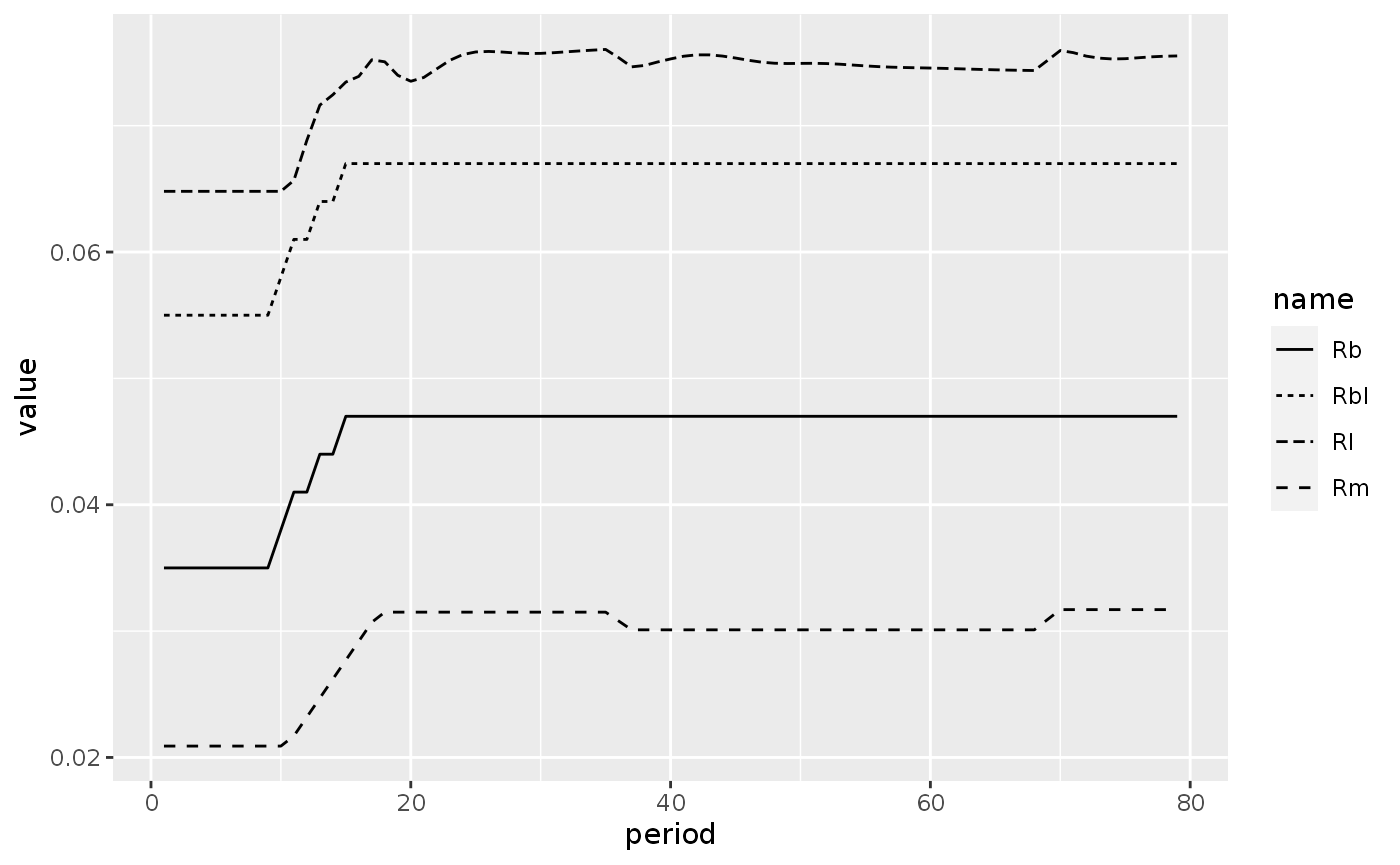

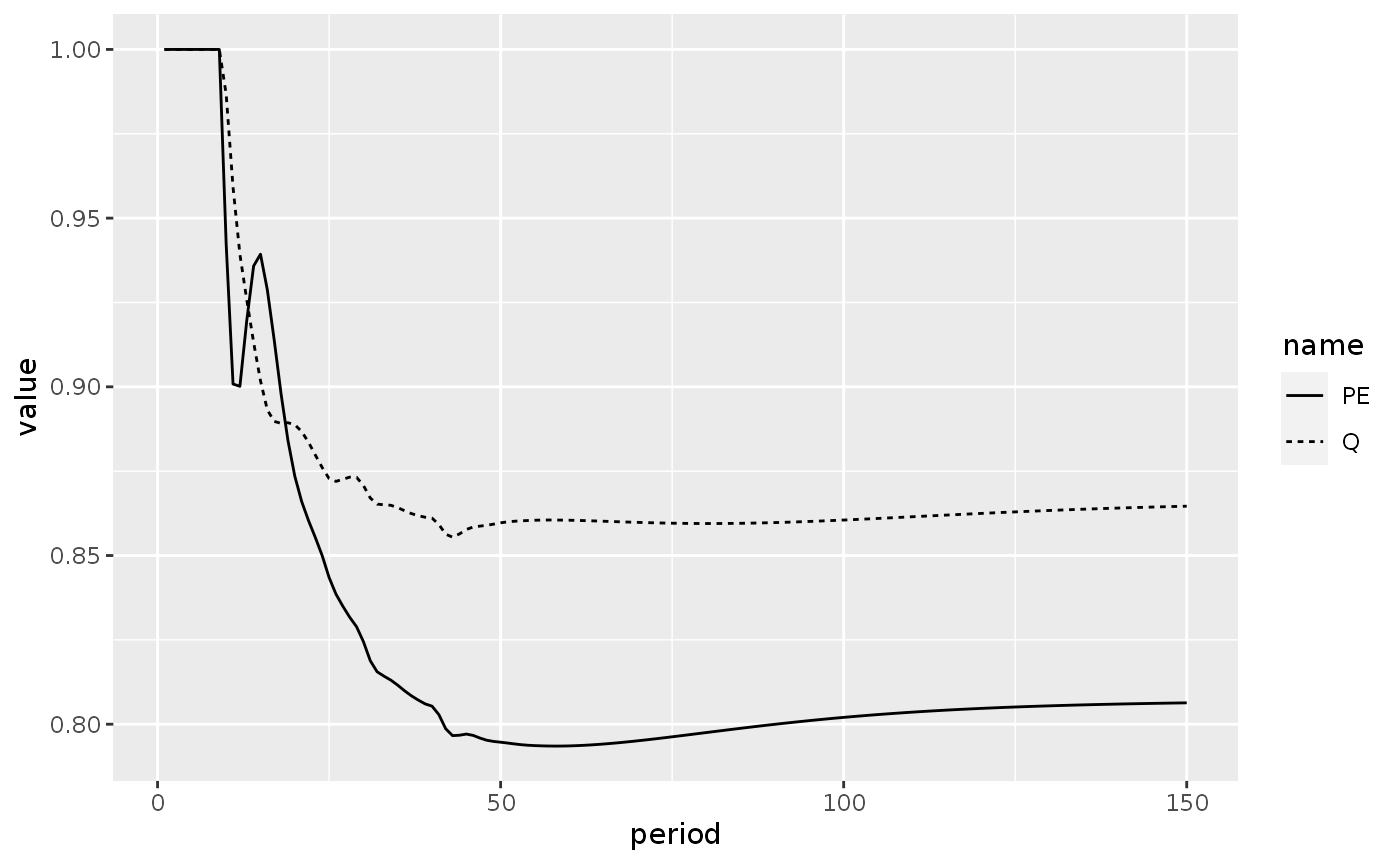

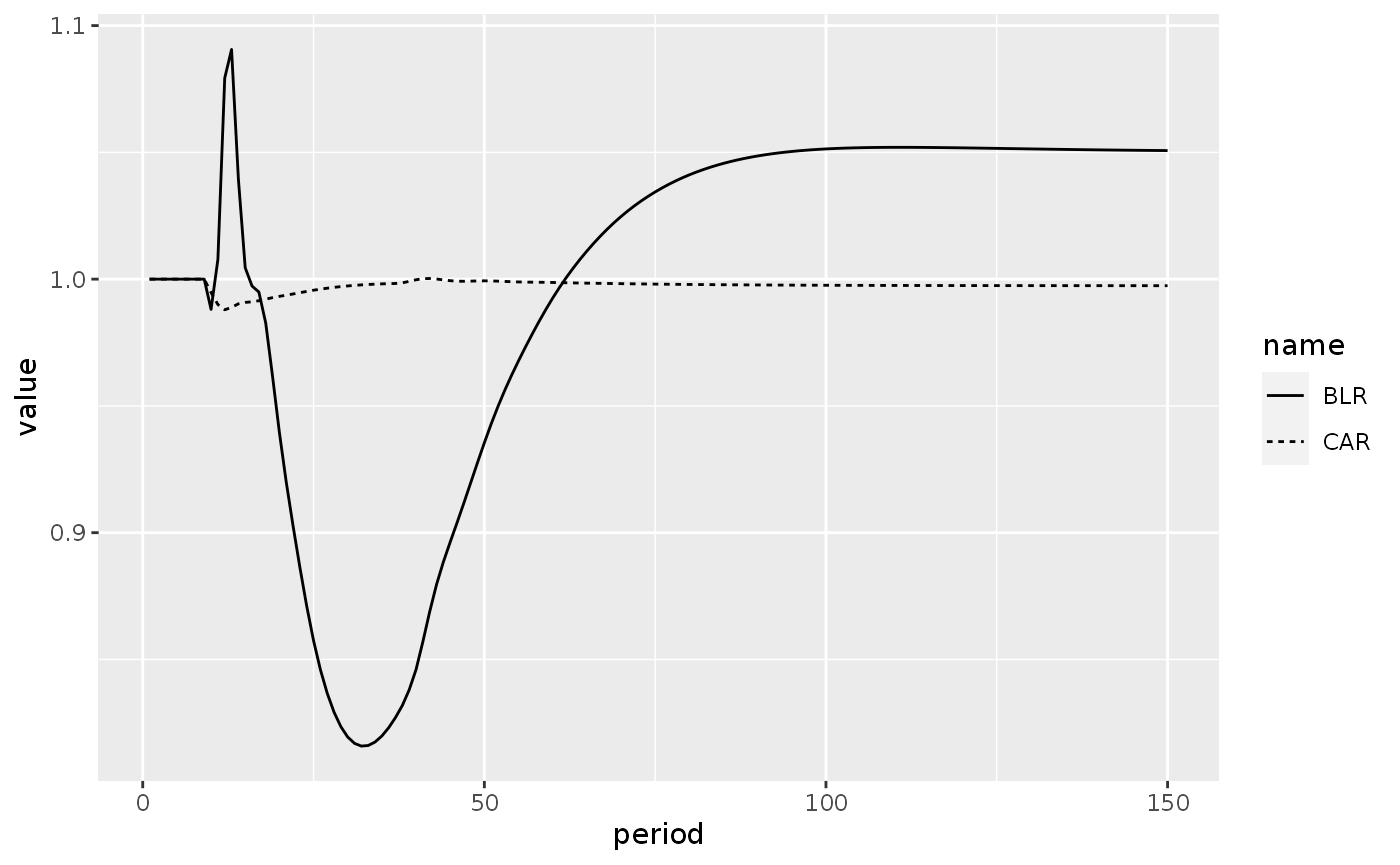

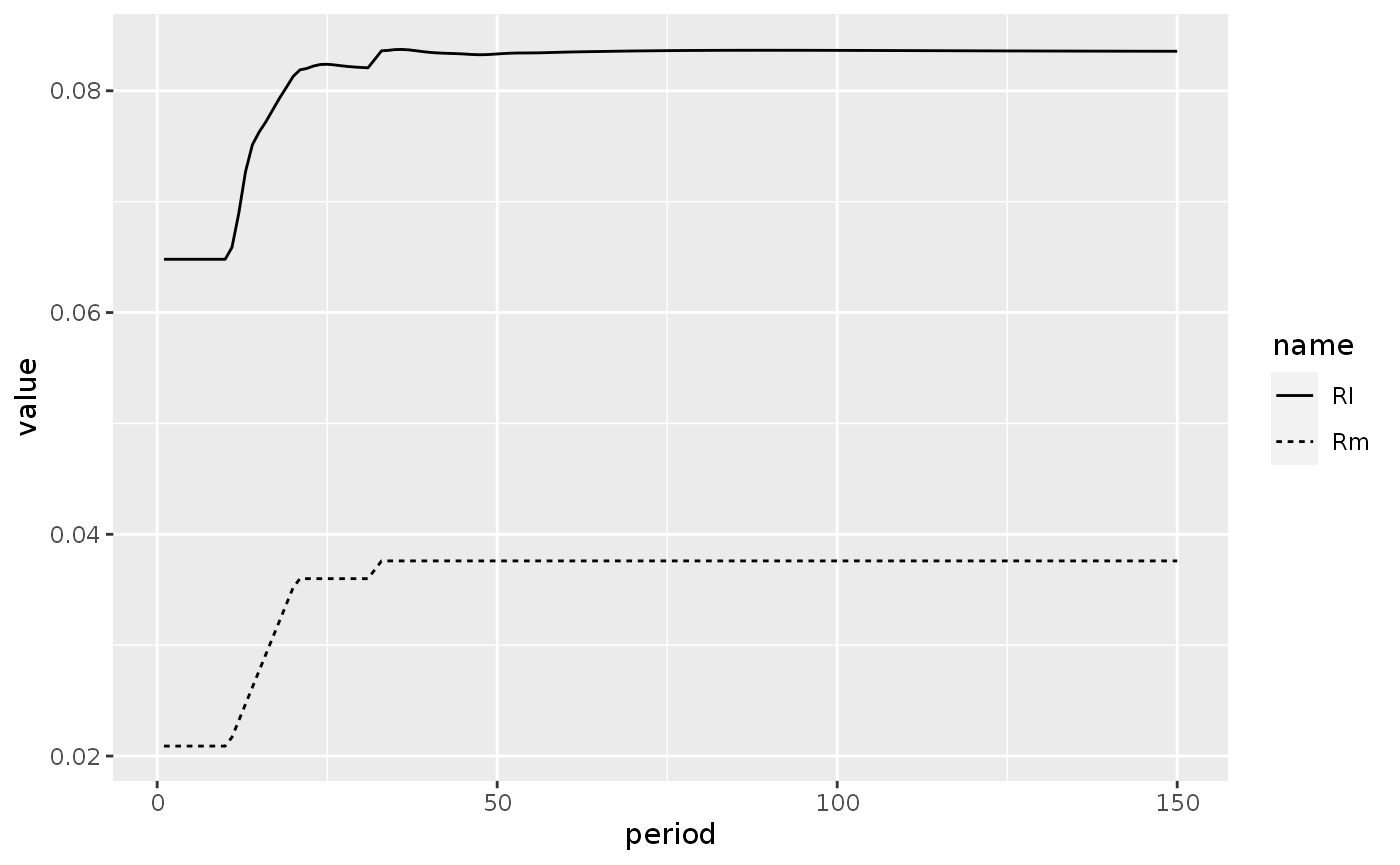

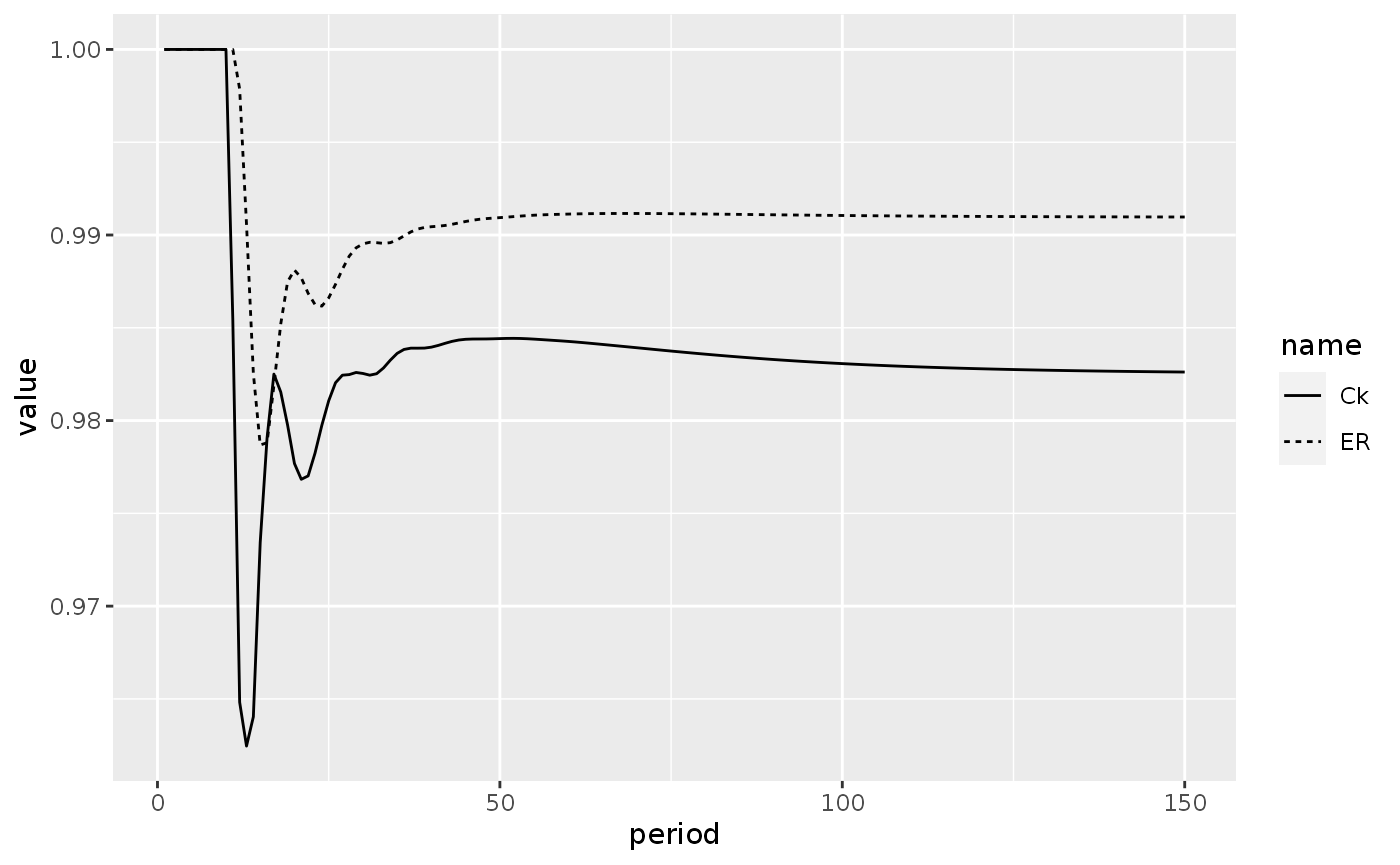

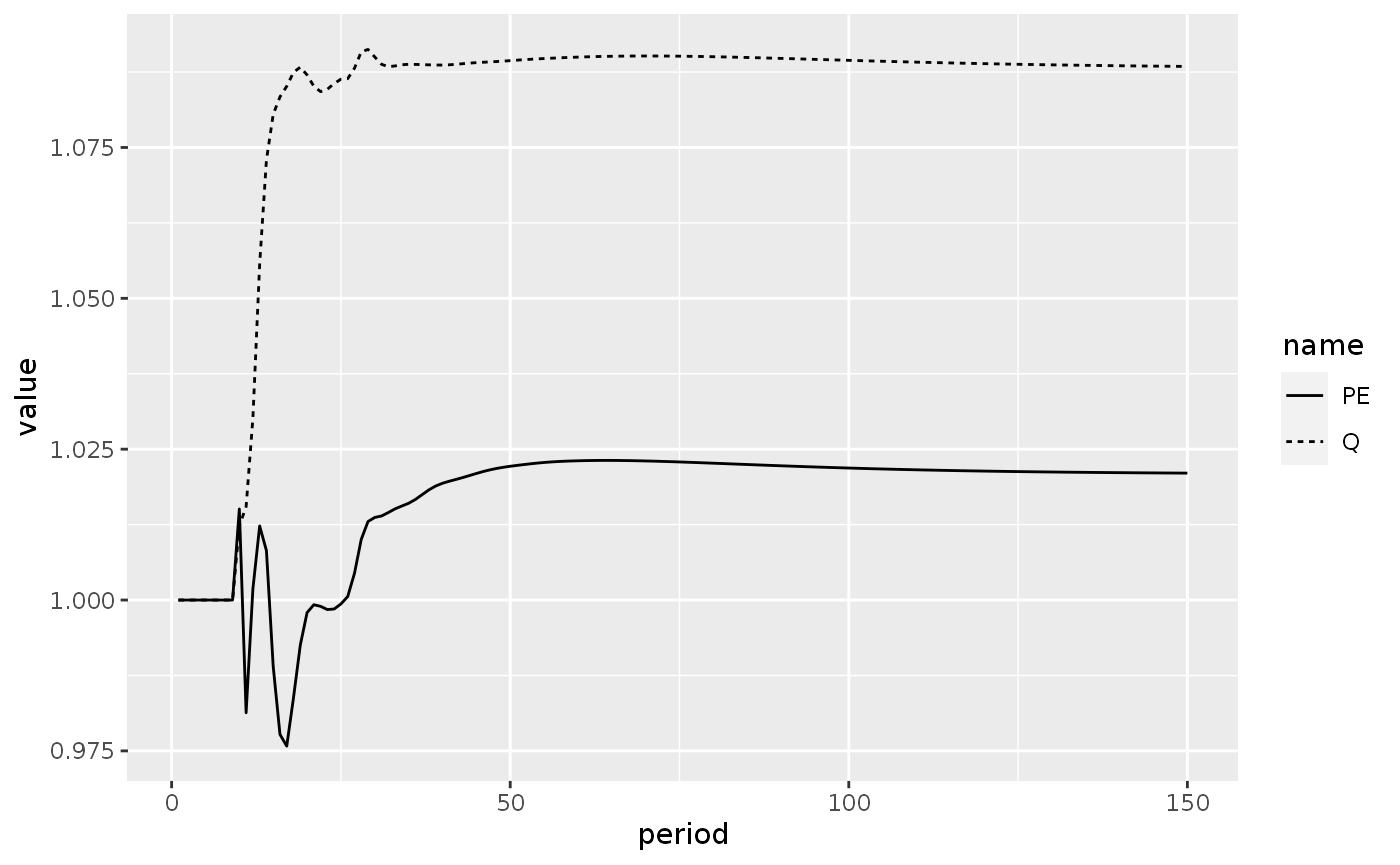

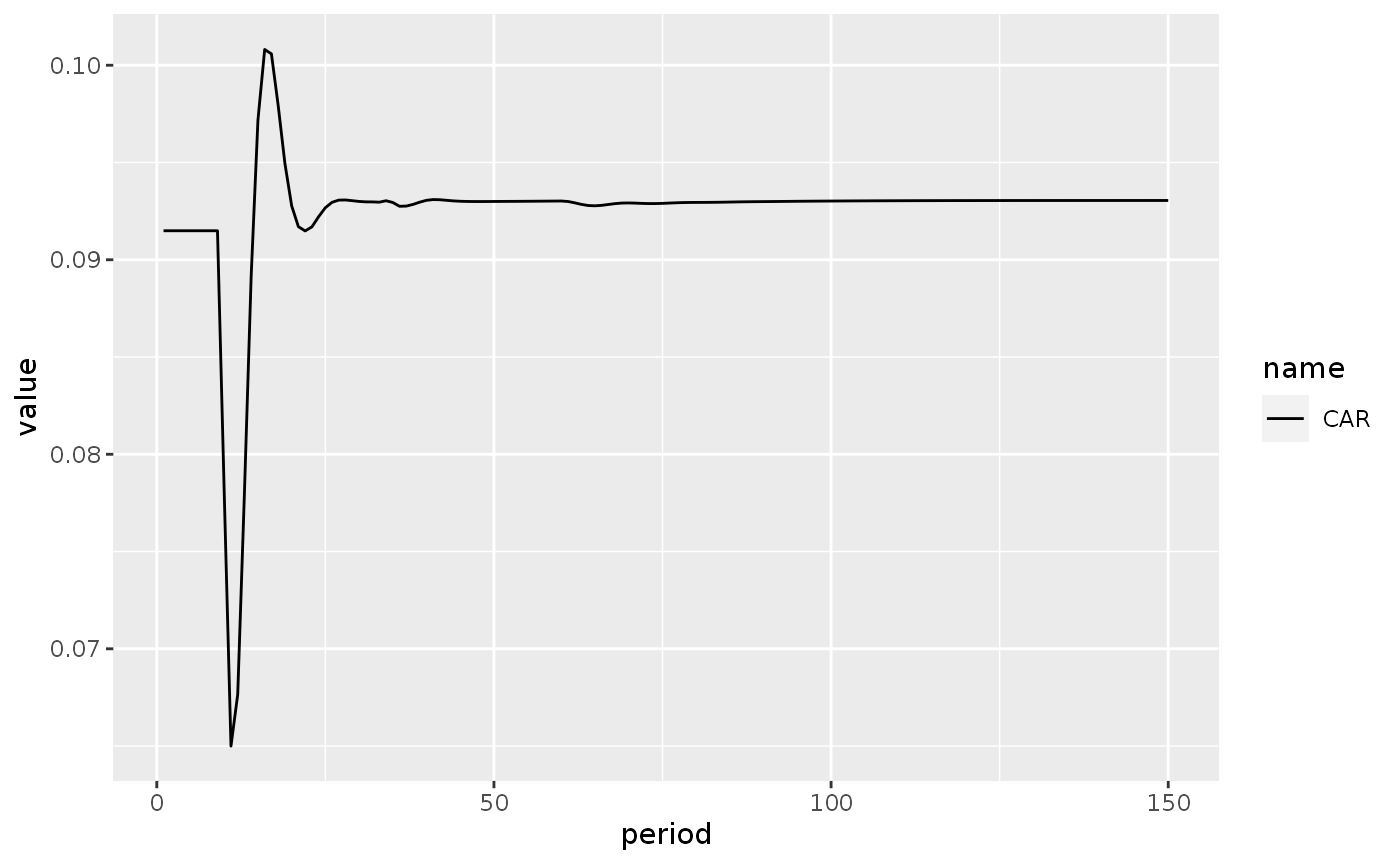

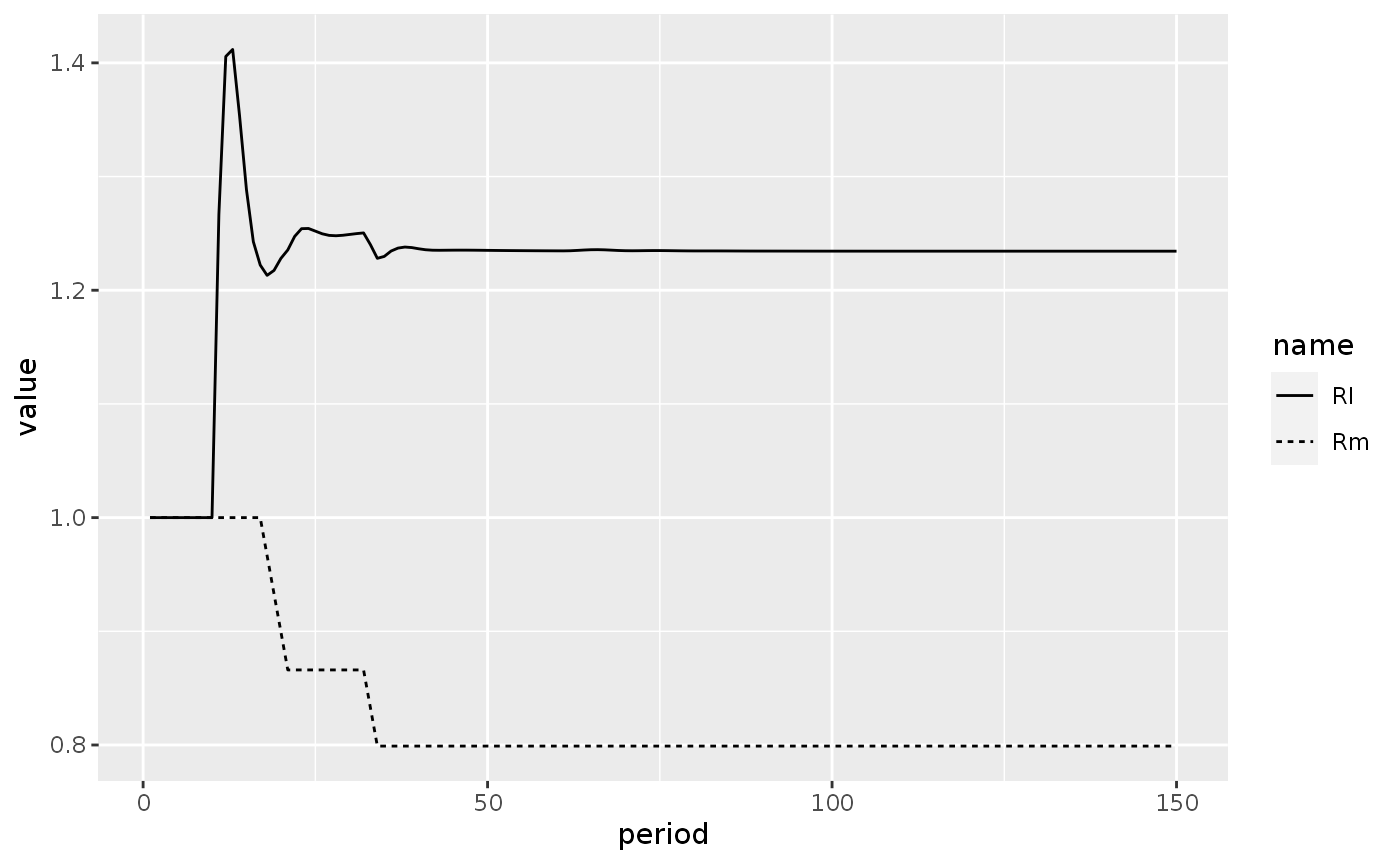

Scenario 4: A permanent increase in the bill rate of interest

shock6a <- sfcr_shock(v = sfcr_set(Rbbar ~ 0.038), s = 10, e = 11)

shock6b <- sfcr_shock(v = sfcr_set(Rbbar ~ 0.041), s = 11, e = 12)

shock6c <- sfcr_shock(v = sfcr_set(Rbbar ~ 0.044), s = 13, e = 14)

shock6d <- sfcr_shock(v = sfcr_set(Rbbar ~ 0.047), s = 15, e = 150)

growthd <- sfcr_scenario(

baseline = growth,

scenario = list(shock6a, shock6b, shock6c, shock6d),

periods = 150,

method = "Broyden"

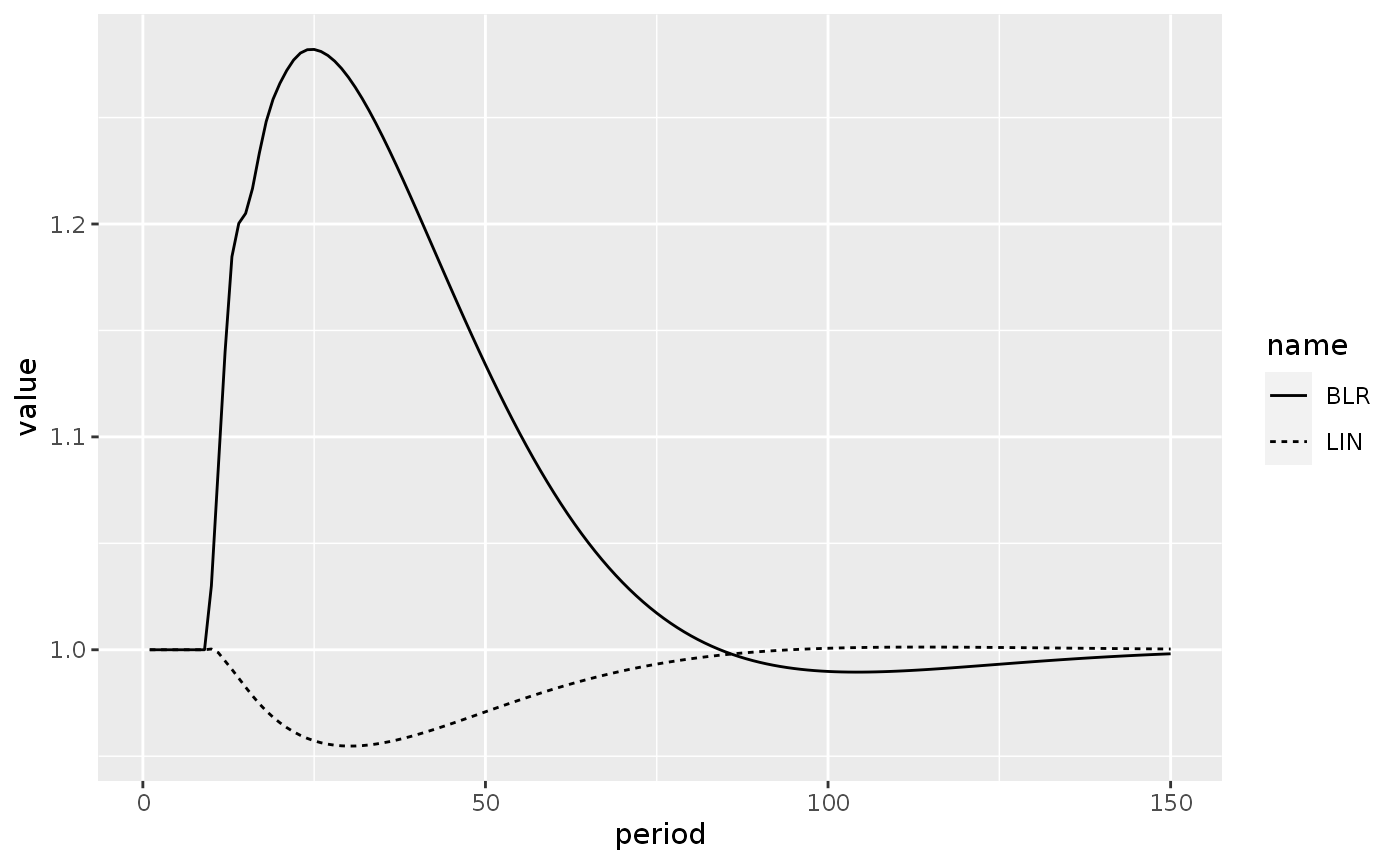

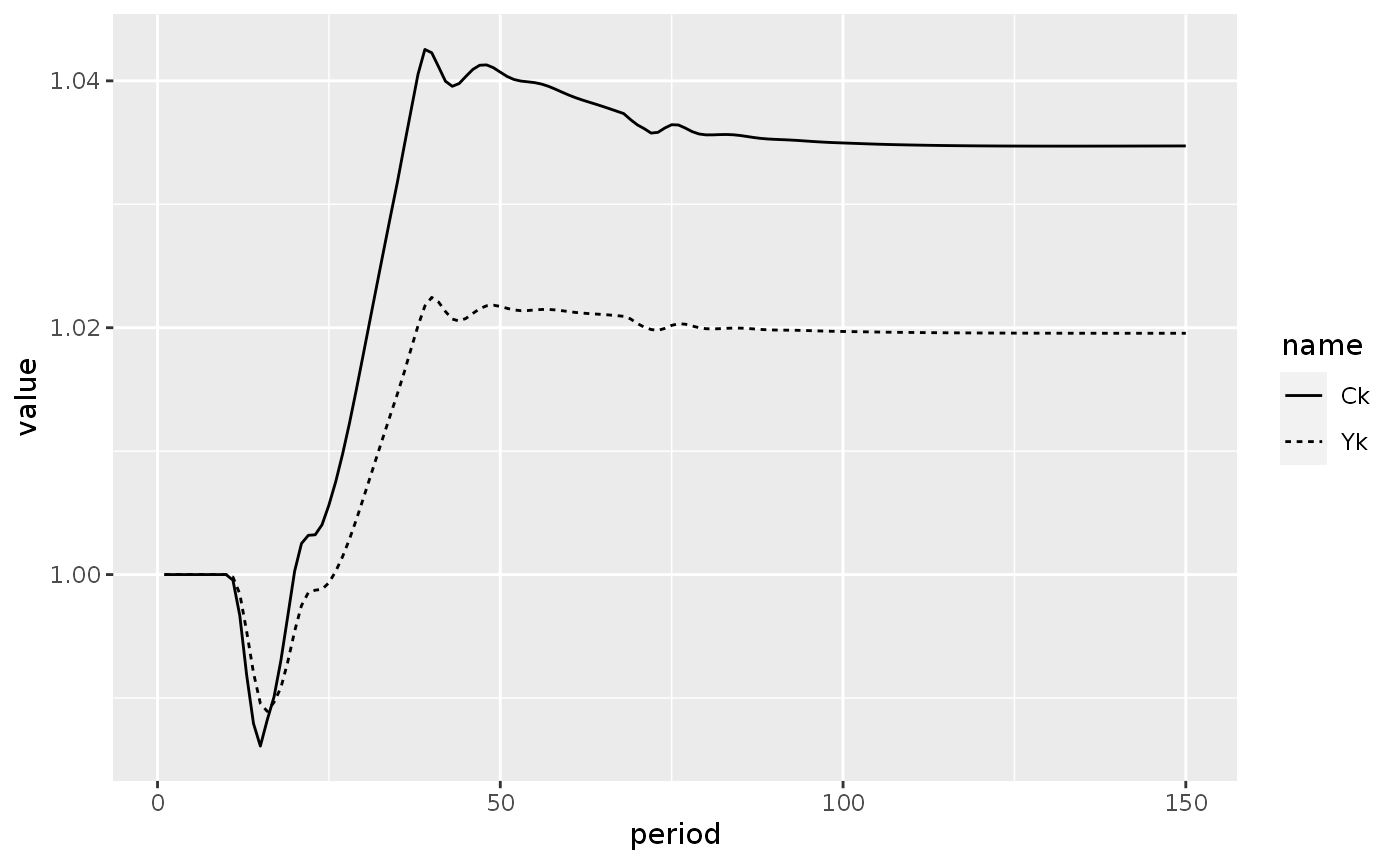

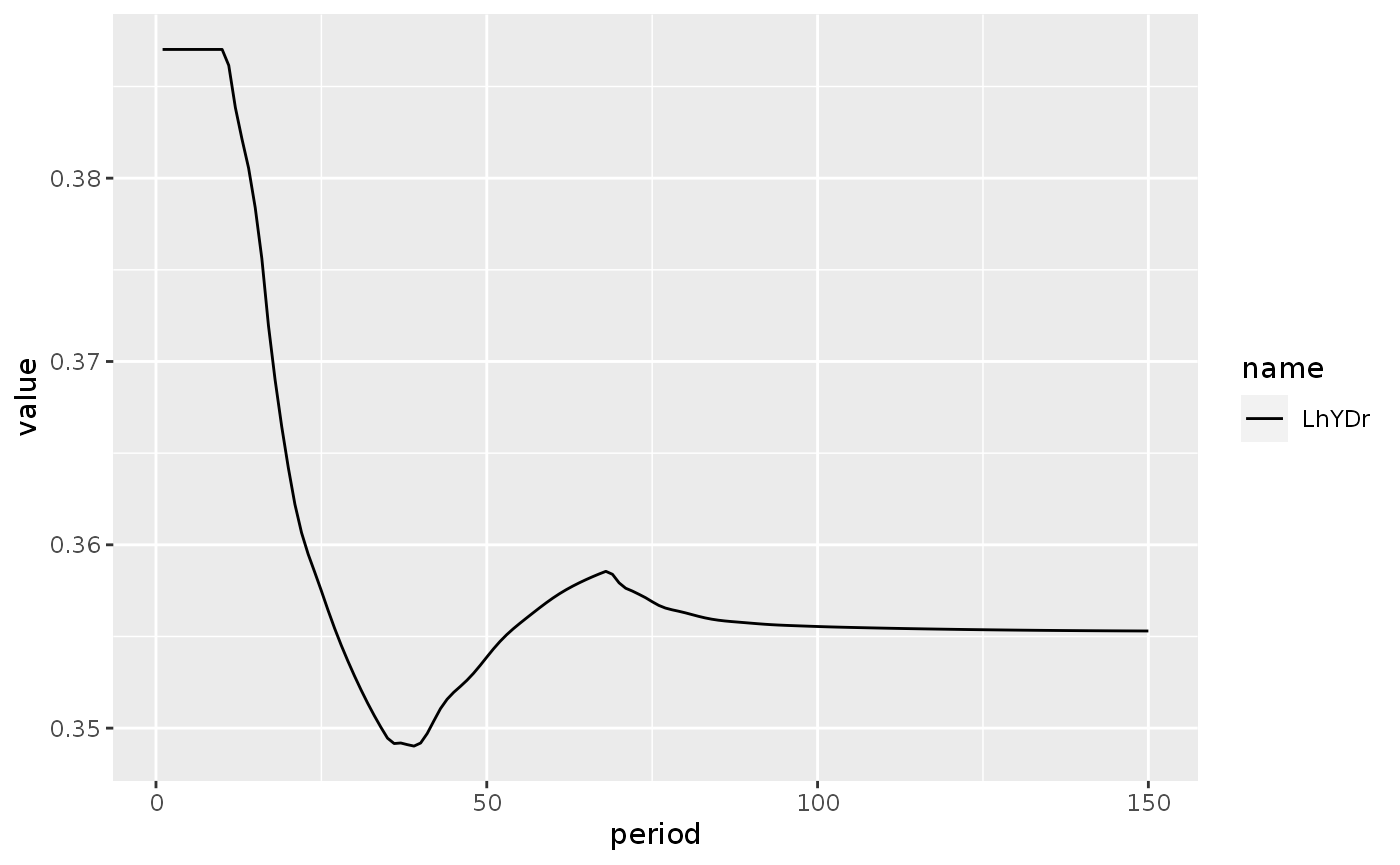

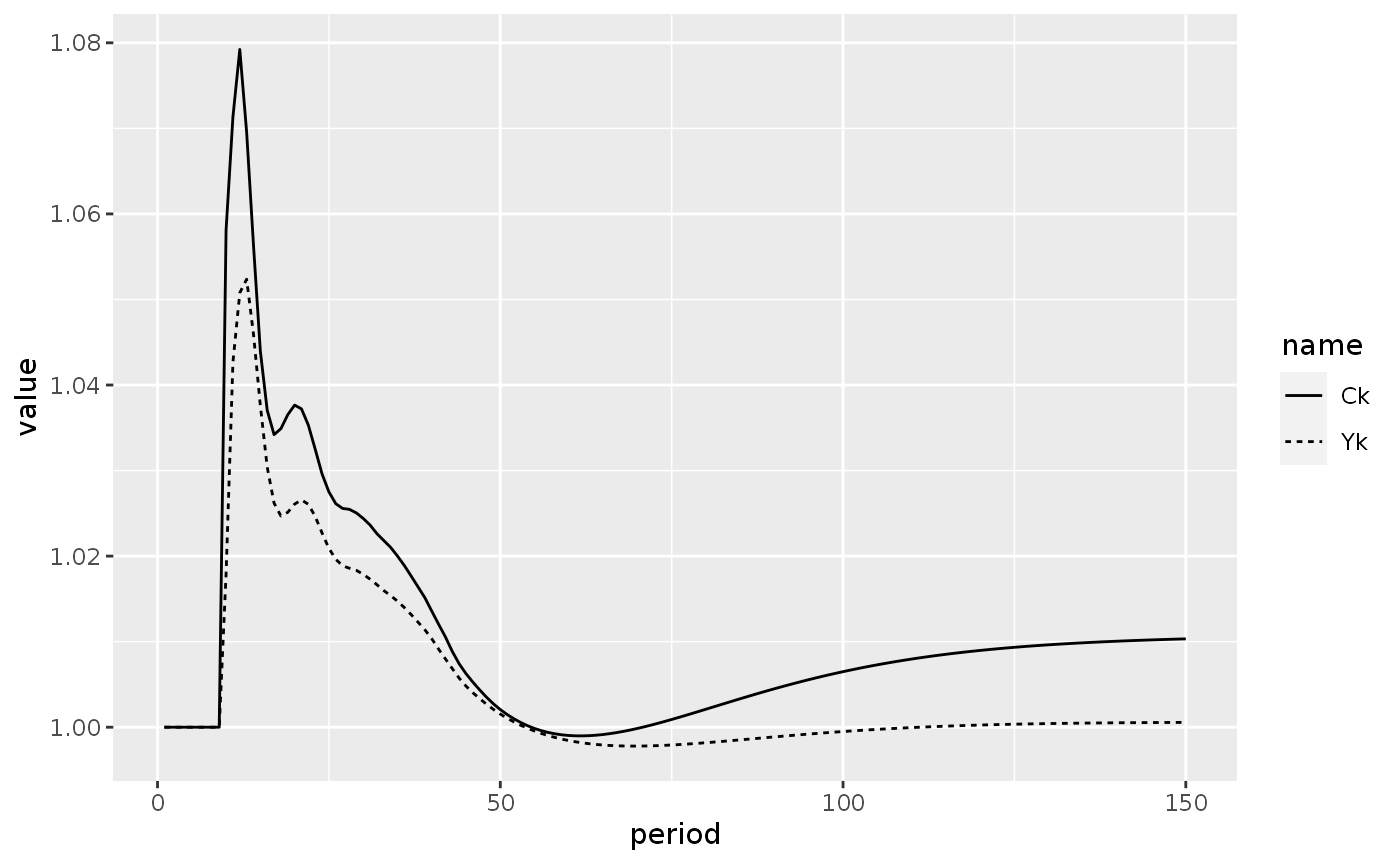

)Scenario 5: Increase in the propensity to consume out of regular income

shock7 <- sfcr_shock(v = sfcr_set(alpha1 ~ 0.80), s = 10, e = 150)

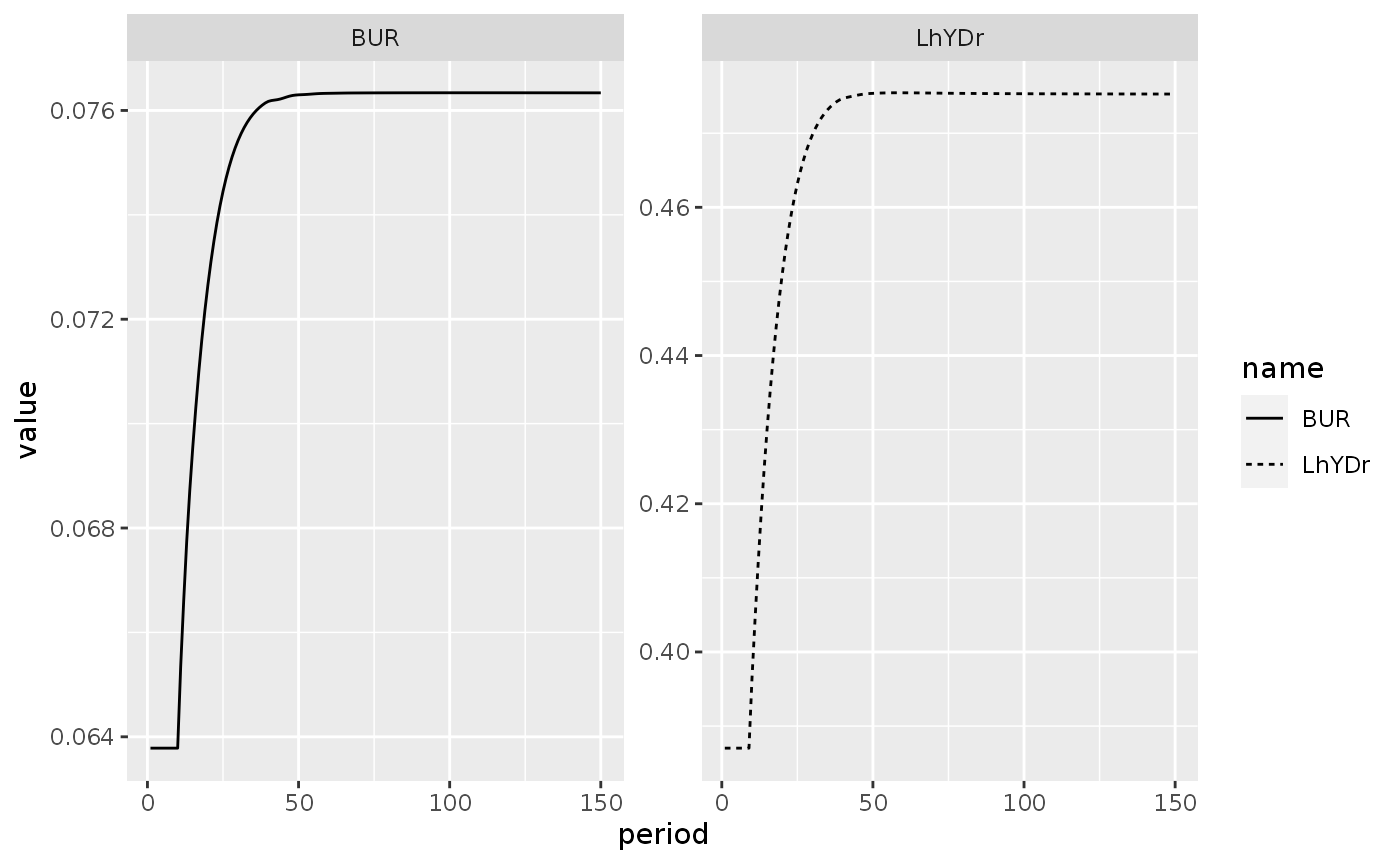

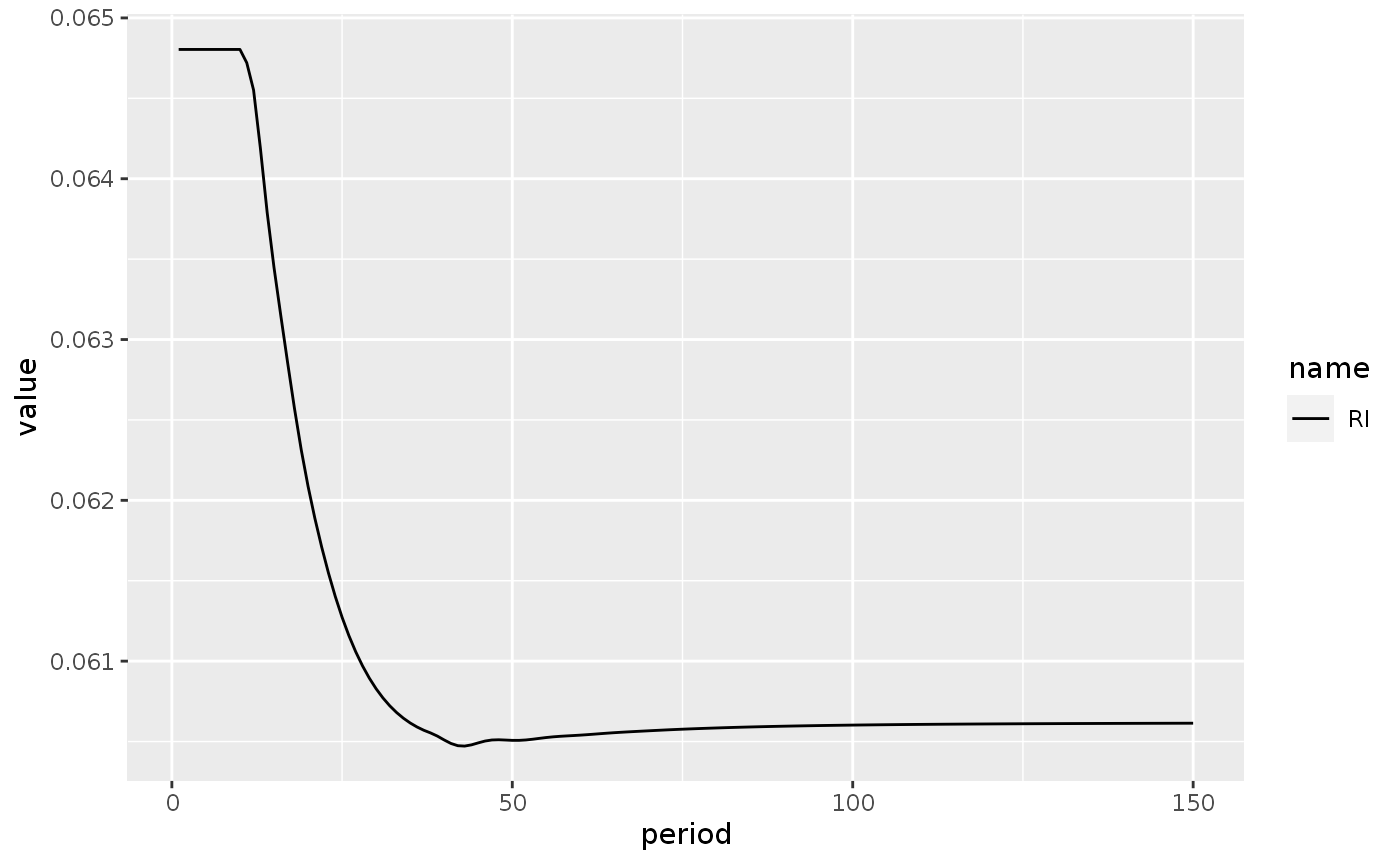

growthe <- sfcr_scenario(growth, shock7, 150, method = "Broyden")Scenario 7: An increase in the gross new loans to personal income ratio

shock8 <- sfcr_shock(v = sfcr_set(eta0 ~ 0.08416), s = 10, e = 150)

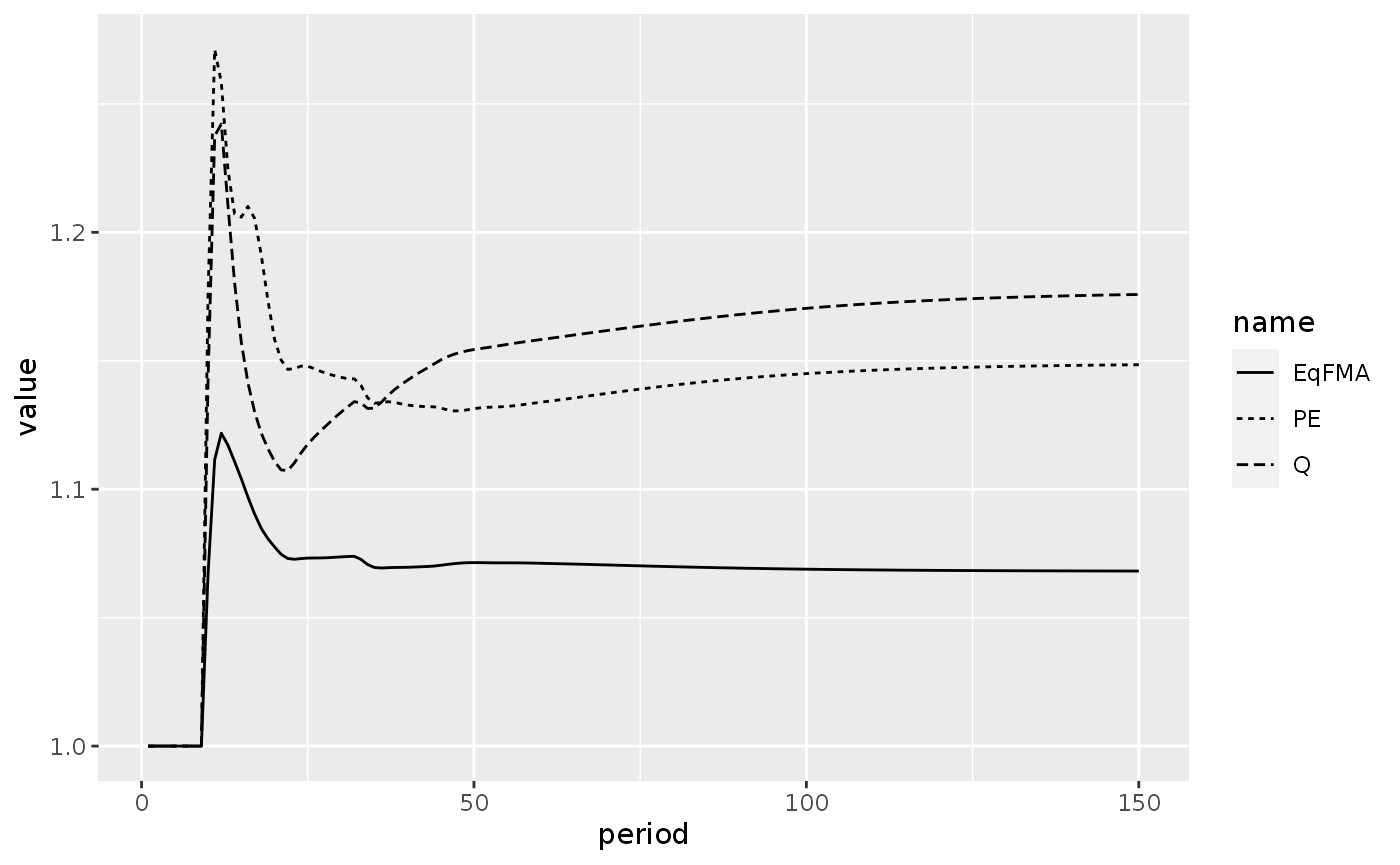

growthf <- sfcr_scenario(growth, shock8, 150, method = "Broyden")Scenario 8: An increase in the desire to hold equities

This scenario changes one of the portfolio parameters. We can change only one parameter without affecting the consistency of the model since such changes are counterbalanced by changes in the hidden deposit parameters (that are not explicitly modelled).

shock9 <- sfcr_shock(v = sfcr_set(lambda40 ~ 0.77132), s = 10, e = 150)

growthg <- sfcr_scenario(growth, shock9, 150, method = "Broyden")Scenario 8b: Increase in the desire to hold equities that is offset by a decline in the desire to hold bills and bonds

shock10 <- sfcr_shock(

v = sfcr_set(

lambda20 ~ 0.20,

lambda30 ~ -0.09341),

s = 10,

e = 150)

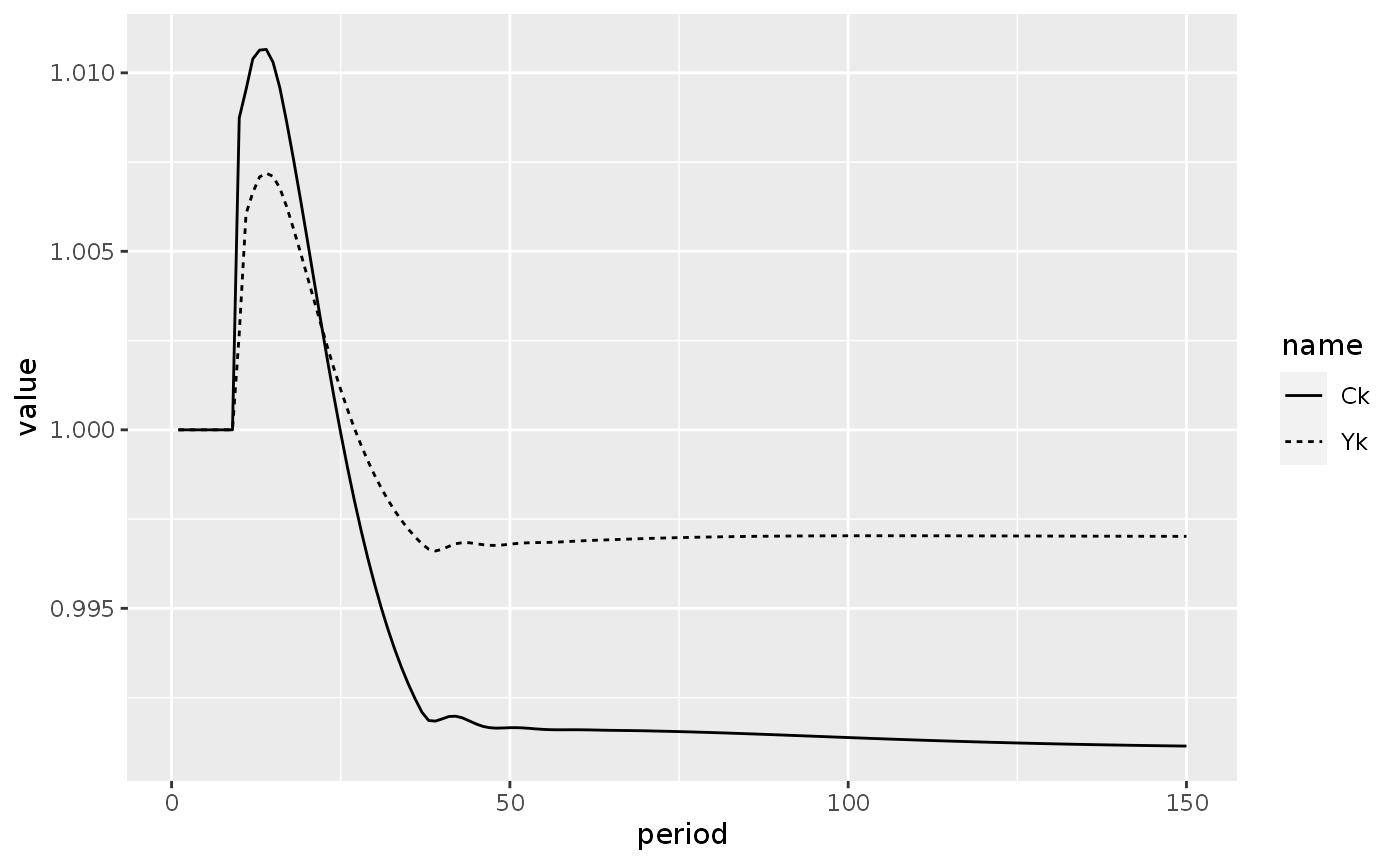

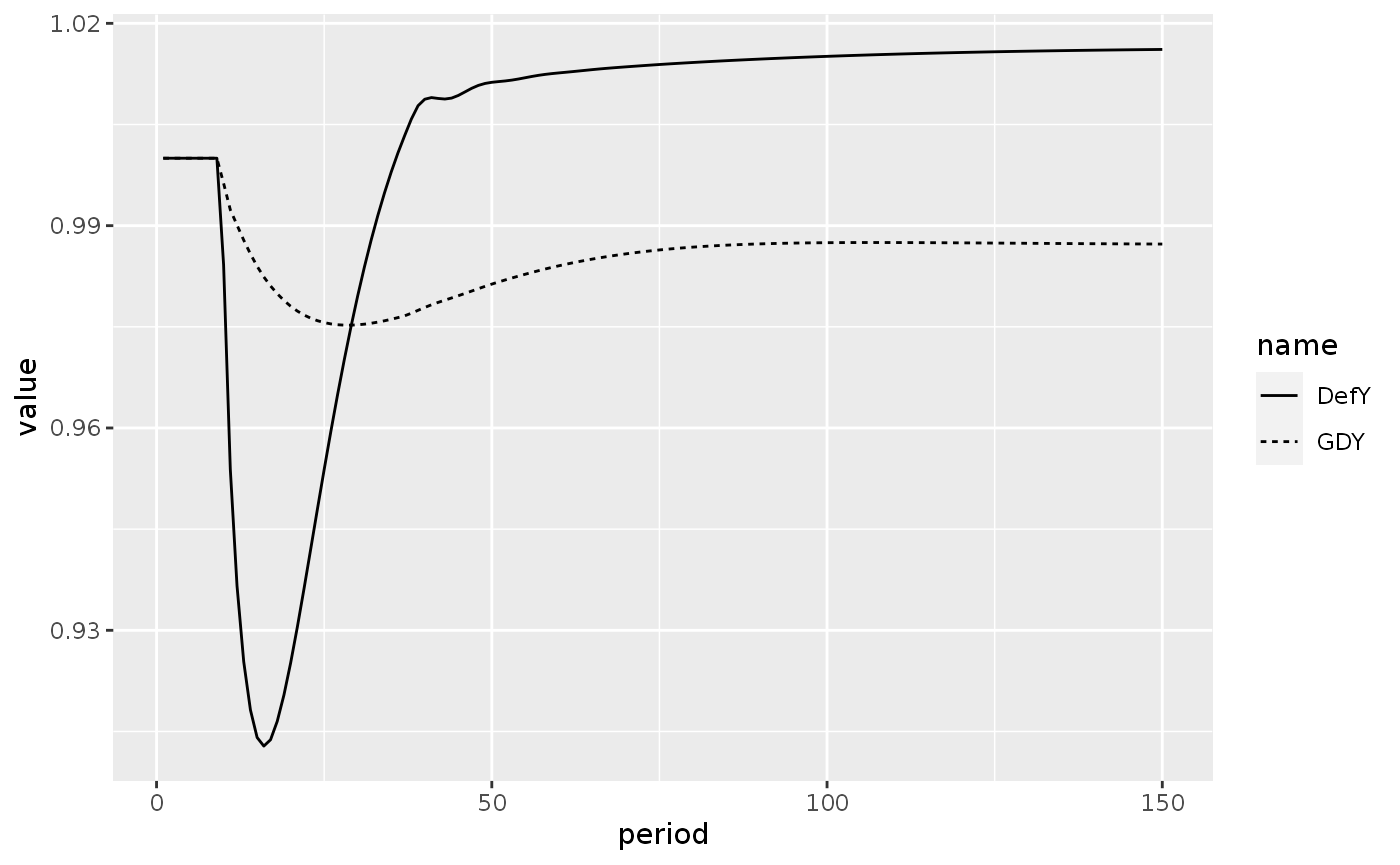

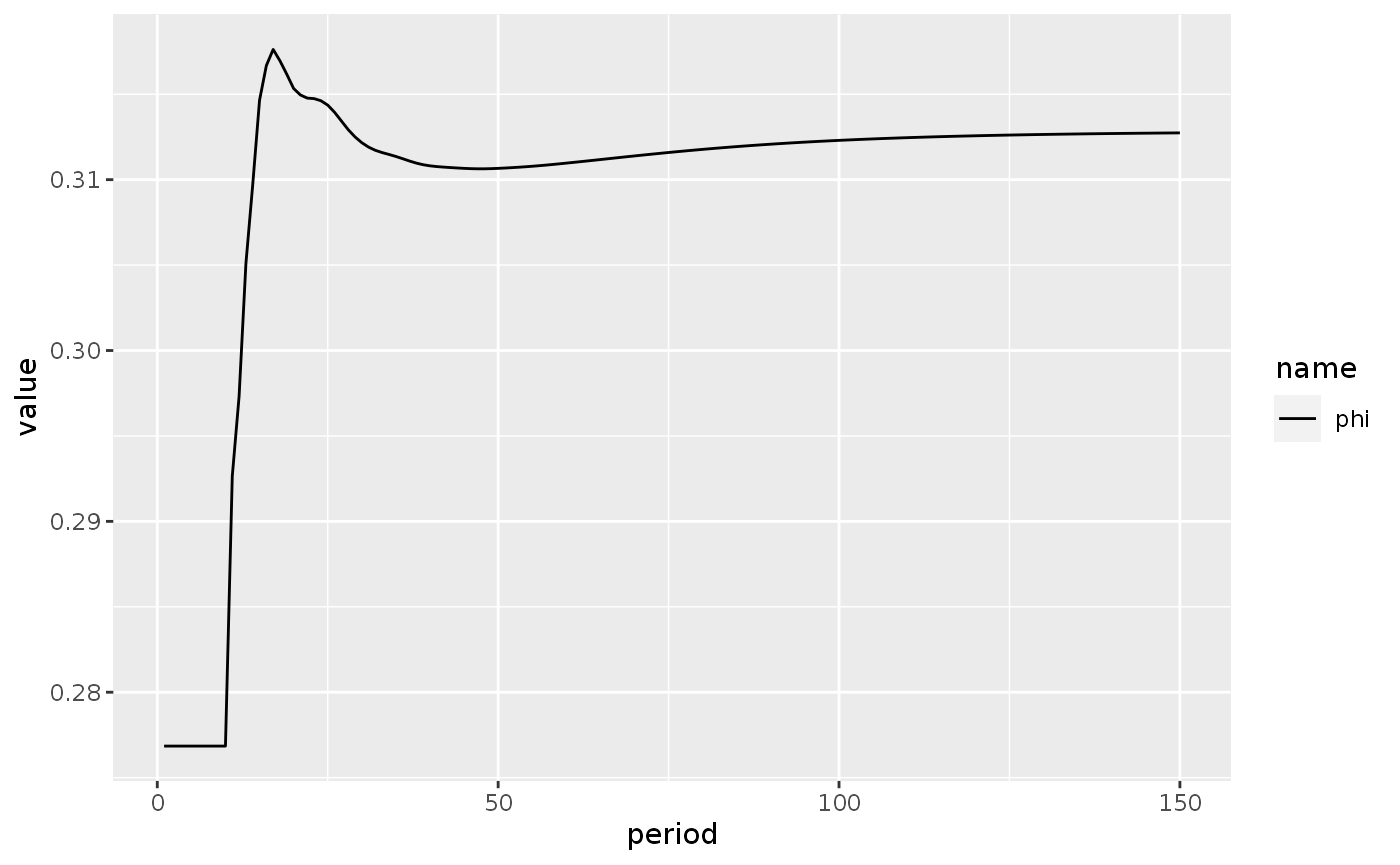

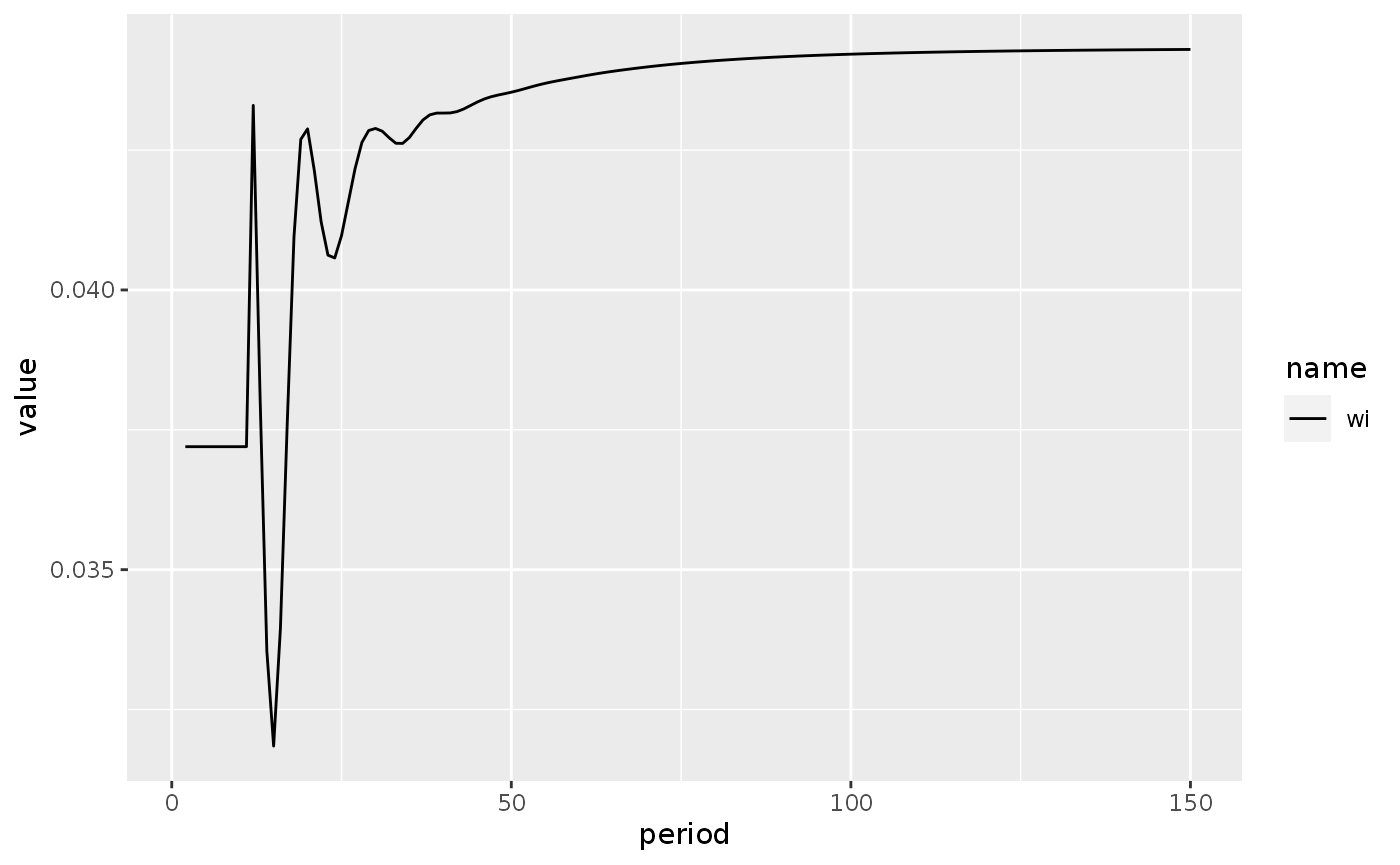

growthgb <- sfcr_scenario(growth, list(shock9, shock10), 150, method = "Broyden")Scenario 9: An increase in the target proportion of gross investment financed by retained earnings

shock11 <- sfcr_shock(v = sfcr_set(psiu ~ 1), s = 10, e = 150)

growthh <- sfcr_scenario(growth, shock11, 150, method = "Broyden")Figure 11.10B

growthh %>% do_plot("wi")

#> Warning: Removed 1 row(s) containing missing values (geom_path).

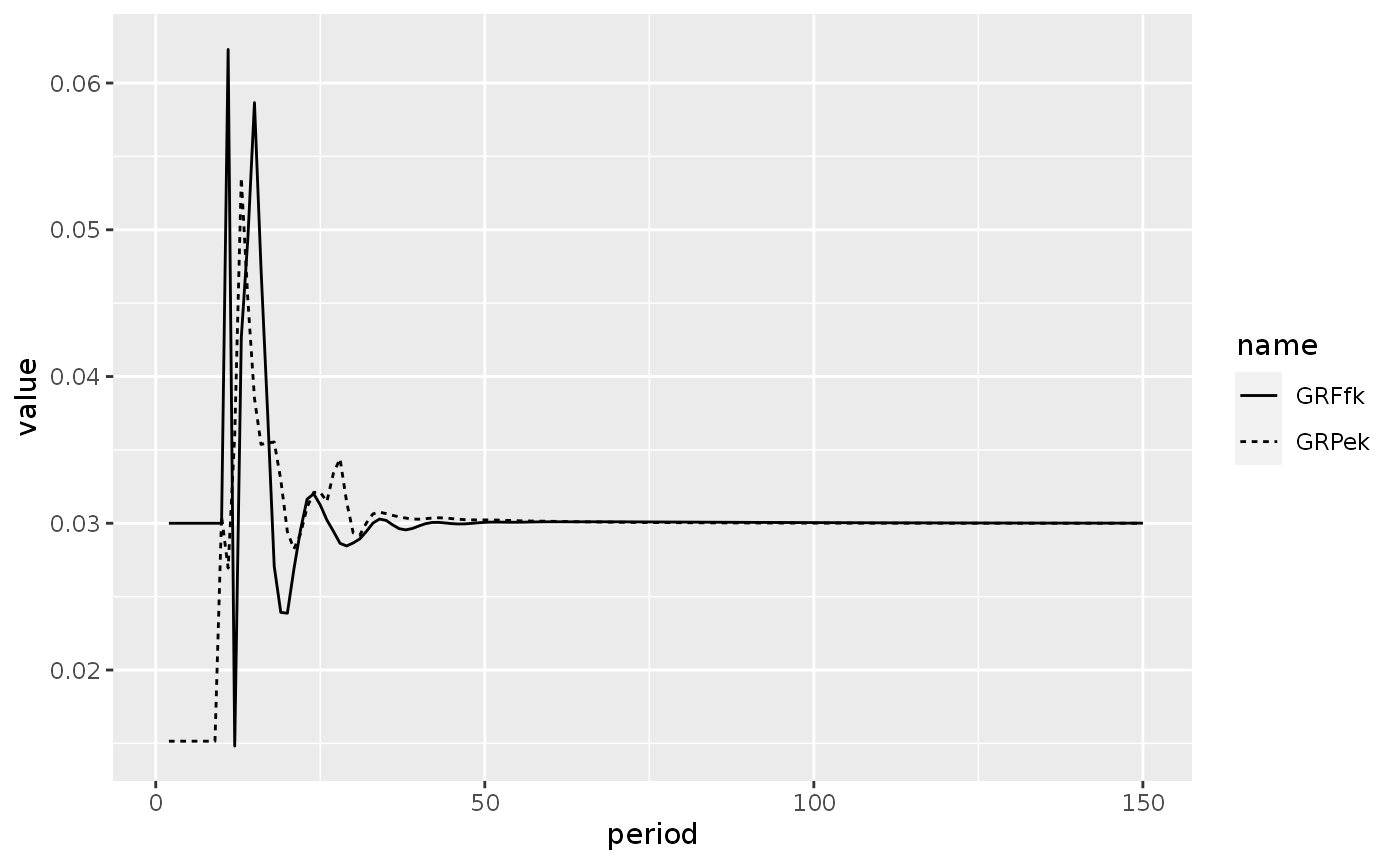

Figure 11.10E

do_plot(growthh, v = c("GRFfk", "GRPek"))

#> Warning: Removed 2 row(s) containing missing values (geom_path).

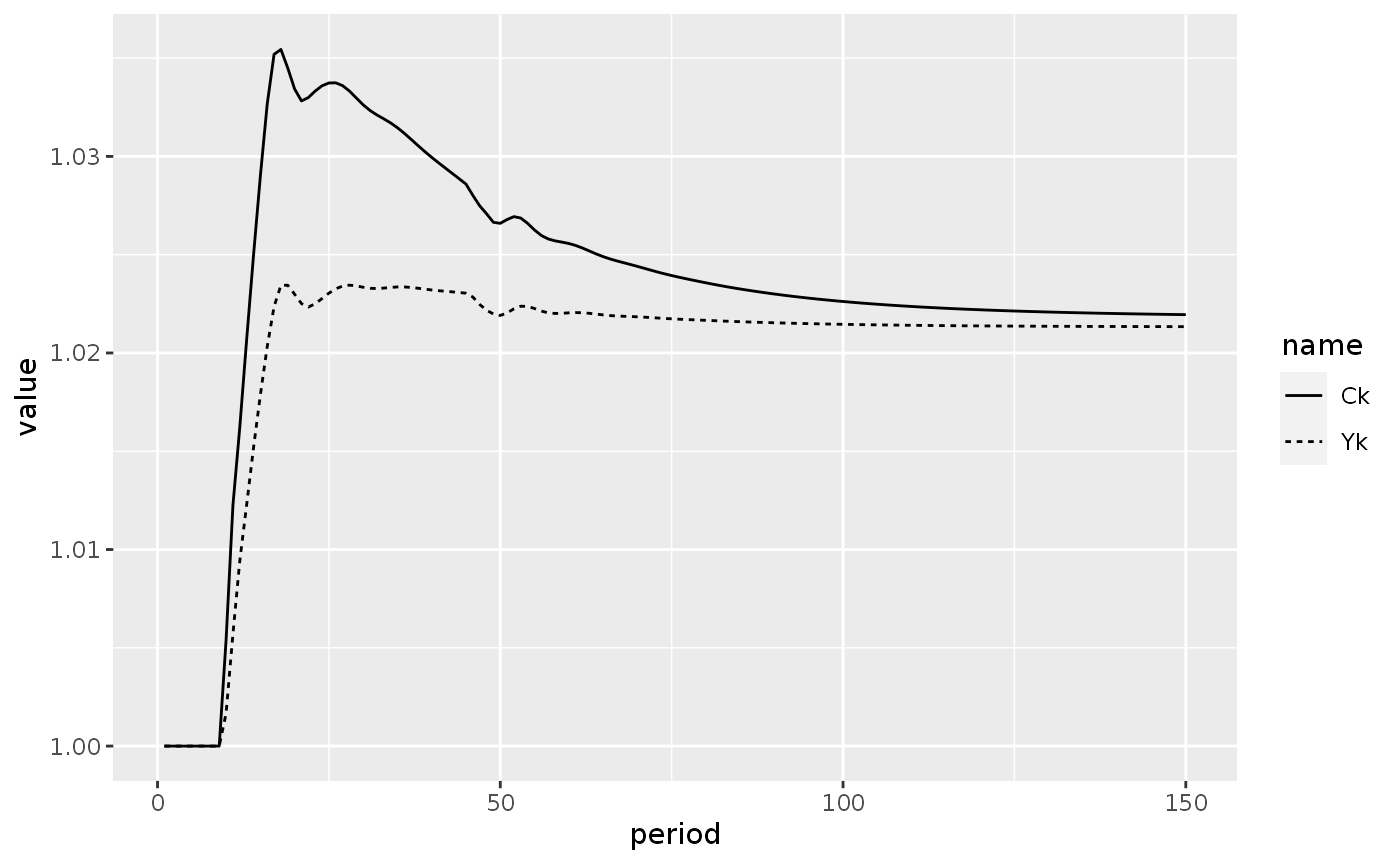

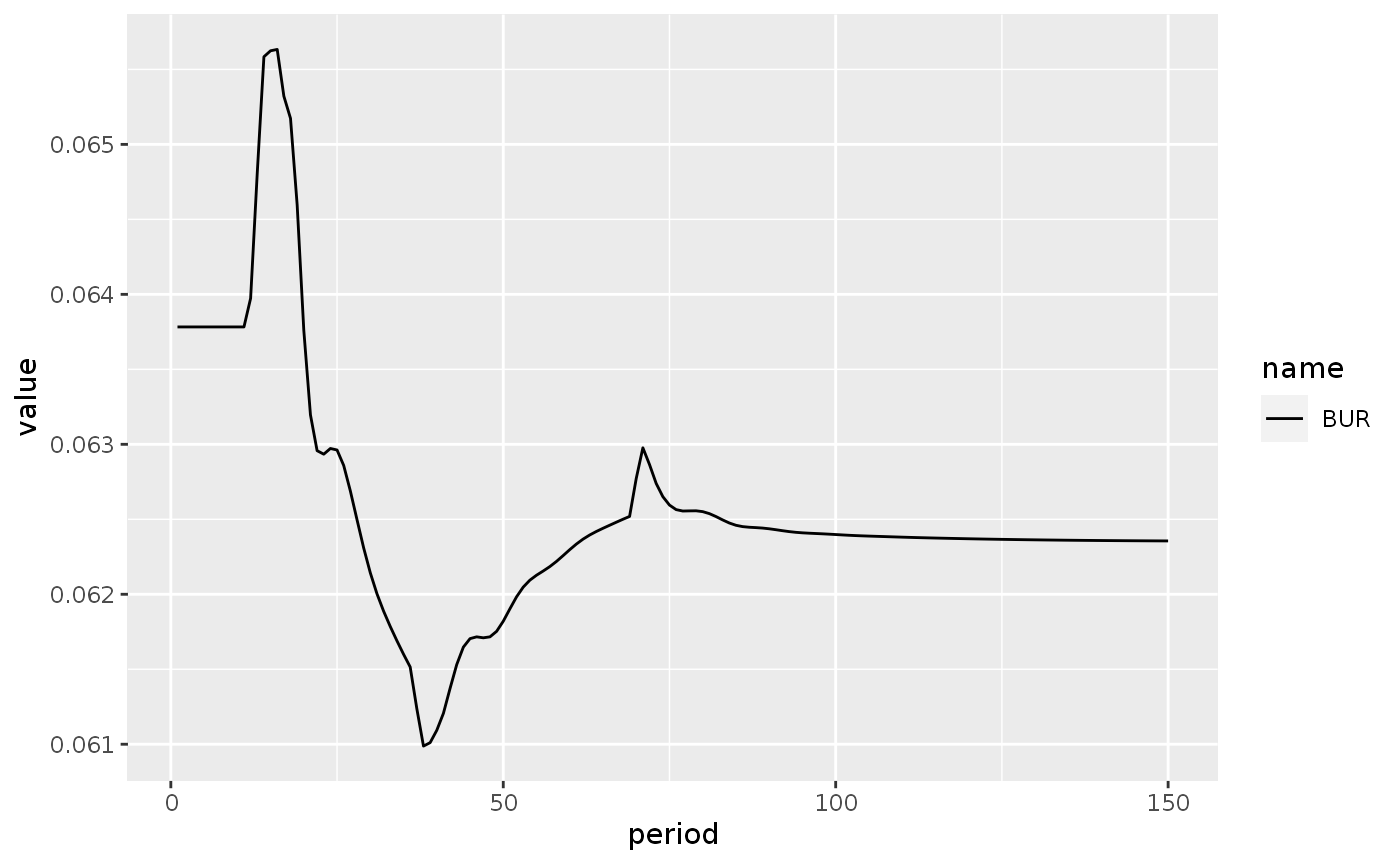

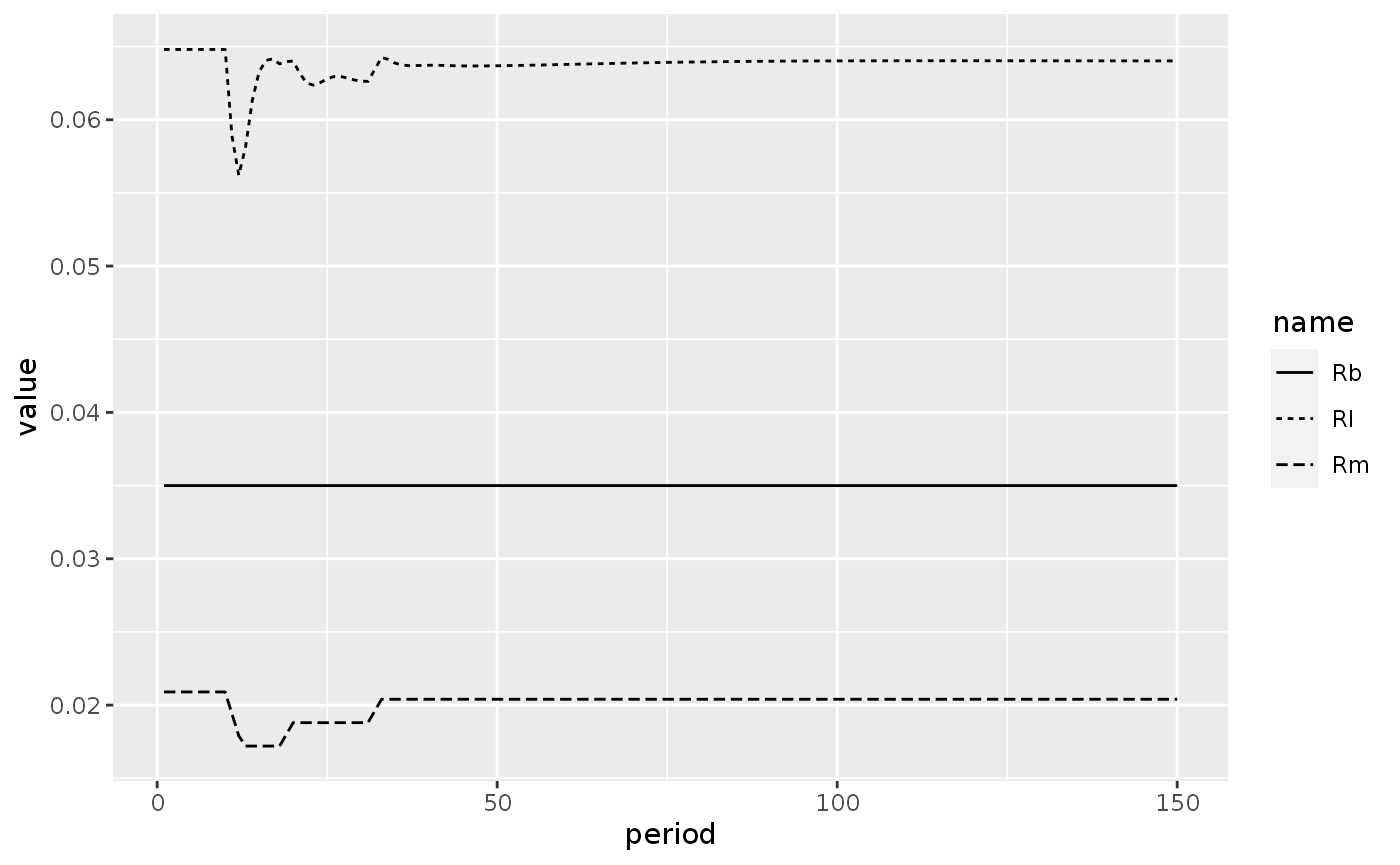

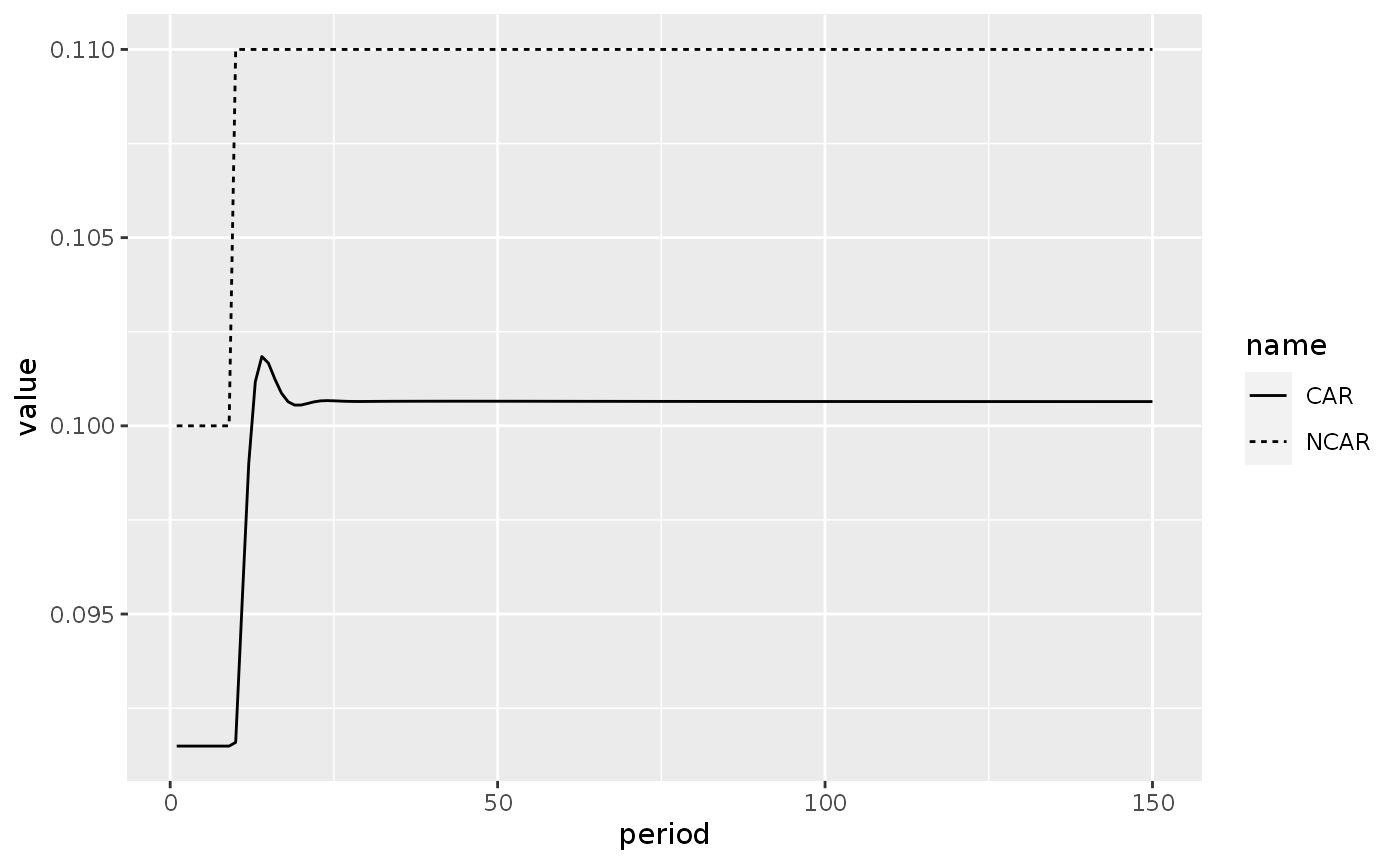

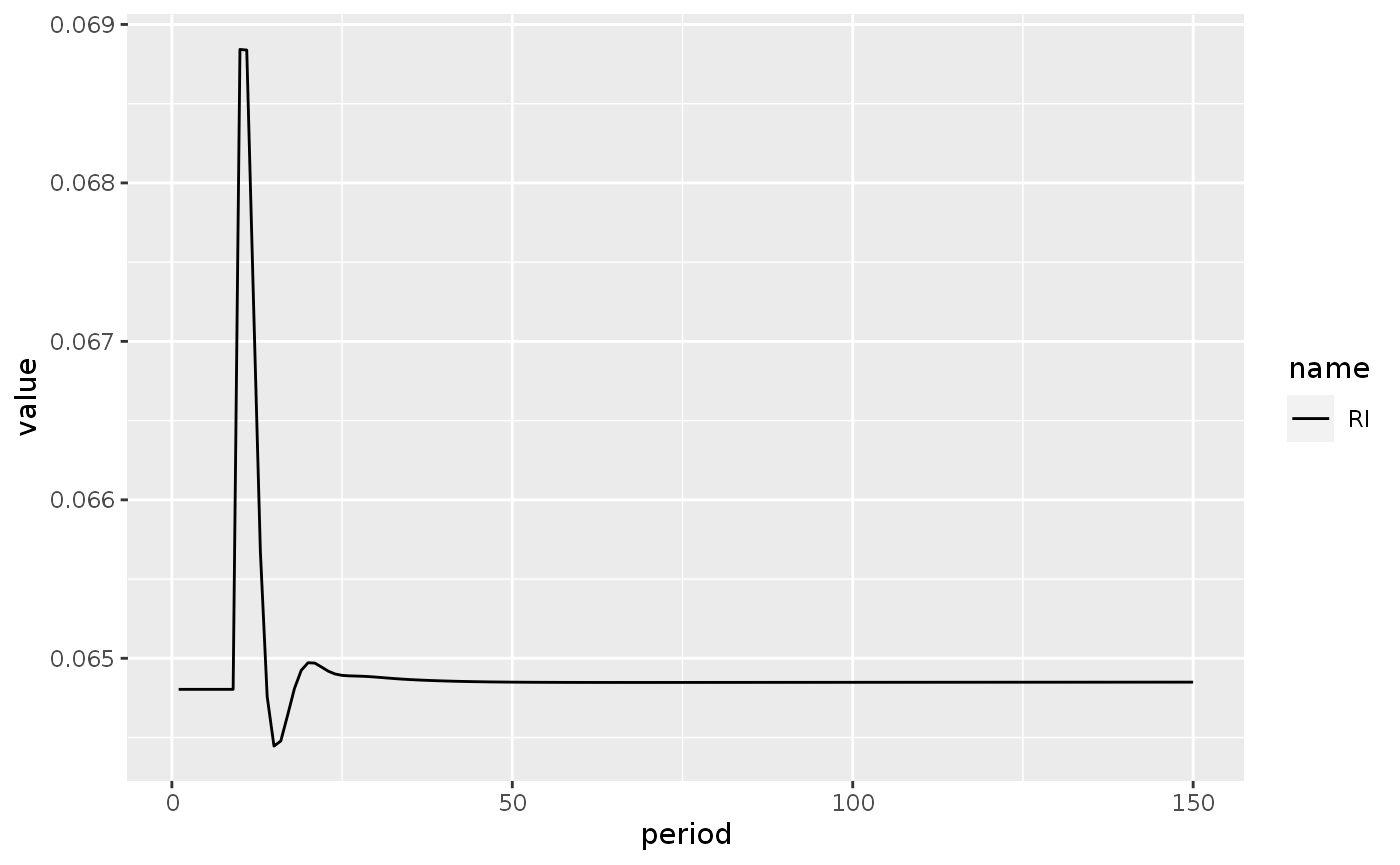

Scenario 10: An increase in non-performing loans

shock12 <- sfcr_shock(v = sfcr_set(NPLk ~ 0.05), s = 10, e = 150)

growthi <- sfcr_scenario(growth, shock12, 150, method = "Broyden")Scenario 10B: An increase in the normal adequacy ratio

shock13 <- sfcr_shock(v = sfcr_set(NCAR ~ 0.11), s = 10, e = 150)

growthib <- sfcr_scenario(growth, shock13, 150, method = "Broyden")Model GROWTH2: Making monetary policy endogenous

growth_eqs2 <- growth_eqs

growth_eqs2[[88]] <- Rb ~ (1 + Rrb) * (1 + PI) - 1

growth_eqs2 <- c(

growth_eqs2,

Rrbt ~ (1 + Rb)/(1 + PI) - 1,

Rrb ~ Rrb[-1] + epsrb * (Rrbt - Rrb[-1])

)

growth_parameters2 <- c(

growth_parameters,

epsrb ~ 0.9

)

growth_initial2 <- c(

growth_initial,

Rrbt ~ 0.03232,

epsrb ~ 0.9,

Rrb ~ 0.03232

)

growth2 <- sfcr_baseline(

equations = growth_eqs2,

external = growth_parameters2,

periods = 350,

initial = growth_initial2,

hidden = c("Bbs" = "Bbd"),

.hidden_tol = 1e-6,

method = "Broyden",

rhtol = TRUE

)Steady state

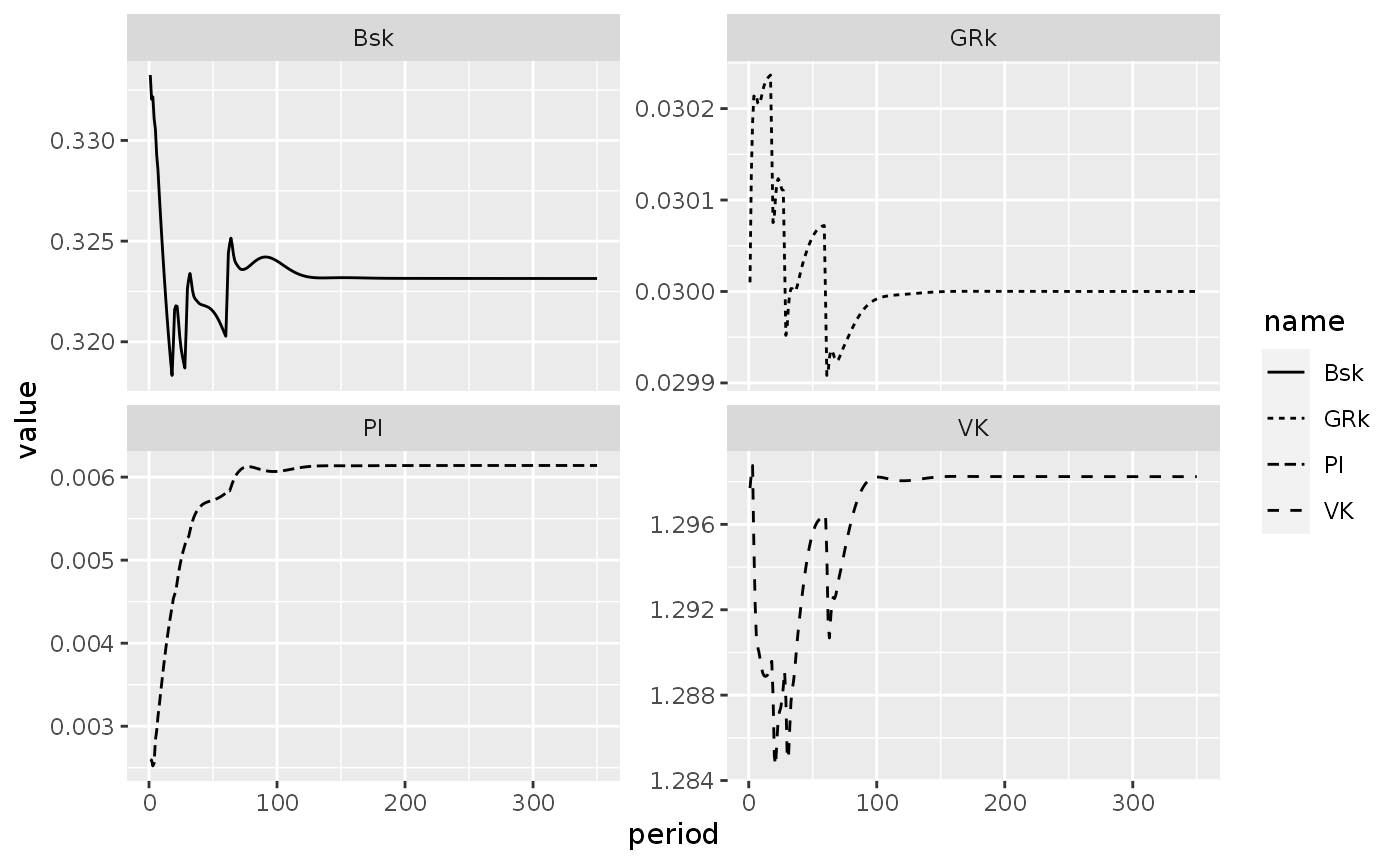

We can see that this model arrives to a steady state:

growth2 %>%

do_plot(variables = c("Uk", "Bsk", "VK", 'GRk', "PI")) +

facet_wrap(~name, scales = "free_y")

Scenario benchmark

growthbl2 <- sfcr_scenario(

growth2,

NULL,

100,

method = "Broyden"

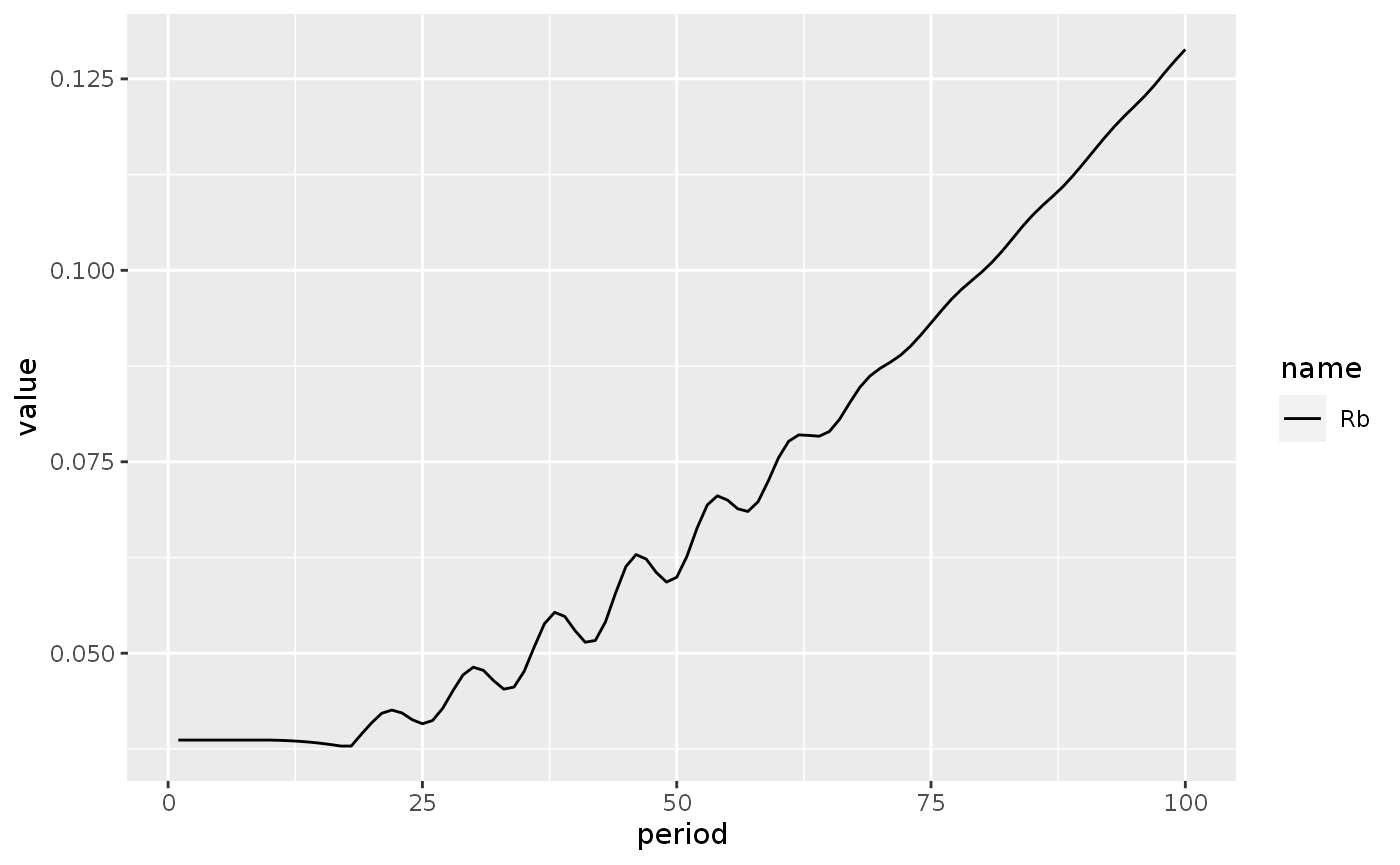

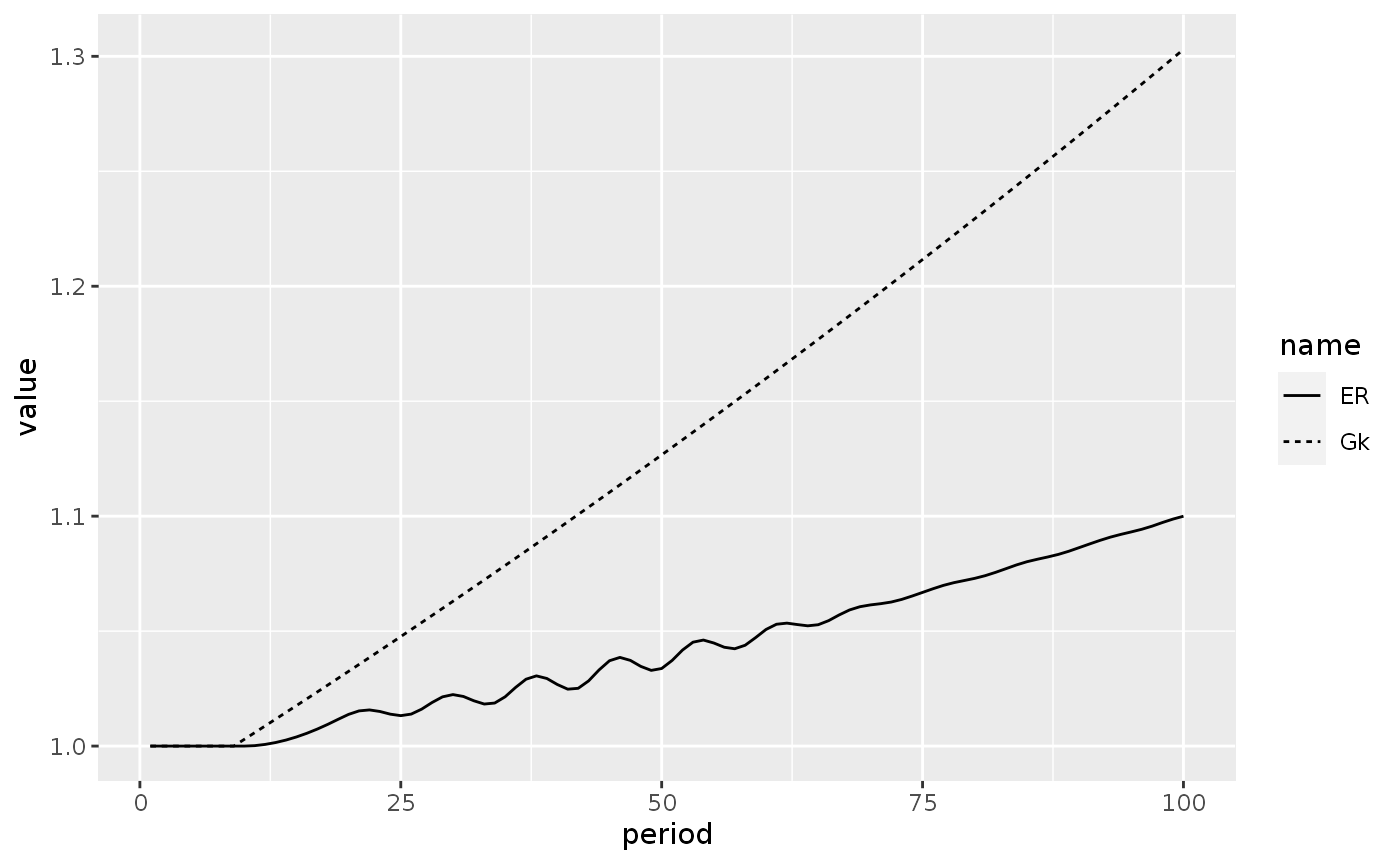

)Scenario 1: Permanent increase in government expenditures

This model is rather unstable and breaks the Broyden/Gauss algorithms if run for many periods (I couldn’t make it run with 150 periods). Sometimes it did run with Newton method and sometimes it didn’t.

shock1 <- sfcr_shock(v = sfcr_set(GRg ~ 0.033), s = 10, e = 100)

growth2a <- sfcr_scenario(

baseline = growth2,

scenario = shock1,

periods = 100,

method = "Broyden"

)Figure 11.6A

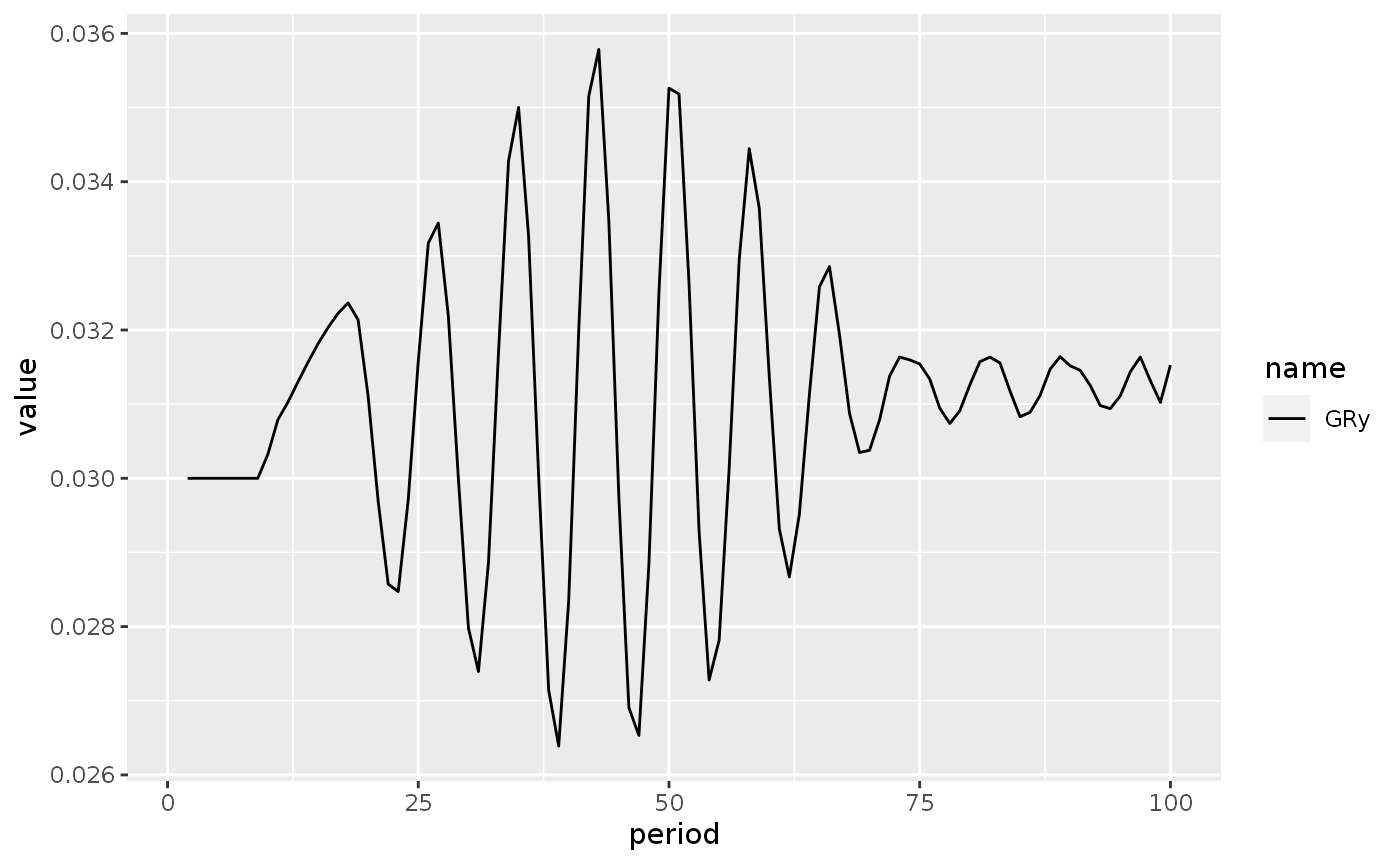

do_plot(growth2a, c("GRy"))

#> Warning: Removed 1 row(s) containing missing values (geom_path).

Session information

sessionInfo()

#> R version 4.0.2 (2020-06-22)

#> Platform: x86_64-pc-linux-gnu (64-bit)

#> Running under: Ubuntu 16.04.6 LTS

#>

#> Matrix products: default

#> BLAS: /usr/lib/openblas-base/libblas.so.3

#> LAPACK: /usr/lib/libopenblasp-r0.2.18.so

#>

#> locale:

#> [1] LC_CTYPE=en_US.UTF-8 LC_NUMERIC=C

#> [3] LC_TIME=en_US.UTF-8 LC_COLLATE=en_US.UTF-8

#> [5] LC_MONETARY=en_US.UTF-8 LC_MESSAGES=en_US.UTF-8

#> [7] LC_PAPER=en_US.UTF-8 LC_NAME=C

#> [9] LC_ADDRESS=C LC_TELEPHONE=C

#> [11] LC_MEASUREMENT=en_US.UTF-8 LC_IDENTIFICATION=C

#>

#> attached base packages:

#> [1] stats graphics grDevices utils datasets methods base

#>

#> other attached packages:

#> [1] forcats_0.5.1 stringr_1.4.0 dplyr_1.0.7 purrr_0.3.4

#> [5] readr_2.0.2 tidyr_1.1.4 tibble_3.1.5 ggplot2_3.3.5

#> [9] tidyverse_1.3.1 sfcr_0.2.1

#>

#> loaded via a namespace (and not attached):

#> [1] fs_1.5.0 lubridate_1.8.0 webshot_0.5.2 httr_1.4.2

#> [5] rprojroot_2.0.2 tools_4.0.2 backports_1.2.1 utf8_1.2.2

#> [9] R6_2.5.1 DBI_1.1.1 colorspace_2.0-2 withr_2.4.2

#> [13] gridExtra_2.3 tidyselect_1.1.1 compiler_4.0.2 textshaping_0.3.5

#> [17] cli_3.0.1 rvest_1.0.1 expm_0.999-6 xml2_1.3.2

#> [21] desc_1.4.0 labeling_0.4.2 scales_1.1.1 pkgdown_1.6.1

#> [25] systemfonts_1.0.2 digest_0.6.28 rmarkdown_2.11 svglite_2.0.0

#> [29] pkgconfig_2.0.3 htmltools_0.5.2 dbplyr_2.1.1 fastmap_1.1.0

#> [33] highr_0.9 htmlwidgets_1.5.4 rlang_0.4.11 readxl_1.3.1

#> [37] rstudioapi_0.13 jquerylib_0.1.4 farver_2.1.0 generics_0.1.0

#> [41] jsonlite_1.7.2 magrittr_2.0.1 kableExtra_1.3.4 Matrix_1.2-18

#> [45] Rcpp_1.0.7 munsell_0.5.0 fansi_0.5.0 viridis_0.6.1

#> [49] lifecycle_1.0.1 stringi_1.7.5 yaml_2.2.1 ggraph_2.0.5

#> [53] MASS_7.3-51.6 rootSolve_1.8.2.3 grid_4.0.2 ggrepel_0.9.1

#> [57] crayon_1.4.1 lattice_0.20-41 graphlayouts_0.7.1 haven_2.4.3

#> [61] hms_1.1.1 knitr_1.36 pillar_1.6.3 igraph_1.2.6

#> [65] reprex_2.0.1 glue_1.4.2 evaluate_0.14 modelr_0.1.8

#> [69] tweenr_1.0.2 vctrs_0.3.8 tzdb_0.1.2 Rdpack_2.1.2

#> [73] networkD3_0.4 cellranger_1.1.0 polyclip_1.10-0 gtable_0.3.0

#> [77] assertthat_0.2.1 cachem_1.0.6 ggforce_0.3.3 xfun_0.26

#> [81] rbibutils_2.2.4 broom_0.7.9 tidygraph_1.2.0 ragg_1.1.3

#> [85] viridisLite_0.4.0 memoise_2.0.0 ellipsis_0.3.2