Load the required packages for this analysis:

library(sfcr)

library(tidyverse)

#> ── Attaching packages ─────────────────────────────────────── tidyverse 1.3.1 ──

#> ✔ ggplot2 3.3.5 ✔ purrr 0.3.4

#> ✔ tibble 3.1.5 ✔ dplyr 1.0.7

#> ✔ tidyr 1.1.4 ✔ stringr 1.4.0

#> ✔ readr 2.0.2 ✔ forcats 0.5.1

#> ── Conflicts ────────────────────────────────────────── tidyverse_conflicts() ──

#> ✖ dplyr::filter() masks stats::filter()

#> ✖ dplyr::lag() masks stats::lag()Bank-Money World model

Equations

- Write down the equations of the model:

bmw_eqs <- sfcr_set(

# Basic behavioral equations

Cs ~ Cd,

Is ~ Id,

Ns ~ Nd,

Ls ~ Ls[-1] + Ld - Ld[-1],

# Transactions of the firms

Y ~ Cs + Is,

WBd ~ Y - rl[-1] * Ld[-1] - AF,

AF ~ delta * K[-1],

Ld ~ Ld[-1] + Id - AF,

# Transactions of households

YD ~ WBs + rm[-1] * Mh[-1],

Mh ~ Mh[-1] + YD - Cd,

# Transactions of the banks

Ms ~ Ms[-1] + Ls - Ls[-1],

rm ~ rl,

# The wage bill

WBs ~ W * Ns,

Nd ~ Y / pr,

W ~ WBd / Nd,

# Household behavior

Cd ~ alpha0 + alpha1 * YD + alpha2 * Mh[-1],

# The investment behavior

K ~ K[-1] + Id - DA,

DA ~ delta * K[-1],

KT ~ kappa * Y[-1],

Id ~ gamma * (KT - K[-1]) + DA

)

bmw_external <- sfcr_set(

rl ~ 0.025,

alpha0 ~ 20,

alpha1 ~ 0.75,

alpha2 ~ 0.10,

delta ~ 0.10,

gamma ~ 0.15,

kappa ~ 1,

pr ~ 1

)Baseline

This model is tricky. The “Broyden” does not converge to a sensible answer if we don’t set the initial values of the following variables to reasonably large values (as the ones below). Interestingly, the other two solvers (“Gauss” and “Newton”) succeed in arriving to a sensible steady state without setting the initial values:

bmw_initial <- sfcr_set(

Ns ~ 128, # Needs to be set

Ls ~ 12, # Needs to be set

Y ~ 128, # Needs to be set

Ld ~ 12, # Needs to be set

Mh ~ 12, # Needs to be set

Ms ~ 12, # Needs to be set

Nd ~ 128, # Needs to be set

)

bmw <- sfcr_baseline(bmw_eqs, bmw_external, periods = 100, initial = bmw_initial, method = "Broyden", hidden = c("Ms" = "Mh"))

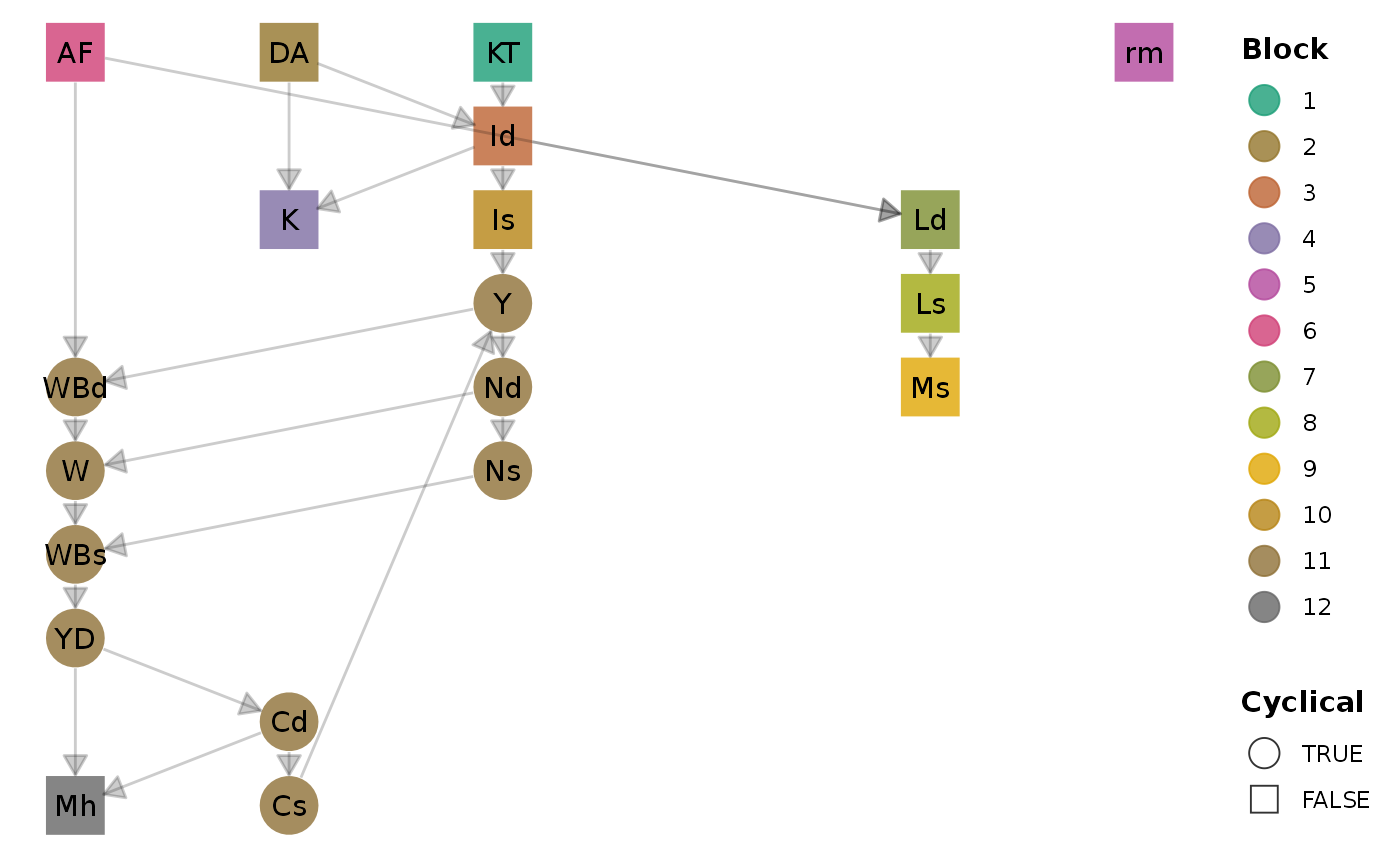

bmw <- sfcr_baseline(bmw_eqs, bmw_external, periods = 100, method = "Newton", hidden = c("Ms" = "Mh"))DAG

Let’s check the internal structure of this model with the sfcr_dag_blocks_plot() function:

sfcr_dag_blocks_plot(bmw_eqs)

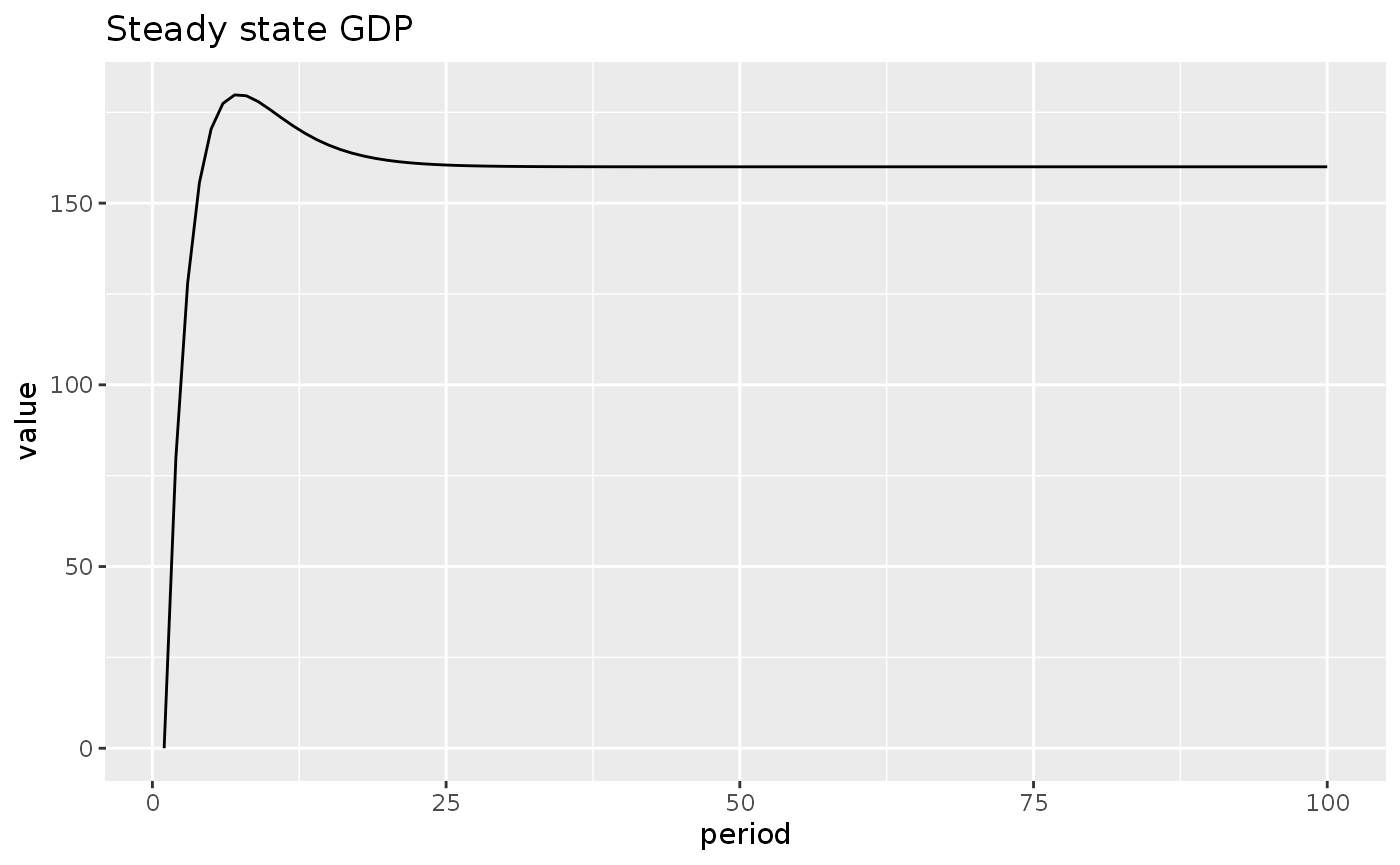

First, let’s check that the model arrived to a steady state income level:

bmw %>%

pivot_longer(cols = -period) %>%

filter(name == "Y") %>%

ggplot(aes(x = period, y = value)) +

geom_line() +

labs(title = "Steady state GDP")

Matrices of model BMW

Balance-sheet

bs_bmw <- sfcr_matrix(

columns = c("Households", "Firms", "Banks", "Sum"),

codes = c("h", "f", "b", "s"),

c("Money", h = "+Mh", b = "-Ms"),

c("Loans", f = "-Ld", b = "+Ls"),

c("Fixed capital", f = "+K", s = "+K"),

c("Balance", h = "-Mh", s = "-Mh")

)Validate:

sfcr_validate(bs_bmw, bmw, "bs")

#> Water tight! The balance-sheet matrix is consistent with the simulated model.Transactions-flow

tfm_bmw <- sfcr_matrix(

columns = c("Households", "Firms_current", "Firms_capital", "Banks_current", "Banks_capital"),

codes = c("h", "fc", "fk", "bc", "bk"),

c("Consumption", h ="-Cs", fc = "+Cd"),

c("Investment", fc = "+Is", fk = "-Id"),

c("Wages", h = "+WBs", fc = "-WBd"),

c("Depreciation", fc = "-AF", fk = "+AF"),

c("Interest loans", fc = "-rl[-1] * Ld[-1]", bc = "+rl[-1] * Ls[-1]"),

c("Interest on deposits", h = "+rm[-1] * Mh[-1]", bc = "-rm[-1] * Ms[-1]"),

c("Ch. loans", fk = "+d(Ld)", bk = "-d(Ls)"),

c("Ch. deposits", h = "-d(Mh)", bk = "+d(Ms)")

)

sfcr_validate(tfm_bmw, bmw, "tfm")

#> Water tight! The transactions-flow matrix is consistent with the simulated model.Now we add some shocks to this model to see how it behaves in different scenarios.

Scenario 1: An increase in autonomous consumption expenditures

First, let’s write a helper function to convert the models to the long format, filter the variables we want to plot, and make a line plot:

do_plot <- function(model, variables, title = NULL) {

model %>%

mutate(YK = Y / lag(K)) %>%

pivot_longer(cols = -period) %>%

filter(name %in% variables) %>%

ggplot(aes(x = period, y = value)) +

geom_line(aes(linetype = name)) +

labs(title = title)

}We then write the shock we want to add and simulate the new scenario:

shock1 <- sfcr_shock(

variables = sfcr_set(

alpha0 ~ 30

),

start = 5,

end = 60

)

bmw1 <- sfcr_scenario(bmw,

scenario = shock1,

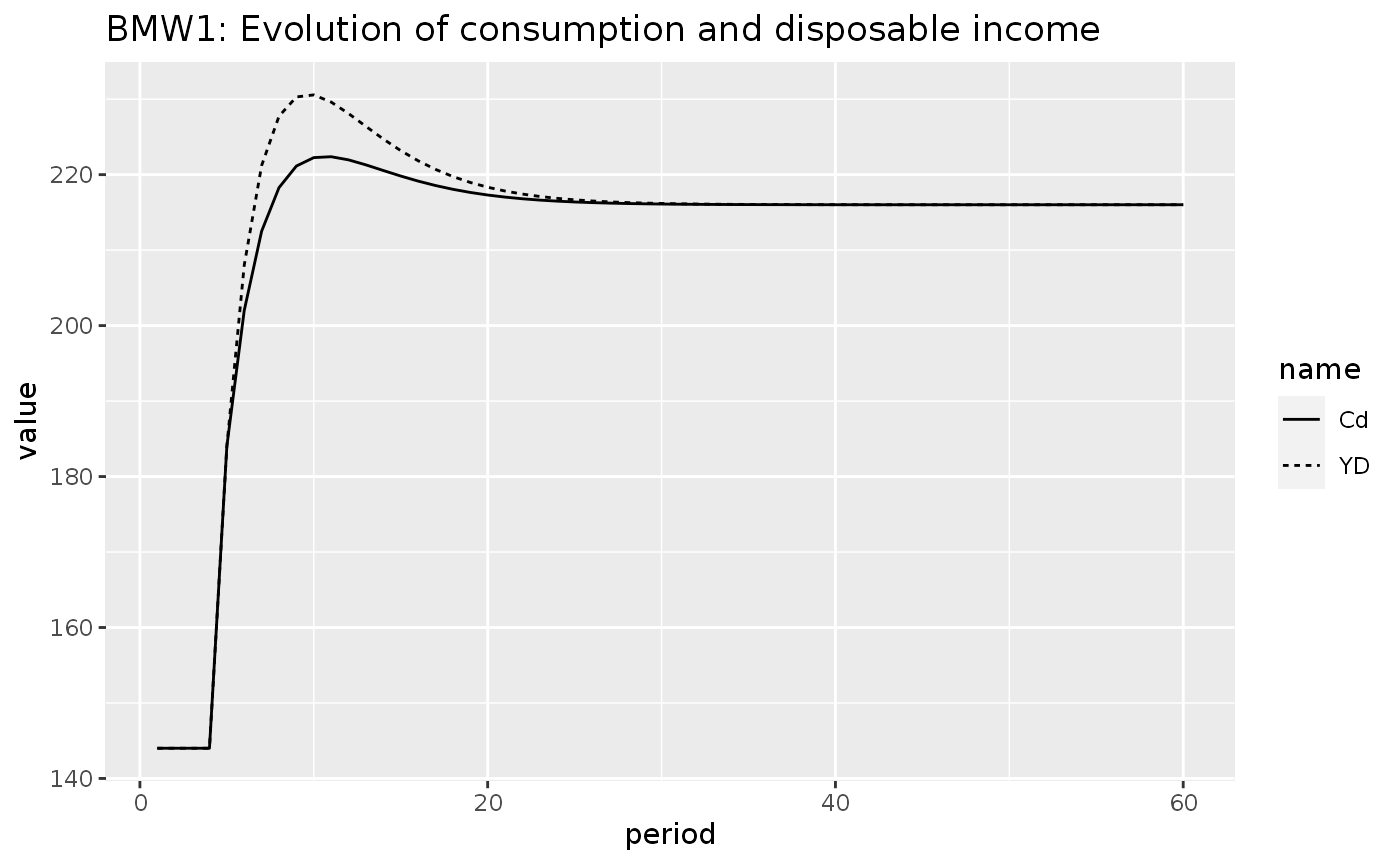

periods = 60)How the consumption of households and their disposable income evolves?

bmw1 %>%

do_plot(variables = c("Cd", "YD"),

title = "BMW1: Evolution of consumption and disposable income")

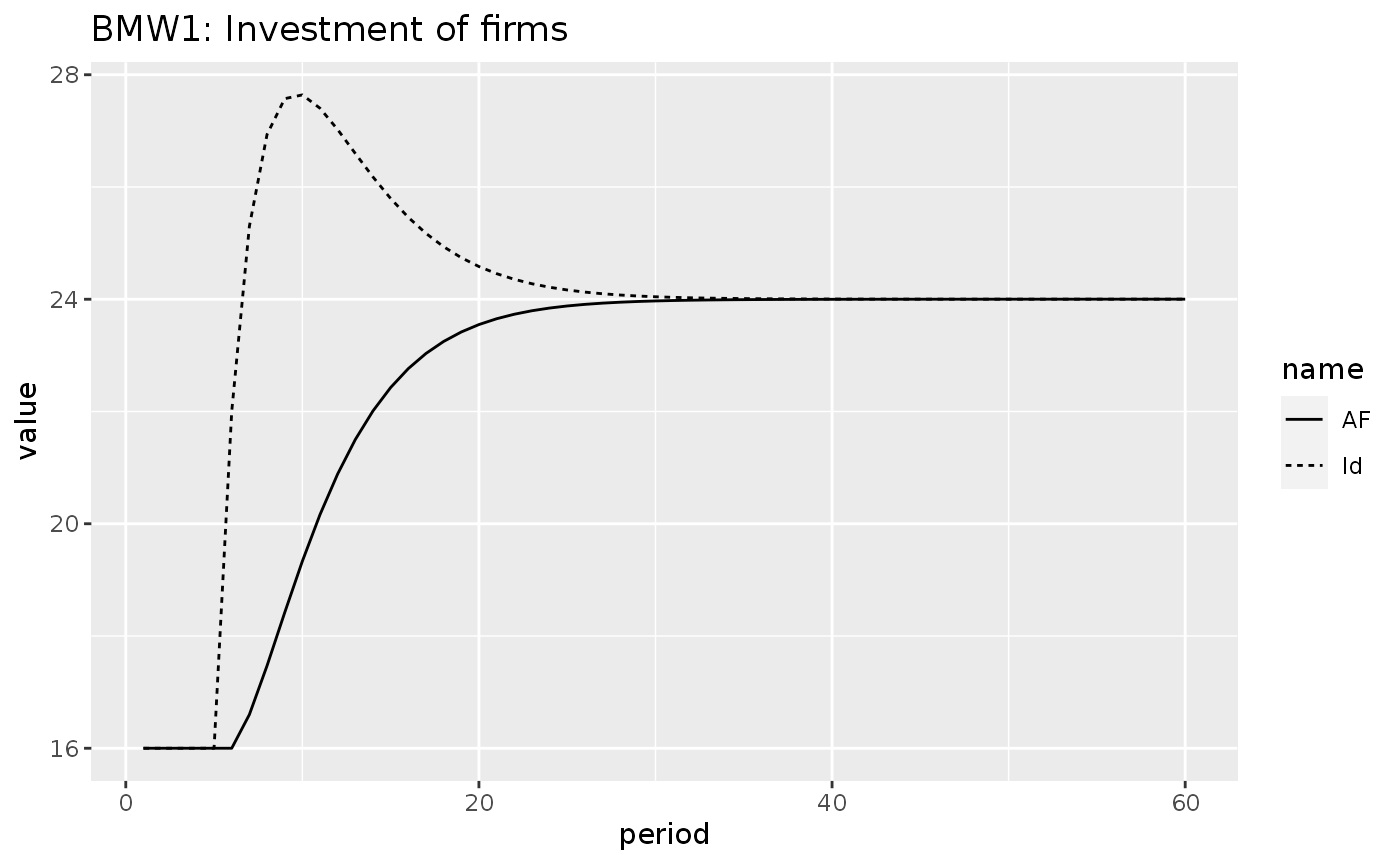

And the investment of firms?

bmw1 %>%

do_plot(variables = c("Id", "AF"),

title = "BMW1: Investment of firms")

Increase in the propensity to save

shock2 <- sfcr_shock(

variables = sfcr_set(

alpha1 ~ 0.7

),

start = 5,

end = 60

)

bmw2 <- sfcr_scenario(bmw,

scenario = shock2,

periods = 60)

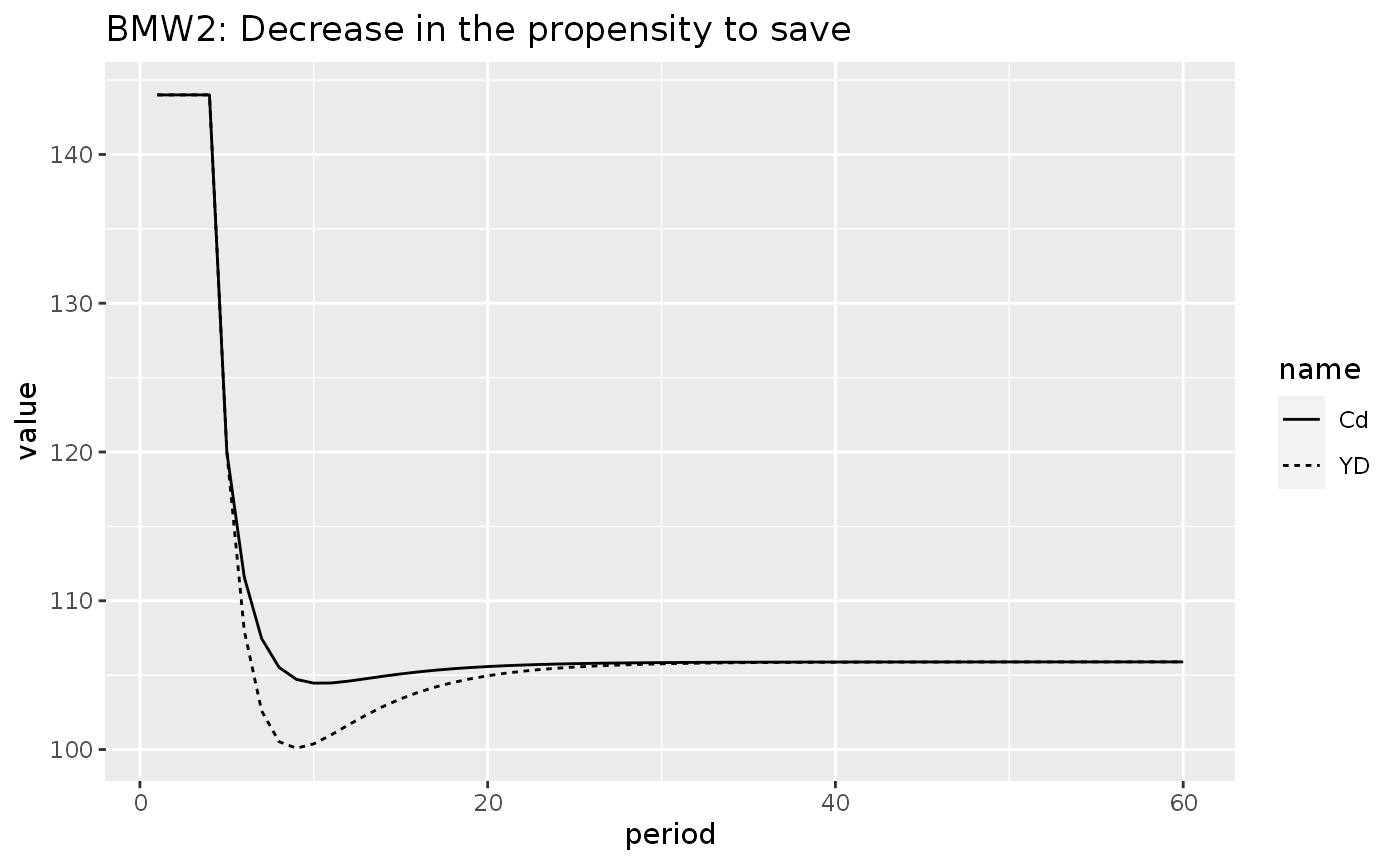

bmw2 %>%

do_plot(variables = c("Cd", "YD"), title = "BMW2: Decrease in the propensity to save") As can be seen, a decrease in the propensity to save in this model leads to a permanent decrease in consumption and on disposable income.

As can be seen, a decrease in the propensity to save in this model leads to a permanent decrease in consumption and on disposable income.

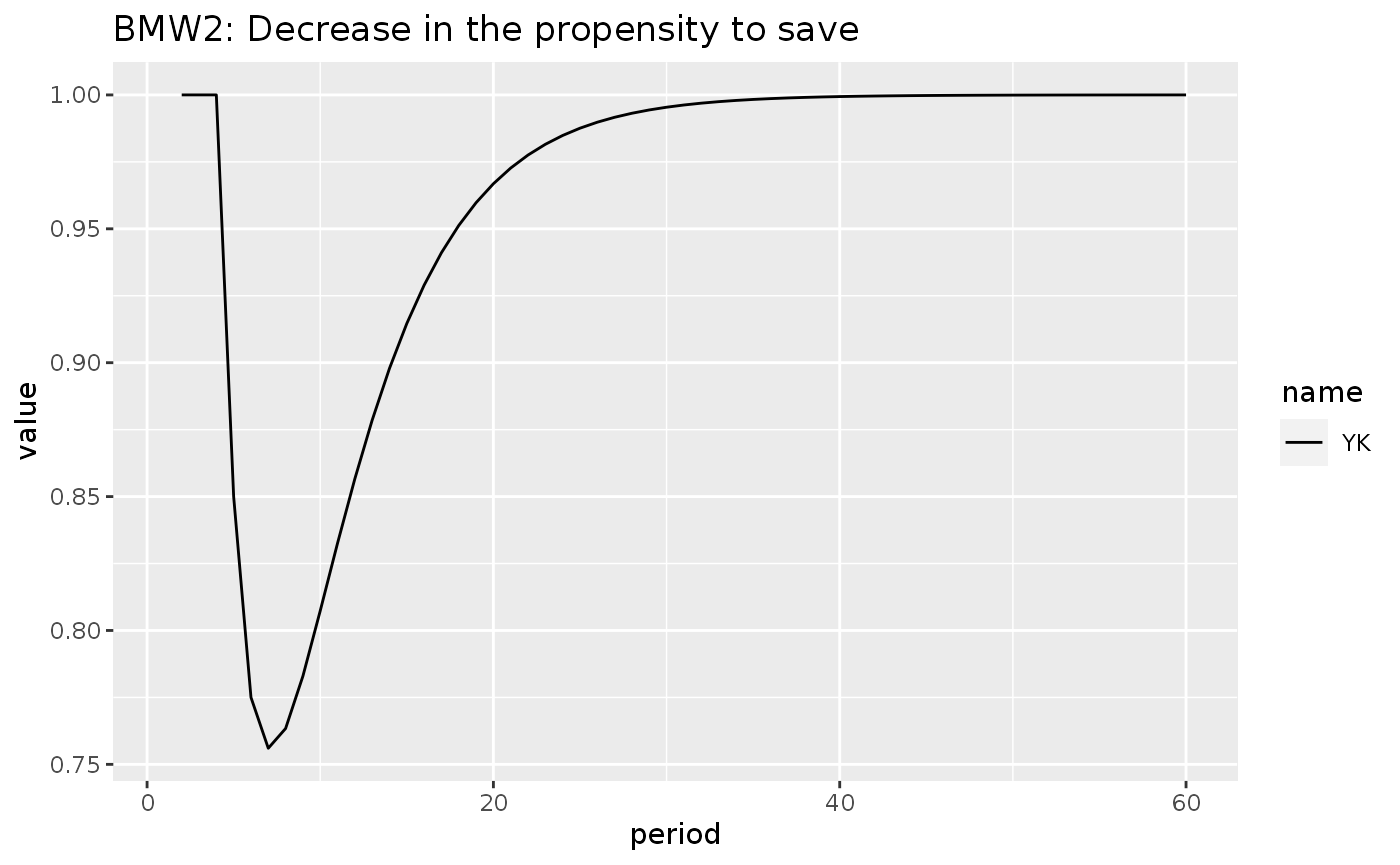

bmw2 %>%

do_plot(variables = c("YK"), title = "BMW2: Decrease in the propensity to save")

#> Warning: Removed 1 row(s) containing missing values (geom_path). As a note, it is possible to add

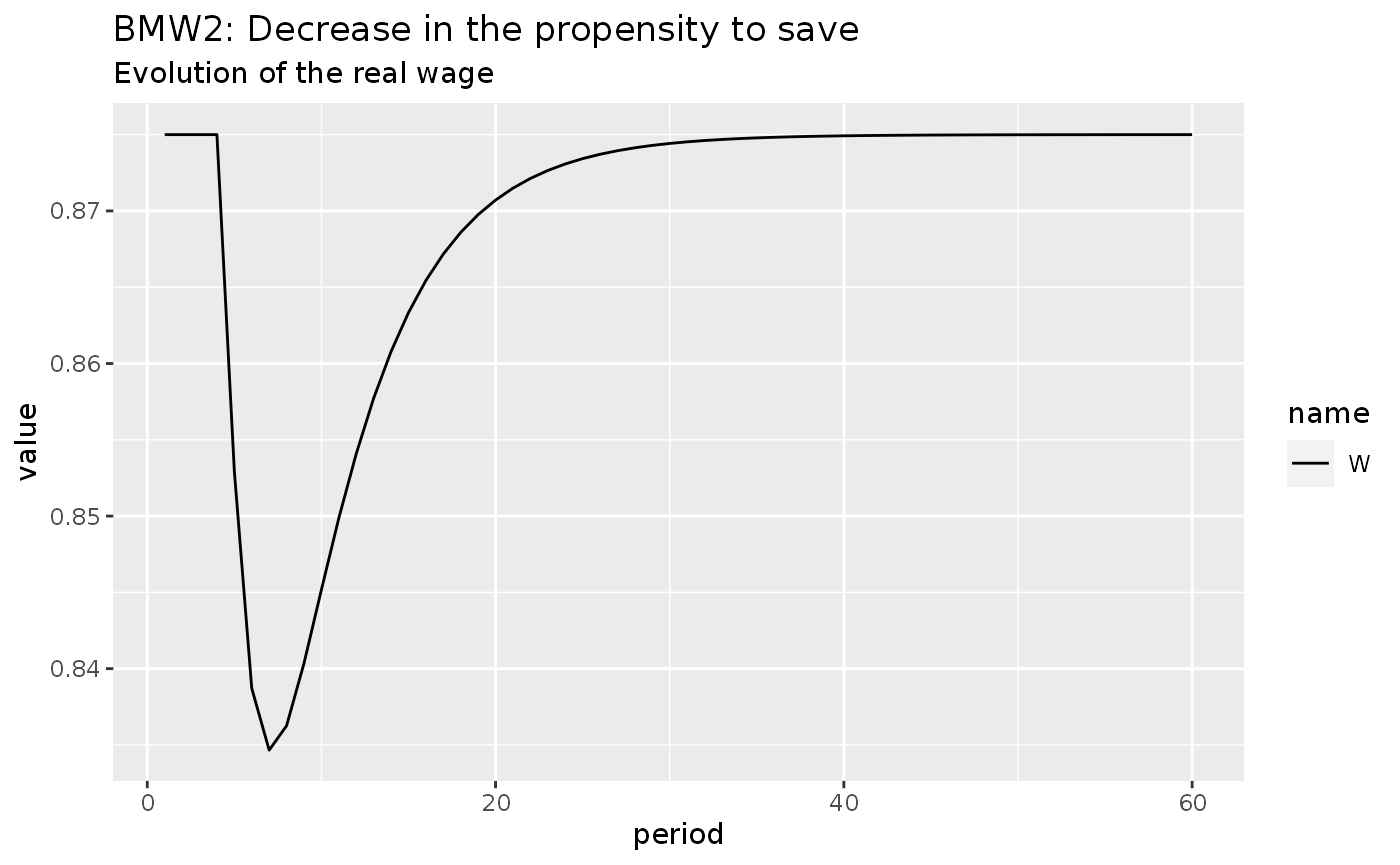

As a note, it is possible to add ggplot2 arguments to our helper function:

bmw2 %>%

do_plot(variables = c("W"), title = "BMW2: Decrease in the propensity to save") +

labs(subtitle = "Evolution of the real wage")

Model BMWK

sfcr_set_index(bmw_eqs) %>%

dplyr::filter(lhs == "Cd")

#> # A tibble: 1 × 3

#> id lhs rhs

#> <int> <chr> <chr>

#> 1 16 Cd alpha0 + alpha1 * YD + alpha2 * Mh[-1]

bmwk_eqs <- sfcr_set(

bmw_eqs,

Cd ~ alpha0 + alpha1w * WBs + alpha1r * rm[-1] * Mh[-1] + alpha2 * Mh,

exclude = 16)

sfcr_set_index(bmw_external) %>%

dplyr::filter(lhs == "alpha1")

#> # A tibble: 1 × 3

#> id lhs rhs

#> <int> <chr> <chr>

#> 1 3 alpha1 0.75

bmwk_ext <- sfcr_set(

bmw_external,

alpha1w ~ 0.8,

alpha1r ~ 0.15,

exclude = 3

)

bmwk <- sfcr_baseline(equations = bmwk_eqs,

external = bmwk_ext,

periods = 100,

hidden = c("Ms" = "Mh"),

tol = 1e-20,

method = "Newton"

)

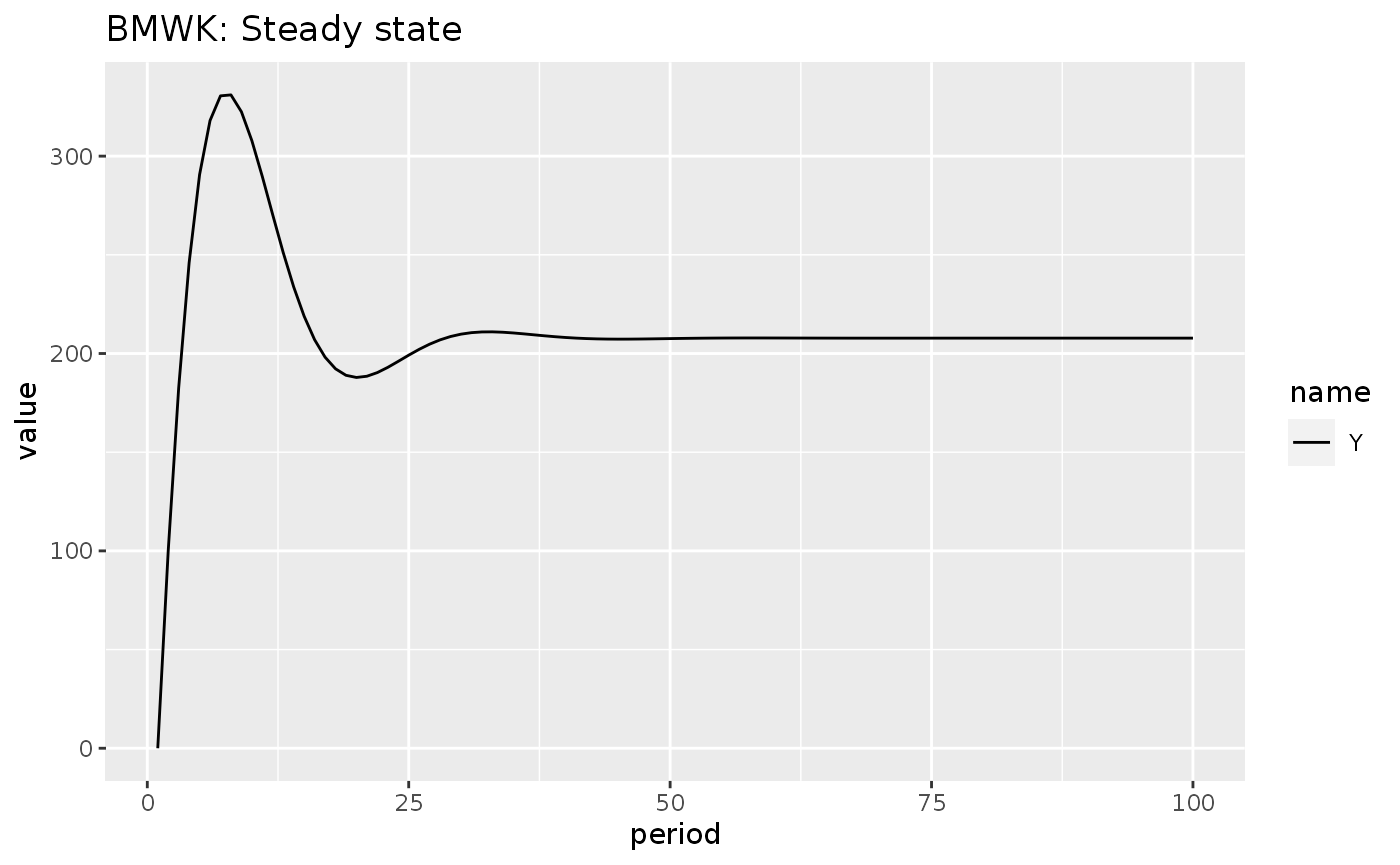

bmwk %>%

do_plot(variables = 'Y', "BMWK: Steady state")

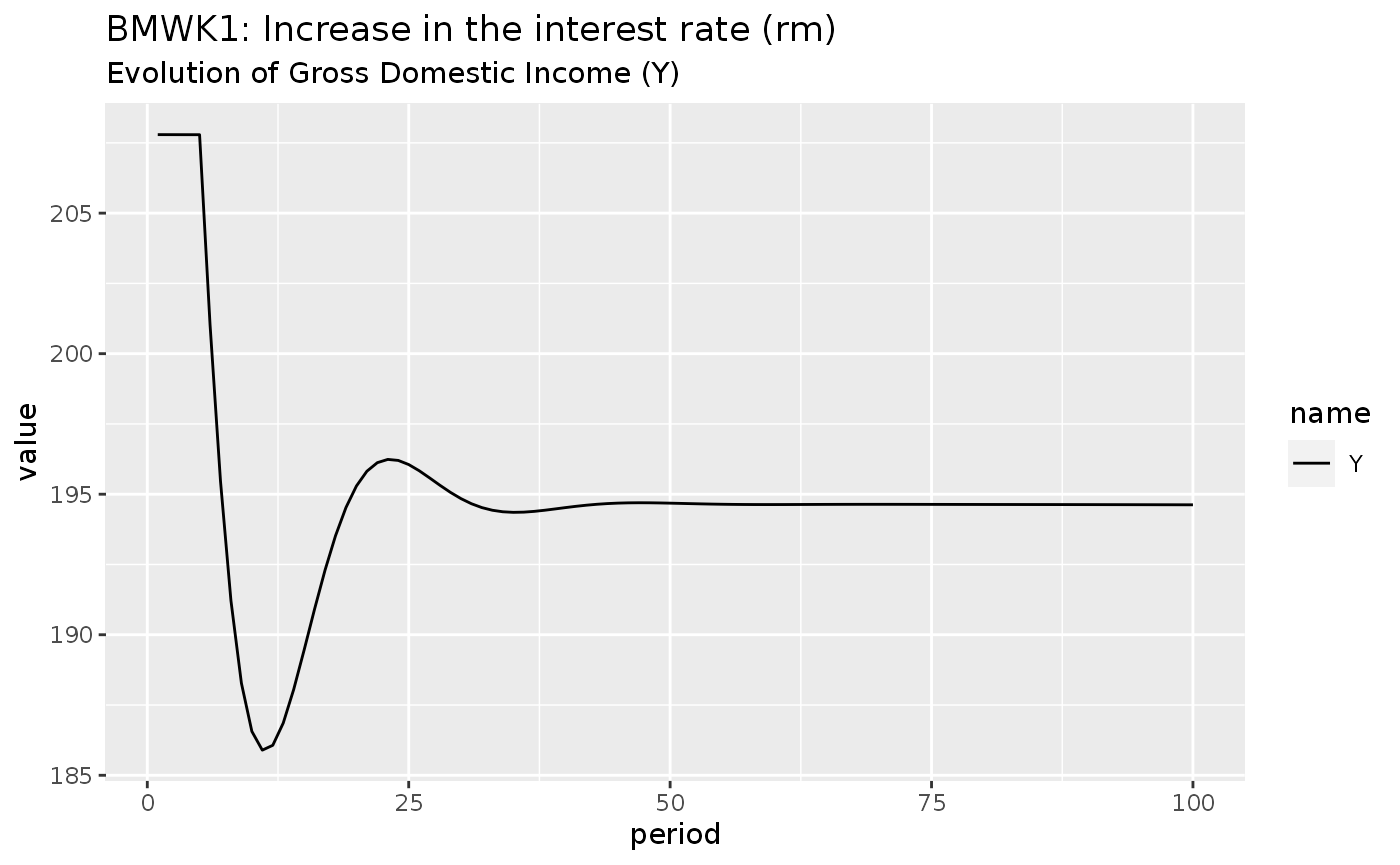

Let’s see the impact of an increase on interest rates in this model:

shock3 <- sfcr_shock(

variables = sfcr_set(rl ~ 0.035),

start = 5,

end = 100

)

bmwk1 <- sfcr_scenario(bmwk, shock3, 100, tol = 1e-10)

bmwk1 %>%

do_plot("Y", "BMWK1: Increase in the interest rate (rm)") +

labs(subtitle = "Evolution of Gross Domestic Income (Y)")

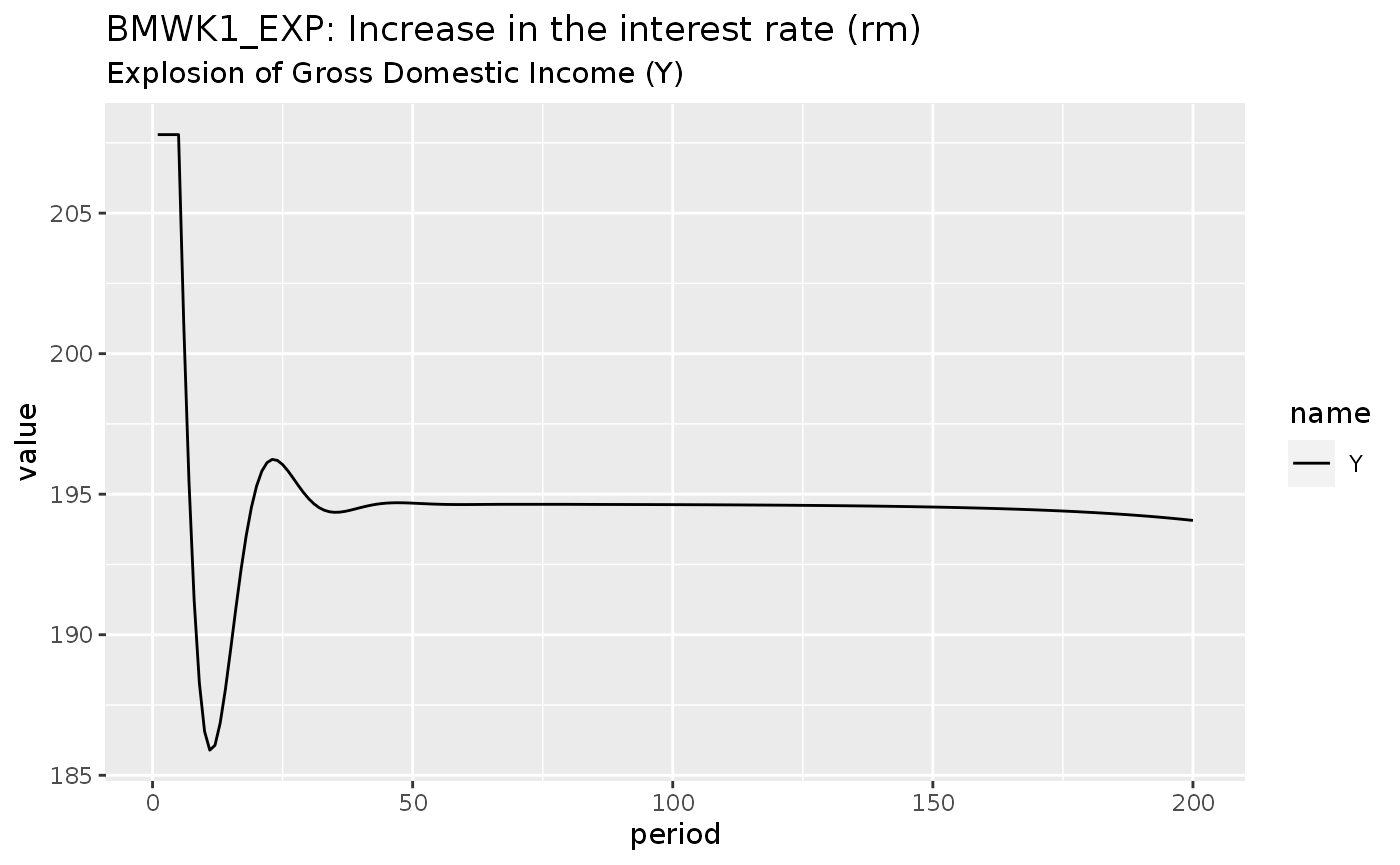

This model has a very interesting characteristic. If we don’t strive for numerical precision with a very small tol argument at the bmw model, the tiny differences in each period lead the model to explosion:

shock3 <- sfcr_shock(

variables = sfcr_set(rl ~ 0.035),

start = 5,

end = 200

)

bmwk1_explode <- sfcr_scenario(bmwk, shock3, 200, tol = 1e-5, method = "Newton")

bmwk1_explode %>%

do_plot("Y", "BMWK1_EXP: Increase in the interest rate (rm)") +

labs(subtitle = "Explosion of Gross Domestic Income (Y)")

Stability tests

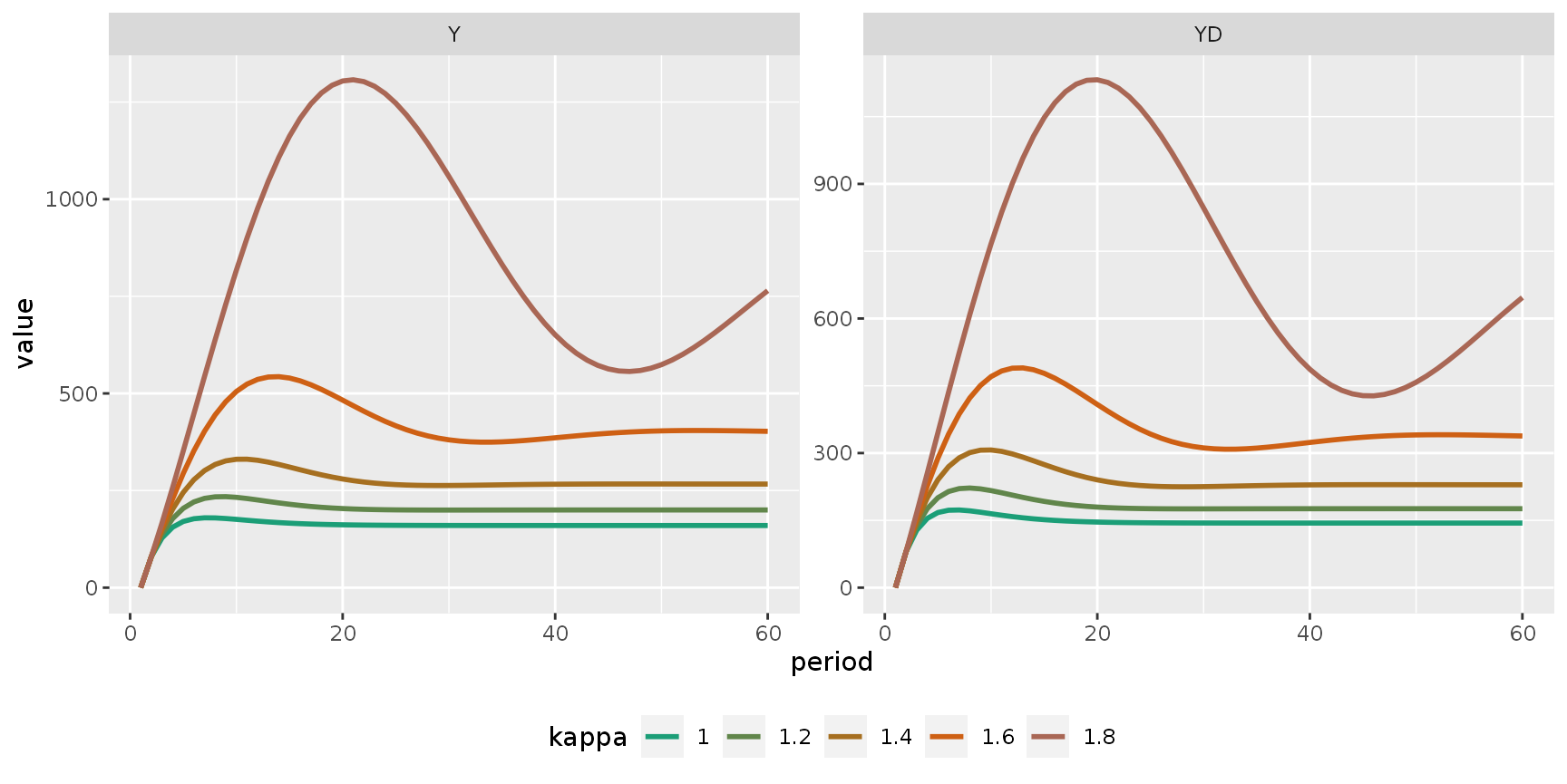

Let’s try to visualize the sensitivity of the model BMW to different parameter values, as discussed in Godley and Lavoie (2007, sec. 7.5.2)

We’ll start by expanding the values of the kappa parameter in the external set:

bmw_xext <- sfcr_expand(bmw_external, kappa, seq(1, 2.6, 0.2))

xbmw <- sfcr_multis(bmw_xext, bmw_eqs, periods = 60, method = "Newton")We can see that the model start to become very unstable from \(kappa > 1.6\):

getPalette <- grDevices::colorRampPalette(RColorBrewer::brewer.pal(8, "Dark2"))

bind_rows(xbmw[c(1, 2, 3, 4, 5)]) %>%

mutate(simulation = as_factor(simulation)) %>%

pivot_longer(cols = -c(period, simulation)) %>%

filter(name %in% c("Y", "YD", "C")) %>%

ggplot(aes(x = period, y = value, color = simulation)) +

geom_line(size = 1, alpha = 1) +

theme(legend.position = "bottom") +

scale_color_manual("kappa",

values = getPalette(20),

labels = as.character(seq(1, 2.6, 0.2))) +

facet_wrap(~ name, scales = 'free_y')